In the competitive world of prop firm trading, the Rithmic vs Tradovate platform choice can significantly impact your success. Both Rithmic and Tradovate offer robust solutions for futures traders, but they serve different needs and trading styles. At Phidias Propfirm, we understand that selecting the right trading infrastructure is crucial for meeting evaluation targets and achieving consistent results as a funded trader.

This comprehensive Rithmic vs Tradovate comparison will help you determine whether Rithmic or Tradovate better aligns with your prop firm trading goals. Let’s dive into the essential aspects of both platforms and explore why one might be more suitable than the other for your specific trading approach.

TL;DR: Rithmic vs Tradovate for Prop Firm Traders

For most prop firm traders, Rithmic offers superior advantages for passing evaluations and sustaining profitability due to its exceptional execution speed, platform flexibility, and advanced analysis tools. Tradovate provides a more beginner-friendly, all-in-one solution with potential cost benefits for high-volume traders.

Choose Rithmic if you’re:

- An experienced trader requiring professional-grade tools

- Using advanced order flow or algorithmic strategies

- Needing platform flexibility to match your trading style

- Prioritizing execution speed and precision

Choose Tradovate if you’re:

- New to prop trading and prefer simplicity

- Trading primarily with basic chart patterns

- Needing cross-device accessibility

Quick Comparison Table for Prop Firm Traders

| Feature | Rithmic | Tradovate | Best for Prop Trading |

|---|---|---|---|

| Execution Speed | Superior low-latency | Standard cloud-based | Rithmic for time-sensitive strategies |

| Platform Options | 20+ professional platforms | Single all-in-one platform | Rithmic for customization needs |

| Analysis Tools | Advanced (order flow, footprint) via third-party platforms | Basic chart patterns & indicators | Rithmic for sophisticated analysis |

| Learning Curve | Steeper, more technical | Gentler, more intuitive | Tradovate for beginners |

| Scalping/Day Trading | Excellent | Good | Rithmic |

| Swing Trading | Very good | Very good | Either works well |

| Device Compatibility | Windows-focused (depends on platform) | Any device (web, desktop, mobile) | Tradovate for multi-device needs |

| Phidias Propfirm Compatibility | Full support and integration | Not directly supported | Rithmic |

At Phidias Propfirm, we’ve chosen Rithmic for its superior performance in professional trading environments, but your optimal choice depends on your specific trading approach, experience level, and technical requirements.

Understanding Prop Firm Platform Requirements

What Prop Firm Traders Need When Choosing Rithmic vs Tradovate

Prop firm traders face unique challenges that differ from typical retail traders. When pursuing funding through prop firm evaluations, speed, reliability, and precision become critical factors for success when deciding between Rithmic vs Tradovate. Your platform must support:

- Ultra-fast execution to capitalize on short-term opportunities

- Rock-solid stability during high-volatility market conditions

- Precise order management for tight risk control

- Reliable data feeds for accurate market analysis

- Compatibility with various trading styles from scalping to swing trading

The right platform should help you navigate the specific rules of prop firm challenges, such as drawdown limits, profit targets, and trading time restrictions. Your choice between Rithmic vs Tradovate should align with these fundamental requirements.

Rithmic: Platform Overview

Rithmic: Core Technology and Infrastructure

Rithmic stands as a leading provider of direct market access (DMA) trade execution software for the global financial community. At its core, Rithmic delivers low and ultra-low latency performance with high throughput capabilities – features traditionally valued by professional trading firms and hedge funds.

Rithmic operates as a broker-neutral infrastructure, connecting traders directly to exchanges rather than functioning as a full brokerage itself. This design philosophy allows for faster order routing and execution, critical advantages when trading on prop firm accounts where execution speed can significantly impact profitability.

