This guide is your one-stop resource answering the question “What is the best futures trading platform for you”. Whether you’re a complete beginner or a seasoned trader looking to switch platforms, we’ve got you covered. We have created the most comprehensive selection, reviews and practical comparison of the best trading platforms for futures available.

Choosing the right platform is a major first step to get started trading futures markets. However there is no one size fits all when it comes to trading. A platform that’s perfect for a high-frequency day trader might be completely unsuitable for a long-term position trader.

I) Choosing the Right Futures Trading Platform for you

What is a Trading Platform for futures?

A futures trading platform is the software or web-based interface that connects you, the trader, to the futures exchanges (like the CME Group, CBOT, NYMEX, etc.). It’s where you’ll view market data, analyze charts, execute trades, manage your positions, and monitor your account and set risk management. The platform is not the exchange itself; it’s the tool you use to access the exchange.

Key Features to Look For

Choosing the right features is critical. Here’s a breakdown of what to consider when evaluating a futures trading platform:

- Cost:Futures contract trading platform fees vary a lot. Understand the different pricing models:

- Lifetime License: One big upfront payment.

- Subscription: Monthly or annual fee.

- Freemium: Basic version is free, pay for extra features.

- Per-Contract: You pay a small fee for each contract traded.

Don’t forget about other costs like data feeds and routing fees. We’ll look at some of the cheapest futures trading platforms later.

- Charting and Technical Analysis Tools:This is where you’ll analyze price movements. Look for:

- Lots of technical indicators (like moving averages, RSI, MACD).Drawing tools (trend lines, Fibonacci).Different chart types (candlestick, bar, line, Renko).

The more customization, the better! A good platform helps you analyze the market before you trade.

- Order Flow Charts / Tools:Essential for serious traders. Order flow tools show you what’s happening “behind” the price. These tools reveal buying and selling pressure.

- Order Book: Shows buy and sell orders at different prices.Volume Profile: Shows trading volume at different price levels.Footprint Charts: Show detailed volume information within each candle.

- Data Feeds:You need real-time data for active trading. Delayed data (10-15 minutes old) is usually not good enough.

- Level 1 Data: Shows the best bid and ask prices.

- Level 2 Data: Shows the full order book – how many contracts are available at each price. A must for intraday traders.

- Order Execution Speed and Reliability:Every second counts in futures. A slow platform can cost you money! Look for fast order execution and a reliable connection. This is crucial for day traders and scalpers looking for fastest futures trading platform.

- Order Types:You need more than just basic market orders. Good platforms offer:

- Limit Orders: Buy or sell at a specific price (or better).Stop-Limit Orders: A combination of stop and limit orders.Trailing Stop Orders: Your stop price automatically moves with the market.

Different order help to manage your risk and find the best opportunity.

- Mobile App Availability:Can you trade on your phone? A good mobile app lets you monitor and manage trades from anywhere. Crucial if you are on the go.

- Customer Support:What happens when you need help? Check if they offer phone, email, or live chat support. Are they helpful and quick to respond?

- Educational Resources:Especially helpful for beginners. Look for tutorials, webinars, and articles. The best futures charting software platform will have lots of learning materials.

- Paper Trading (Demo Account):A must-have! Practice with virtual money before risking real money. The best futures paper trading platform will feel just like the real thing.

- Automated Trading Capabilities:Want to use trading robots? Look for platforms that support automated trading (often using programming languages like C# or EasyLanguage). The best automated futures trading platform allows for deep customization.

Section II: Reviewing the Most Popular Futures Trading Platforms

Futures Trading Platform Comparison

| Platform | Best For | Pricing |

|---|---|---|

| NinjaTrader | Active Day Traders, Automated Traders | Free (limited), $59/month for advanced features |

| Tradovate | Beginners, Cost-Conscious | Free when opening brokerage Account |

| Trader Workstation (TWS) | Professional, High-Volume, Multi-Asset | Free platform; IBKR commissions apply |

| Thinkorswim (TOS) | Active Traders, Options Traders | Free when opening brokerage Account |

| TradeStation | Active, Automated Swing Traders | Free when opening brokerage Account |

| TradingView | Beginners and multi instrument charting | Free (limited), Paid starting at $12.95/month |

| Sierra Chart | Day Traders, Order Flow Traders, Automated Strategies | Subscription starting at 26 USD/month |

| Quantower | Intermediate/Advanced, Order Flow | Free (limited), Premium at $70/month |

You can find below the detailed overview of each platform.