Real also: How to Prevent Rithmic Data Feed Issues

Rithmic Platform Options and Integration

The Rithmic ecosystem offers several ways to access its trading infrastructure:

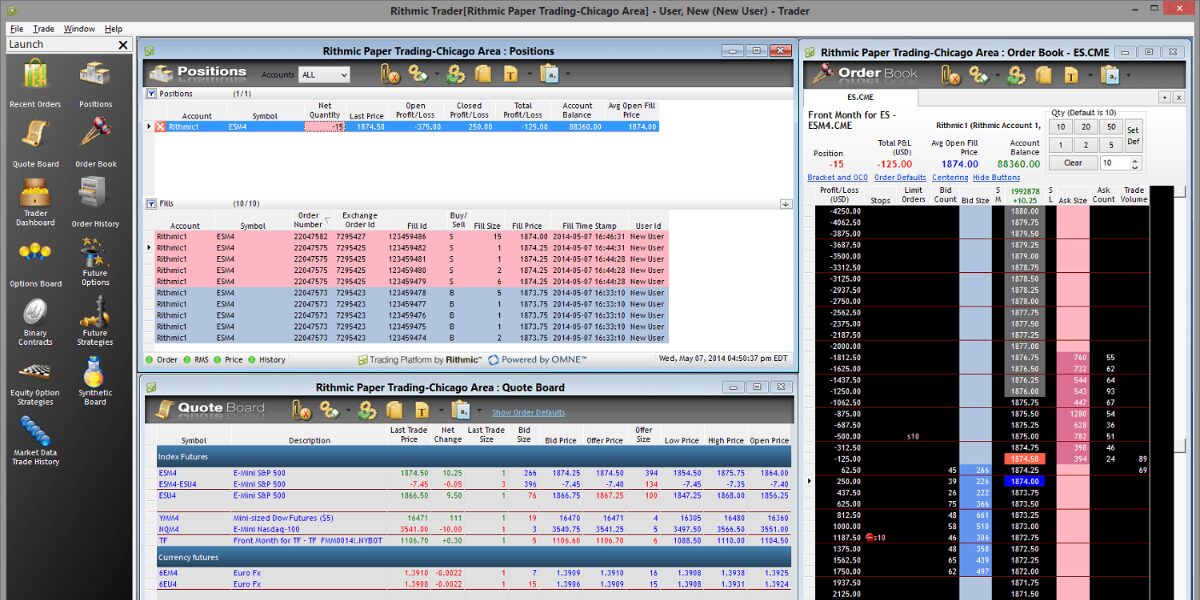

- R|Trader Pro™ – Rithmic’s proprietary front-end platform featuring:

- Integrated charting with technical indicators

- One-click trading from charts and DOM

- Real-time integration with Microsoft Excel for custom analysis

- Server-side order management (orders persist even if your connection drops)

- Third-Party Platform Compatibility – One of Rithmic’s greatest strengths is its support for over 20 different trading platforms, including:

- NinjaTrader

- Sierra Chart

- Bookmap

- Quantower

- MultiCharts

- TradingView (via certain brokers)

This flexibility allows prop traders to select the platform that best matches their trading style rather than being locked into a single interface.

Rithmic Data Quality and Speed

For prop firm traders, especially those focused on scalping or day trading strategies, Rithmic’s data quality is a standout feature:

- Market By Order (MBO) data provides full market depth visibility

- Microsecond timestamp granularity for precise performance analysis

- Unfiltered price data that isn’t aggregated or averaged

- Low latency connections with potential for colocation services

Many prop firm evaluations have strict rules around news trading and market volatility periods. Rithmic’s high-quality data feed helps traders navigate these challenging market conditions with greater precision.

Tradovate: Platform Overview

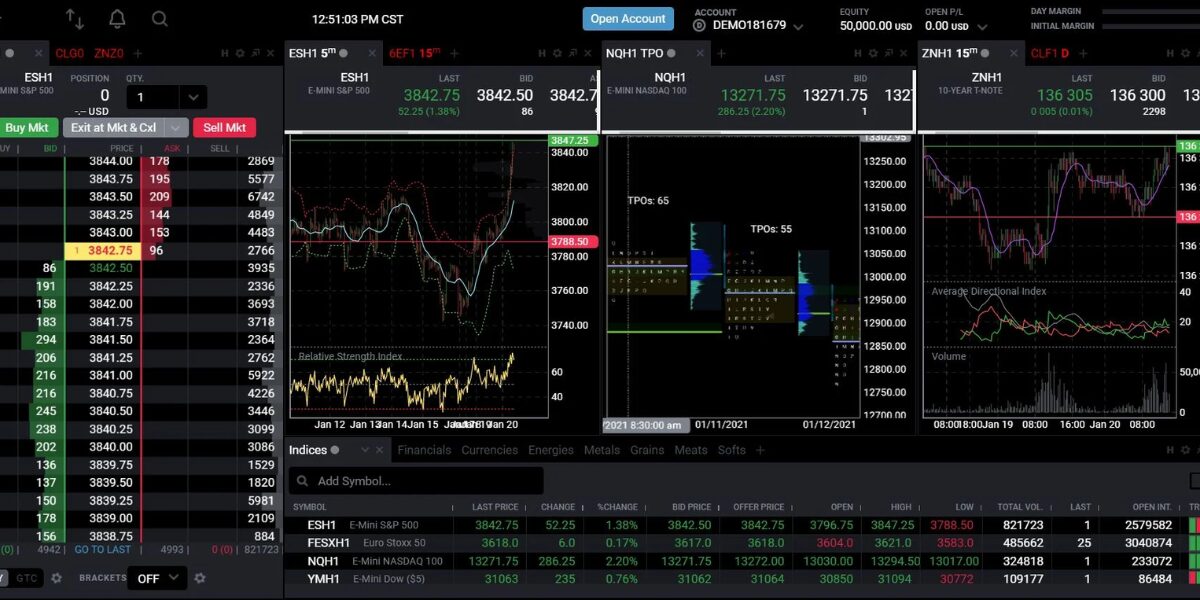

Tradovate: Cloud-Based Technology

Tradovate has emerged as a modern futures trading platform built on cloud-based technology. Unlike traditional platforms, Tradovate was designed from the ground up specifically for futures traders, with an emphasis on accessibility and user experience.

As a complete brokerage solution, Tradovate provides its proprietary trading platform alongside clearing and execution services. This integrated approach differentiates it from Rithmic’s infrastructure-focused model.

Tradovate Platform Accessibility

One of Tradovate’s key advantages is its accessibility across multiple devices and operating systems:

- Web-based platform accessible from any browser

- Desktop applications for Windows and Mac

- Mobile apps for iOS and Android devices

This cross-platform compatibility makes Tradovate particularly appealing to prop traders who need trading flexibility while traveling or away from their primary workstation.

Tradovate Pricing Model Innovation

Tradovate revolutionized the futures trading industry with its subscription-based pricing model that can eliminate per-trade commissions entirely:

- Pay As You Trade – Traditional commission structure with no monthly fee

- Active – Monthly subscription with reduced commissions

- Lifetime – One-time payment for substantially reduced commissions

This pricing innovation potentially benefits high-volume prop traders who might otherwise incur significant commission costs during active trading periods.

Rithmic vs Tradovate: Pricing and Cost Structure

Rithmic vs Tradovate: Market Data Fees

| Rithmic | Tradovate | |

|---|---|---|

| CME Top of Book Data | $3 per month/exchange (non-professional) | Included in subscription plans |

| CME Full Market Depth | $13 per month/exchange (non-professional) | Included in subscription plans |

| CME Full Depth Bundle | $39 per month (non-professional) | Included in subscription plans |

Rithmic vs Tradovate: Platform and Connectivity Fees

| Rithmic | Tradovate | |

|---|---|---|

| Monthly Connection | $25 per month per User ID | No separate connection fee |

| Trading Platform | Varies depending on third-party platform choice | Included in subscription |

| API Access | $100 per month for programmatic trading | $25 per month (requires funded account) |