Methodology:

The platforms reviewed below were chosen based on a combination of factors, including: popularity among futures traders, user reviews, feature sets, pricing, and overall reputation. We’ve conducted thorough research and, where possible, tested the platforms ourselves to provide accurate and up-to-date information. The goal is to find which futures trading platform is best.

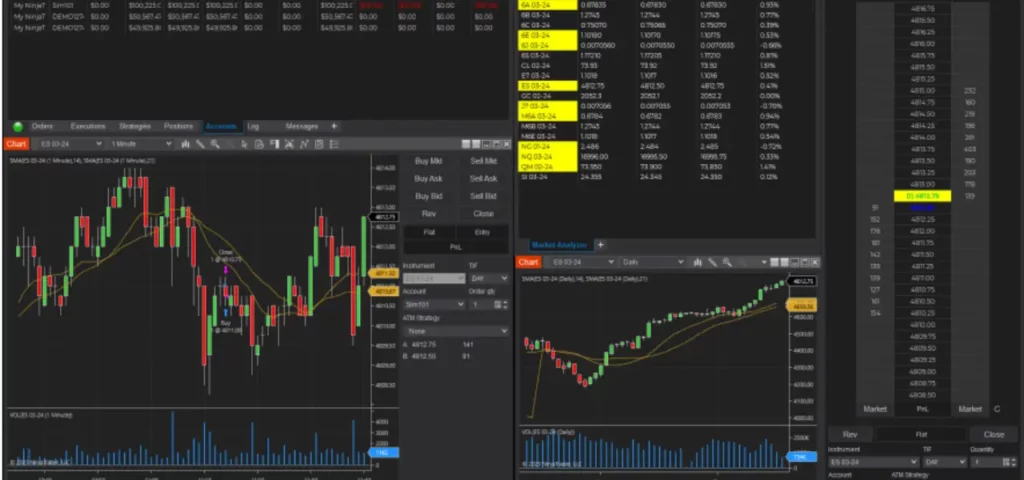

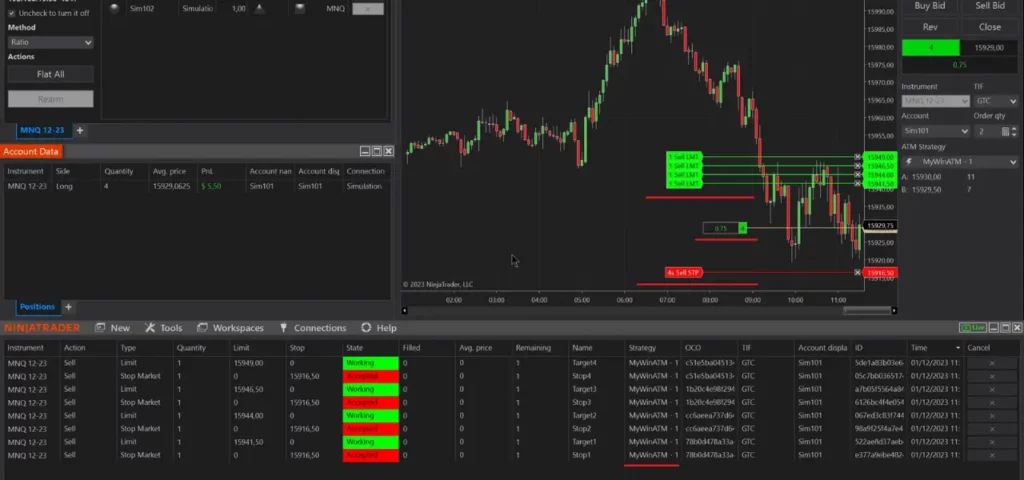

NinjaTrader Review

Overview: NinjaTrader is a hugely popular trading platform, particularly among retail futures traders. It’s known for its powerful charting, extensive customization options, and support for automated trading.

Pros:

- Advanced charting and technical analysis tools

- Robust order entry system.

- Large ecosystem of third-party add-ons and indicators.

- Support for automated trading (C#) & robust backtesting.

- Free version available (limited features, but includes charting).

- Lifetime license option available.

- Offers a native mobile app

Cons:

- Can be complex for beginners.

- Require Add-On subscription for orderflow tools (footprint, volume profile, heatmap…)

- Windows Server 2025 compatibility unconfirmed (likely by late 2025).