Rithmic vs Tradovate: Commission Structure

| Rithmic | Tradovate | |

|---|---|---|

| Trade Routing Fee | $0.10 per contract | N/A |

| Standard Contracts | Varies by broker | $1.29/side (Free), $0.99/side (Active), $0.59/side (Lifetime) |

| Micro Contracts | Varies by broker | $0.35/side (Free), $0.25/side (Active), $0.09/side (Lifetime) |

| Subscription Plans | None | Free, Active ($39.99/month), Lifetime ($1,499) |

For prop firm traders, cost considerations vary depending on trading frequency and volume. High-volume traders may benefit from Tradovate’s subscription-based commission-free model, while traders who prioritize execution speed and platform choice might find Rithmic’s fee structure worthwhile despite the additional costs.

Rithmic vs Tradovate: Performance and Reliability

Rithmic vs Tradovate: Speed and Latency Comparison

Speed is often critical for prop firm traders, particularly those employing scalping or short-term strategies:

- Rithmic delivers ultra-low latency with microsecond-level precision, offering exceptional execution speed for time-sensitive trading strategies.

- Tradovate’s cloud-based infrastructure provides consistent performance across devices but cannot match Rithmic’s specialized low-latency infrastructure.

For traders whose strategies depend on rapid execution, Rithmic’s speed advantage could be decisive in meeting prop firm profit targets.

Rithmic vs Tradovate: Platform Stability During Market Volatility

Prop firm rules often include maximum drawdown limits that can quickly be breached during volatile market conditions. Platform stability becomes crucial in these scenarios:

- Rithmic’s infrastructure is designed to handle high message volumes during market volatility, with robust risk management controls to prevent catastrophic losses.

- Tradovate’s cloud-based system holds orders at the exchange or server-side, providing trading continuity even during computer crashes or internet disruptions.

Both platforms offer solid stability, but the choice may depend on whether you prioritize raw performance (Rithmic) or device-independent continuity (Tradovate).

Rithmic vs Tradovate: Major Feature Comparison for Prop Traders

Rithmic vs Tradovate: Order Management and Risk Controls

Both platforms offer comprehensive order management capabilities essential for prop firm trading, but with different strengths:

| Rithmic | Tradovate | |

|---|---|---|

| Latency | Superior execution speed for time-sensitive strategies | Standard latency sufficient for most trading strategies |

| Order Routing | Faster order routing with fewer intermediary steps | Cloud-based routing through Tradovate’s infrastructure |

| Basic Order Types | Market, Limit, Stop, Stop-Limit | Market, Limit, Stop, Stop-Limit |

| Advanced Order Types | OCO, Bracket, Trailing Stop | OCO, Bracket, Trailing Stop |

| Server-Side Orders | Yes, orders persist if connection drops | Yes, cloud-based order management |

| Risk Controls | Extensive pre-trade risk checks and position limits | Basic risk management features |

| Automated Trading | Better API support for algorithmic strategies | API available but with more limitations |

Prop firm rules often include maximum drawdown limits and profit targets. Both platforms offer tools to manage these constraints, but Rithmic provides more granular control for risk-conscious traders.

Rithmic vs Tradovate: Charting and Analysis Tools

| Rithmic (with third-party platforms) | Tradovate | |

|---|---|---|

| Chart Types | Advanced chart types through specialized platforms like Bookmap and Quantower | Basic chart styles with customizable timeframes |

| Technical Indicators | Vast library of indicators through third-party platforms | Around 40 basic technical indicators |

| Advanced Analysis | Advanced order flow, volume profile, and footprint charts | Limited to basic technical patterns |

| Custom Indicators | Full customization through platform of choice | Limited indicator customization |

| Trade from Chart | Yes, with sophisticated execution options | Yes, with basic one-click trading |

While Tradovate offers an all-in-one solution with basic charting, Rithmic’s flexibility allows advanced traders to access sophisticated platforms with cutting-edge analysis tools far beyond what Tradovate provides.

Rithmic vs Tradovate: Historical Data for Backtesting

| Rithmic | Tradovate | |

|---|---|---|

| Data Availability | Historical data from 2011 to present | Time-based charts back to January 2017 |

| Tick Data | Comprehensive tick data with custom lookback | Tick-based charts limited to 2 weeks of historical data |

| Backtesting Tools | Better integration with third-party backtesting platforms | Basic market replay functionality |

Developing and validating trading strategies is crucial for prop firm success. Rithmic’s more extensive historical data provides a significant advantage for thorough strategy testing across various market conditions.

Why Phidias Propfirm Chose Rithmic

Platform Flexibility for Serious Traders

At Phidias Propfirm, we recognize that professional traders require specialized tools that match their unique trading styles. Rithmic’s compatibility with over 20 different trading platforms provides our traders with unmatched flexibility to choose their ideal trading environment:

- Order flow traders can leverage platforms like Bookmap and Jigsaw

- Technical traders can utilize TradingView or NinjaTrader

- Algorithmic traders can implement strategies through MultiCharts or custom solutions

- Discretionary traders can choose platforms with superior DOM visualization like Quantower

This flexibility allows each trader to select the platform that best aligns with their proven strategy, rather than forcing them to adapt to a one-size-fits-all solution.

Superior Performance for Critical Trading Scenarios

Prop firm evaluations often include challenging periods such as news releases and volatile market conditions. We’ve found that Rithmic’s low-latency infrastructure provides our traders with critical advantages during these high-stakes moments:

- Faster order execution helps traders capitalize on fleeting opportunities

- More reliable price data ensures accurate decision-making

- Enhanced order routing reduces the risk of slippage during rapid market movements

- Microsecond timestamping allows for precise analysis of trading performance

For serious traders attempting to meet profit targets while respecting strict drawdown limits, these performance advantages can make the difference between success and failure.

Advanced Risk Management Capabilities

As a prop firm, risk management is at the core of our business model. Rithmic’s comprehensive risk management tools align perfectly with our trading rules:

- Real-time position monitoring helps traders stay within drawdown limits

- Server-side risk controls prevent catastrophic losses during connectivity issues

- Advanced order types facilitate precise entry and exit strategies

- Excel integration enables sophisticated risk modeling and analytics

These capabilities ensure that our traders can trade confidently while adhering to our evaluation parameters.

Proven Track Record with Professional Traders

Our decision to partner with Rithmic is reinforced by the observable success of professional traders using this infrastructure. We’ve consistently seen that:

- Experienced traders overwhelmingly choose Rithmic when given platform options

- Evaluation pass rates are higher among traders using professional-grade platforms

- Consistent profitability is more achievable with high-quality, low-latency data

While Tradovate offers a convenient all-in-one solution that appeals to beginners, our focus is on providing professional-grade tools for serious traders who are committed to long-term success in the prop trading industry.

Integration with Prop Firm Evaluation Parameters

Rithmic’s infrastructure integrates seamlessly with our specific evaluation requirements:

| Rithmic Advantage for Phidias Traders | |

|---|---|

| Overnight/Weekend Holding | Fully supported for swing trading accounts with reliable position tracking |

| News Trading Support | Superior execution during high-volatility news events |

| Trailing Drawdown Tracking | Advanced risk tools for precise monitoring of drawdown limits |

| Profit Target Calculation | Accurate P&L tracking with Excel integration for verification |

By providing our traders with Rithmic’s professional-grade infrastructure, we’re setting them up for success from day one of their evaluation through their entire funded trading journey.

Rithmic vs Tradovate: User Experience and Learning Curve

Rithmic vs Tradovate: Interface and Accessibility

| Rithmic | Tradovate | |

|---|---|---|

| Platform Access | Multiple professional platforms with advanced features | All-in-one web-based solution for beginners |

| User Interface | Customizable interfaces through various platform options | Fixed interface with limited customization |

| Mobile Trading | Limited to account monitoring in native app, but full functionality through third-party platforms | Full trading functionality on mobile devices |

| Advanced Tools | Sophisticated order flow, market profile, and footprint charts | Basic technical analysis tools |

Rithmic provides advanced traders with access to cutting-edge professional platforms, while Tradovate offers a simplified, all-inclusive experience better suited for beginners who prioritize convenience over advanced functionality.