Best For: Active Day Traders, Automated Traders, Experienced Traders.

Pricing: Free version when Opening an account with Ninjatrader Broker (includes basic charting). Subscription ($59/month) or Lifetime license ($1,499 one-time payment) for Order flow tools.

Key Features: Advanced Charting, Automated Trading, Market Replay, Order Flow Tools, Extensive Third-Party Support.

Mobile App: Offers Native mobile app.

Brokerage/Platform Type: Both. Offers both a standalone platform and its own brokerage (NinjaTrader Brokerage). Free platform use requires a funded NinjaTrader Brokerage account; otherwise, a license fee applies.

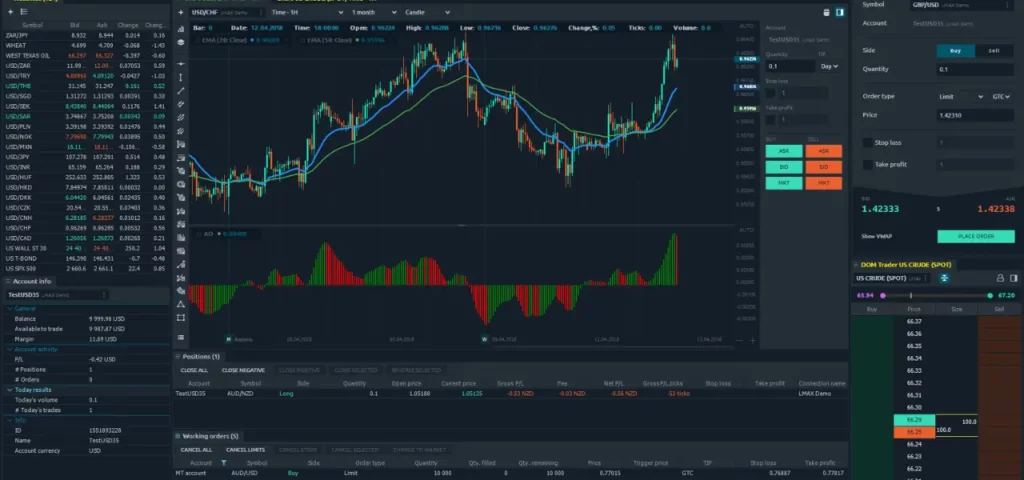

Tradovate Review

Overview: Tradovate was acquired by NinjaTrader in 2022, and the platforms are undergoing integration. Tradovate is a cloud-based platform designed specifically for futures trading. It’s known for its commission-free pricing model (with membership) and user-friendly interface.

Pros:

- Cloud-based, accessible from any device with a web browser.

- Clean and intuitive interface.

- Good charting tools.

- Integrated paper trading.

- Free version available when opening an account and deposit any amount

Cons:

- Fewer advanced features compared to NinjaTrader or TradeStation.

- Limited third-party add-on support.

Best For: Beginners, Cost-Conscious Traders, Traders Who Value Simplicity.

Pricing: Free platform access when opening brokerage Account. Exchange and data fees still apply.

Key Features: Cloud-Based, Commission-Free Option, User-Friendly Interface, Charting, Order Flow Tools.

Mobile App: Full-featured mobile app available.

Brokerage/Platform Type: Brokerage with integrated platform for trading futures.

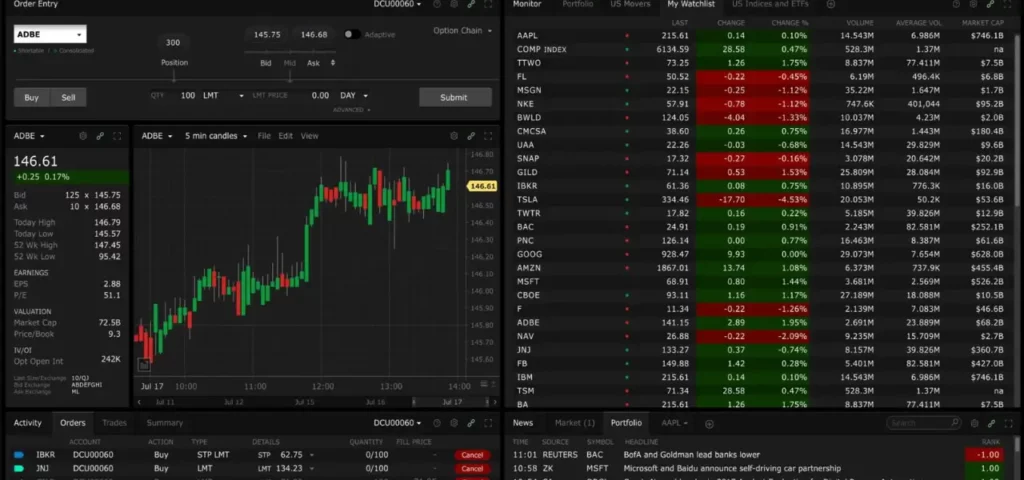

Trader Workstation (TWS) Review

Overview: Trader Workstation (TWS) is the flagship trading platform offered by Interactive Brokers (IBKR). It’s a powerful, downloadable platform designed for active traders and investors who trade multiple products, including futures, options, stocks, forex, bonds, and ETFs, across global markets. TWS is known for its advanced order types, sophisticated tools, and low cost, but it also has a reputation for being complex.

Pros:

- Access to a vast range of global markets and instruments, including a wide selection of futures contracts.

- Very low commissions through IBKR’s tiered or fixed pricing structure.

- Advanced order types and algorithms, including bracket orders, algorithmic trading, and spread trading tools.

- Powerful charting, technical analysis tools, and market scanners.

- Real-time market data and news.

- Customizable interface and layouts.

- Robust risk management tools.

- Paper trading account is available: simulating trading using real market conditions without risking actual capital.

Cons:

- Steep learning curve; the platform can be overwhelming for beginners due to its vast array of features.

- The interface, while powerful, can feel dated compared to some newer platforms.

- Requires a funded Interactive Brokers account.

Best For: Professional Traders, Active Traders, High-Volume Traders, International Traders, Cost-Conscious Traders who trade multiple asset classes.

Pricing: TWS is provided free of charge to Interactive Brokers clients. However, trading commissions and fees apply based on IBKR’s tiered or fixed pricing structure. Exchange and data fees also apply. IBKR’s tiered pricing generally offers lower comissions for higher-volume traders.

Key Features: Global Market Access, Advanced Order Types, Algorithmic Trading, Charting, Technical Analysis, Market Scanners, Risk Management Tools, Portfolio Analysis, Real-time Data and News.

Mobile App: Full-featured mobile app available (IBKR Mobile), providing most of the functionality of the desktop platform.

Brokerage/Platform Type: Integrated platform provided by the Interactive Brokers brokerage. Requires an IBKR account.

Trader Workstation (TWS) Website

Thinkorswin (TOS) Review

Overview: TD Ameritrade‘s (now Charles Schwab‘s) thinkorswim platform is a powerful and popular platform for trading futures, options, and stocks. It’s known for its advanced charting, analysis tools, and educational resources.

Pros:

- Excellent charting and technical analysis tools.

- Wide range of research and educational resources.

- Powerful options trading capabilities.

- User-friendly interface (though can be complex).

Cons:

- Round turn comissions can be higher than competitors.

- Can be overwhelming for complete beginners.

Best For: Active Traders, Options Traders, Traders Who Value Research and Education.

Pricing: Free when opening brokerage Account, no minimum desposit for futures trading.

Key Features: Advanced Charting, Options Analytics, Extensive Research Tools, Paper Trading.

Mobile App: Excellent mobile app with full functionality.

Brokerage/Platform Type: Brokerage with integrated platform (thinkorswim).

TradeStation Review

Overview: TradeStation is a powerful platform popular among active traders and those interested in automated trading. It offers advanced charting, backtesting, and strategy development tools.

Pros:

- Advanced charting and technical analysis.

- Powerful strategy development and backtesting capabilities (EasyLanguage).

- Robust order execution.

- Large community and support resources.

- New web-based platform available.

Cons:

- Can be complex for beginners.

- Fees can be higher than some competitors, depending on the plan.

Best For: Active Traders, Automated Traders, Experienced Traders.

Pricing: Free when opening brokerage Account, no minimum desposit for futures trading.

Key Features: Advanced Charting, EasyLanguage Programming, Strategy Backtesting, RadarScreen (market scanning), Matrix (order entry), Web-Based Platform.

Mobile App: Full-featured mobile app available.

Brokerage/Platform Type: Both. Offers both a standalone platform and its own brokerage.