Rithmic vs Tradovate: Support and Community Resources

| Rithmic | Tradovate | |

|---|---|---|

| Technical Support | Reputation for “top-notch support and customized service” | In-app live chat support available to all customers |

| Documentation | Comprehensive but technical | Built-in knowledge base with user-friendly guides |

| Community | Limited direct community features | Exclusive customer forum for community discussion |

| Educational Resources | Limited | Up-to-date market resources and educational content |

Tradovate offers more beginner-friendly support resources, while Rithmic typically provides more specialized technical support catering to professional traders.

Rithmic vs Tradovate: Which Platform is Right for You?

Rithmic vs Tradovate for Scalpers and Short-Term Traders

If your prop firm strategy involves:

- Short-term trading (seconds to minutes)

- Precision in entry and exit points

- Need for advanced order flow analysis

- Advanced risk management requirements

Rithmic is likely your best choice due to its low latency, precision data, and advanced platform options. The marginal cost difference is often justified by improved execution quality and flexibility.

Rithmic vs Tradovate for Discretionary Day and Swing Traders

If your prop firm approach involves:

- Manual trading based on chart patterns and indicators

- Trading across multiple devices or locations

- Preference for intuitive, modern interfaces

- High trading volume where commissions are a concern

Tradovate might be more suitable with its user-friendly interface, cross-platform accessibility, and potentially lower costs for frequent traders using the subscription model.

Rithmic vs Tradovate: Decision Framework for Prop Firm Traders

Consider these key questions when making your Rithmic vs Tradovate decision:

- What’s your trading experience level?

- Beginner: Tradovate’s all-in-one simplicity

- Advanced: Rithmic’s professional-grade flexibility

- What’s your primary trading timeframe?

- Ultra-short term (seconds/minutes): Rithmic advantage

- Intraday (hours): Both viable, personal preference

- Swing (days): Both viable with different strengths

- What’s your trading style?

- Order flow/footprint analysis: Rithmic with specialized platforms

- Algorithmic/automated: Rithmic’s superior API

- Basic chart pattern trading: Either option works

- What’s your volume and cost sensitivity?

- Very high volume: Tradovate’s subscription model

- Moderate volume: Cost differences less significant

- Low volume/prioritizing execution: Rithmic may justify higher costs

Rithmic vs Tradovate: Conclusion

Both Rithmic and Tradovate offer compelling features for prop firm traders, but they excel in different areas in the Rithmic vs Tradovate comparison:

Rithmic strengths for prop firm traders:

- Superior execution speed for precise trade timing

- Support for over 20 third-party platforms allowing maximum flexibility

- Access to advanced professional platforms with cutting-edge analysis tools

- Superior API capabilities for algorithmic traders

- Extensive historical data for thorough strategy development

- Enhanced order routing for improved execution quality

Tradovate strengths for prop firm traders:

- Beginner-friendly all-in-one platform with simple setup

- Cross-platform accessibility from any device

- Potential cost savings with subscription-based pricing

- Streamlined user experience with no technical setup required

- Cloud-based redundancy for trading continuity

At Phidias Propfirm, we offer Rithmic as our primary data feed solution because it provides the technical foundation needed for serious prop traders to succeed in our evaluation and funded programs. Its flexibility allows traders to choose their preferred trading interface while maintaining the high-performance standards required for competitive futures trading.

However, the “best” platform in the Rithmic vs Tradovate debate ultimately depends on your specific trading approach, technical requirements, and preferences. Both platforms can lead to successful prop firm trading when used effectively and aligned with your trading strategy.

If you’re considering joining Phidias Propfirm, our Rithmic integration provides you with a professional-grade trading infrastructure designed to help you pass evaluations and thrive as a funded trader.