TradingView Review

Overview: TradingView is primarily known as a web-based charting platform and social network for traders. However, it also integrates with several brokers to allow for direct futures trading.

Pros:

- Excellent charting and technical analysis tools.

- Large and active community of traders.

- Web-based, accessible from any device with a browser.

- User-friendly interface.

- Free version available (with limitations).

- Expanded broker integrations for futures trading.

Cons:

- Trading functionality, including futures, depends on the integrated broker.

- Not as many advanced features (no advanced order flow tools) and not ideal for low latency trade execution.

- Free version has limitations (ads, fewer indicators).

Best For: Charting Enthusiasts, Social Traders, Traders Who Prefer a Web-Based Platform.

Pricing: Free version available. Paid plans (Pro, Pro+, Premium) starting at $12.95/month. Brokerage fees depend on the integrated broker.

Key Features: Advanced Charting, Social Networking, Pine Script (for custom indicators), Broker Integration.

Mobile App: Excellent mobile app with full charting capabilities.

Brokerage/Platform Type: Standalone platform. Requires integration with a separate broker for trading.

Sierra Chart Review

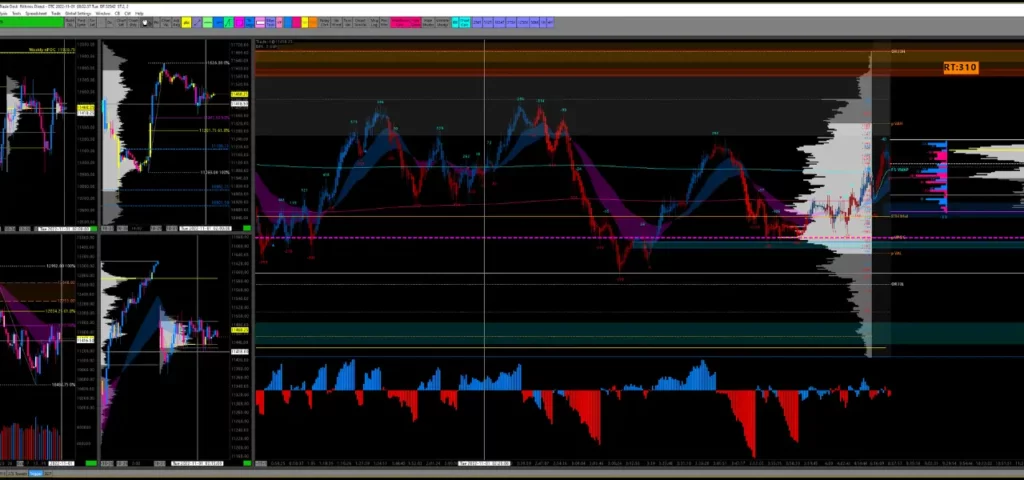

Overview: Sierra Chart is a professional-grade platform known for its stability, high performance, and extensive customization options. It’s highly regarded for its order flow analysis tools.

Pros:

- Highly stable and reliable.

- Excellent performance, even with large amounts of data.

- Extensive customization options (C++).

- Powerful order flow analysis tools.

- Competitive pricing.

Cons:

- Steeper learning curve than some other platforms.

- Interface can feel dated compared to newer platforms.

Best For: Professional Traders, Day Traders, Scalpers, Order Flow Traders, Algo Traders, Traders Who Value Performance and Customization.

Pricing: Subscription starting at 36 USD/month for all charting and order flow tools.

Key Features: Advanced Charting, Order Flow Studies (Number Bars, Volume Profile, TPO Chart), C++ Customization (ACSIL), High Performance.

Mobile App: No native mobile app, but can be accessed through remote desktop solutions.

Brokerage/Platform Type: Standalone platform. Requires a separate brokerage account.

Quantower Review

Overview: Quantower is a multi-asset platform known for its flexibility, advanced charting, and order flow analysis tools. It supports multiple brokers and data feeds, making it a versatile option for traders.

Pros:

- Multi-asset support (futures, stocks, options, forex, crypto).

- Excellent charting and technical analysis tools.

- Advanced order flow analysis features (DOM, Time & Sales, Volume Profile, Footprint).

- Highly customizable interface.

- Expanded support for over 60 connections (brokers and data feeds).

- Good value for the price.

Cons:

- Can be overwhelming for complete beginners due to its many features.

- Fewer built-in automated trading capabilities compared to NinjaTrader or TradeStation. (Requires external tools/programming)

Best For: Intermediate to Advanced Traders, Order Flow Traders, Multi-Asset Traders, Traders Who Value Flexibility.

Pricing: Offers a free version with limited features. Paid licenses (single-asset or multi-asset) starting at $70/month. Brokerage and data feed fees depend on your chosen providers.

Key Features: Multi-Asset, Advanced Charting, Order Flow Analysis (Depth of Market Order Book, Time & Sales, Volume Profile), Customizable Interface, Multiple Connections.

Mobile App: No native mobile app.

Brokerage/Platform Type: Standalone platform. Requires connection to a separate broker or data feed.

Section III: Top Futures Trading Platforms by Use Case

This section breaks down the best futures market platform based on specific trading needs and preferences. It’s not just about the “best” overall, but the best for you. We go beyond our main reviews and consider all available options.

Best Futures Trading Platform for Beginners

- TradingView: While primarily a charting platform, its user-friendly interface and broker integrations make it a viable option for beginners who want to start with simple analysis and execution.

- Tradovate: Still the top recommendation for beginners. The cloud-based access, simple interface, and commission-free option (with membership) are ideal for learning. The integrated paper trading is important for practice.

- NinjaTrader: The free version, which includes advanced charting, is a good starting point. The vast online resources and community support help new traders learn. However, the full platform can be overwhelming, so start with the basics.

Why these choices? Beginners need simplicity, ease of use, and trading educational resources. These platforms minimize complexity while providing the fundamental tools for learning.

Best Futures Paper Trading Platform (Demo Accounts)

- Tradovate: Its demo account perfectly mirrors the live environment, making the transition to real trading seamless.

- Thinkorswim (TOS): A very robust paper trading environment with access to most of the platform’s features – excellent for learning the platform’s capabilities.

- Trader Workstation (TWS): Offers a realistic paper trading account that simulates live market conditions.

- NinjaTrader: Provides a solid simulated trading environment for practice and strategy testing.

- SierraChart: Offers Evaluation mode which enables realistic paper trading with powerful customization to match your futures capital, risk management parameters etc…

Almost all platforms offer demo accounts. These are the standouts for their realism and features.

Free Futures Trading Platform / Low Cost

- NinjaTrader: The free version (with a funded NinjaTrader Brokerage account) provides powerful charting and basic order entry. You still pay commissions and data fees, but the platform itself is free.

- Trader Workstation (TWS): You get a free access to the trading software. In addition, Interactive Brokers consistently offers the lowest per-contract commissions in the industry, making it the best choice for high-volume traders focused solely on cost.

- Tradovate: The commission-free option (with a monthly membership fee) can be very cost-effective, especially for moderately active traders.

“Free” usually means no platform fee, but commissions and data fees still apply. Consider your trading volume when comparing costs.

Trading Platform Used by Professional Traders (Institutional Grade)

- Trading Technologies (TT): A widely used, high-performance platform specifically designed for professional futures traders and brokers. It’s known for its speed, reliability, and advanced order routing capabilities. It is a common choice within prop firms.

- CQG (CQG Trader / QTrader): Another popular choice among professional traders and institutions, offering robust charting, analytics, and order execution tools, with a strong focus on futures and options.

- Bloomberg Terminal (with futures trading capabilities): While not solely a futures trading platform, the Bloomberg Terminal is the industry standard for financial data and analytics. It includes integrated futures trading functionality and is ubiquitous in institutional settings.

- Custom-Built Platforms: Many proprietary trading firms, hedge funds, and large financial institutions develop their own in-house trading platforms. These platforms are tailored to their specific strategies, risk management requirements, and infrastructure. They offer unparalleled customization, control, and security, but are not available to retail traders.

- Interactive Brokers (TWS): The platform of choice for many starting professional and institutions traders due to its global market access, advanced order types, and low costs when trading high volumes.

Institutional platforms prioritize speed, reliability, connectivity to multiple exchanges, sophisticated risk management tools, and often, the ability to handle extremely high trading volumes. Many institutions use proprietary, custom-built solutions for maximum control and performance.

Best Day Trading Futures Platform

- NinjaTrader: The combination of advanced charting, order flow tools, fast execution, and automation capabilities makes it a top choice for day traders.

- Sierra Chart: Its stability, speed, and order flow analysis are crucial for day trading success.

- Tradovate: The cloud-based access and quick order entry are beneficial, especially for traders who need to trade from multiple locations.

- Quantower: Its order flow tools (DOM, Time & Sales) and multi-broker connectivity make it a strong contender.

Day traders need speed, reliability, and powerful analysis tools. Order flow analysis is often a key component.

Best Trading Platform for Scalping Futures

- Sierra Chart: Speed, stability, and detailed order flow data are critical for capturing small price movements.

- Jigsaw Trading: popular among scalpers for DOM Scalping.

- Quantower: Offers excellent order flow visualization and rapid order entry.

Scalpers need the fastest possible execution and the ability to see order flow in real-time.

Best Futures Platform for Swing Trading

Swing trading involves holding positions for several days to several weeks, aiming to capture larger price swings. This requires a different set of features than day trading or scalping.

- Interactive Brokers (TWS): Provides access to a wide range of global futures markets, and its low fees are beneficial for holding positions for longer periods. Its charting and research tools are suitable for swing trading analysis.

- TradingView: Its excellent charting capabilities, extensive indicator library, and alert system make it well-suited for identifying and managing swing trades. The web-based access is also convenient forc hecking positions from anywhere.

- Thinkorswim (TOS): The powerful charting, research tools, and ability to analyze historical data are valuable for swing traders who need to conduct in-depth market analysis.

- NinjaTrader: While often associated with day trading, NinjaTrader’s robust charting, backtesting capabilities, and automated order features (with a paid license) can be effectively used for swing trading strategies.

Key considerations for swing trading platforms:

- Strong Charting: The ability to analyze multiple timeframes, use a wide range of indicators.

- Alerts: Customizable alerts (price levels, indicator crossovers) are crucial for managing trades that may last for days or weeks.

- Fundamental Data (Optional): Some swing traders incorporate fundamental analysis, so access to news and economic data can be beneficial.

- Reasonable Fees: Since swing trades are held for longer periods, minimizing overnight fees and commissions is important.

Best Platform for Futures Spread Trading

- Interactive Brokers (TWS): Offers dedicated spread trading tools and advanced order types specifically designed for executing complex spread strategies.

- TradeStation: Provides robust tools for analyzing and executing spread trades, including strategy backtesting.

- CQG Trader / QTrader: These platforms are known for their strong support of spread trading, with specialized order types and analytics.

Spread trading requires specialized tools for analyzing and executing multi-leg orders.

Best Automated Futures Trading Platform

Finding the best platform for automatic trading futures requires careful consideration based on your needs and your technical skills. Many platforms offer robust capabilities for creating and deploying automated strategies, also referred to as algorithmic trading systems.

- NinjaTrader: Remains a leader among algo trading platforms for futures due to its C# support, large community, extensive third-party add-ons, and robust backtesting capabilities. It’s a popular choice for both retail and professional traders developing automated trading strategies.

- TradeStation: EasyLanguage is a powerful and relatively accessible programming language specifically designed for developing and backtesting algorithmic trading strategies. TradeStation offers a comprehensive environment for creating, testing, and deploying these systems, making it a strong futures algo trading platform.

- Sierra Chart: While it will require advanced coding knowledge, Sierra Chart’s C++ based ACSIL (Advanced Custom Study Interface and Language) provides exceptional performance and flexibility for advanced algorithmic trading systems. It’s a favorite among professional developers who need maximum control and speed. Also they have an extensive well detailed documentation.

- MultiCharts: This platform is highly regarded for its compatibility with EasyLanguage (from TradeStation) and its own PowerLanguage. It offers robust backtesting, optimization, and automated trading features, making it a strong choice for traders seeking a versatile futures algo trading platform.

- Trading Technologies (TT): While significantly more expensive than other options on this list, TT is a professional-grade platform specifically designed for high-frequency Trading and algorithmic futures trading. It offers unparalleled speed, reliability, and access to a wide range of futures exchanges. TT is best suited for professional trading firms, hedge funds, and very high-volume individual traders who require institutional-grade infrastructure and are willing to pay a premium for it.

Key Considerations for Automated Trading Platforms:

- Programming Language: Consider the platform’s supported language (C#, EasyLanguage, C++, PowerLanguage, etc.) and your own programming skills.

- Backtesting Capabilities: Robust backtesting to evaluate the historical performance of your algorithmic trading strategies.

- Optimization: The ability to optimize strategy parameters is crucial for finding the best settings.

- Order Execution: Reliable and fast order execution is critical for automated trading strategies.

- Community and Support: A strong community can provide valuable resources, code examples, and support for building and troubleshooting your algorithmic trading systems.

Best Mobile & Iphone Futures Trading Platform

- Thinkorswim (TOS): The thinkorswim mobile app is exceptionally powerful, offering nearly the full functionality of the desktop platform.

- Tradovate: Its cloud-based nature makes it easily accessible and fully functional on mobile devices.

- Interactive Brokers (IBKR Mobile): A robust mobile app that provides access to most of TWS’s features.

- NinjaTrader: Now offers a native mobile app for on-the-go trading and monitoring. see our NT review

Mobile apps are very convenient for traders who need to monitor and manage positions while away from their desks.

Best Futures Trading Platform for Mac users

- Tradovate: As a fully cloud-based platform, it works seamlessly on Mac without any software installation. see our Tradovate review

- TradingView: Being web-based, it’s fully compatible with Mac. see our TV review

- Interactive Brokers (TWS): TWS has a native Mac version. see our TWS review

These platforms offer full functionality on macOS without requiring Windows emulation.

Best PC software for futures trading

- NinjaTrader: A Windows-based platform. see our NT review

- Sierra Chart: Designed for Windows (a linux compatibility is being developed). see our SC review

- TradeStation: A Windows-based platform. see our TS review

- Quantower: A Windows-based platform. see our QT review

These are native Windows applications.

Futures Online Trading Platform (Web based)

- Tradovate: Fully cloud-based, accessible through any web browser. see our Tradovate review

- TradingView: Primarily web-based. see our TV review

- TradeStation: Now offers a web-based version of its platform. see our TS review

These platforms require no software download and can be accessed from anywhere with an internet connection.

Fastest Futures Trading Platform:

- Sierra Chart: Renowned for its performance, efficiency and low latency. see our SC review

- Interactive Brokers (TWS): Offers Direct Market Access (DMA) routing for fast execution. see our TWS review

Speed is subjective and depends on many factors (internet connection, broker routing, etc.), but these platforms are generally considered very fast.

Copy Trading Platforms Futures

Copy trading allows you to automatically replicate the trades of another trader (or your own trades across multiple accounts). Several platforms offer this functionality, with varying degrees of flexibility and control.

- NinjaTrader (with Replikanto): The third-party tool Replikanto integrates with NinjaTrader to enable copying trades across multiple accounts, including accounts with different brokers, prop firms and data feeds. This is particularly useful for prop firm traders, those managing multiple accounts, or those coordinating trades between personal and managed accounts.

- Quantower: Offers a native copy trading feature, allowing users to copy trades between accounts within the Quantower platform without requiring external tools. This simplifies the setup and management of copy trading and can support multiple brokers, prop firms and data feeds.

- Sierra Chart: Offers a built-in Trade Copier feature (called: Order Allocation to Trade Accounts). This allows you to copy trades across multiple accounts connected to the same data/order routing service. While it doesn’t support cross-broker/data feed copying like Replikanto or Quantower, it provides a reliable solution for users within the Sierra Chart ecosystem.

Important Caveat: Copy trading, while convenient, carries inherent risks. Latency (delays in trade execution) between the master account and the follower accounts can lead to different entry and exit prices, potentially resulting in losses or reduced profits. Errors in the master account’s strategy or execution will also be replicated. Thorough testing, robust risk management, and a good understanding of the copied strategy are absolutely essential before using copy trading with real capital. Start with small position sizes and closely monitor performance. Copy trading is not a guaranteed path to profit and requires significant due diligence and experience.

Futures Trading Platform for Farm Hedging

Farmers looking for user-friendly and straightforward platforms for hedging purposes should prioritize ease of use and clear market access. Tradovate and TD Ameritrade (thinkorswim) are excellent choices.

Which Futures Trading Platform is the Cheapest ?

In order to find the cheapest you might want to go with the main free brokers integrated platforms. They might not be exactly perfect for your trading style but they are perfect to get started. Once you are ready to invest in a better platform then you can switch to some of the paid options.

Here is the list of the major free platforms to get started:

- Interactive Brokers’ TWS: Very solid free platform when opening an account.

- NinjaTrader: you get a free acess to the basic feastures by opening a trading account and when you are ready you can switch to the premium version without changing platforms.

- Quantower: Offers a free access to the basic feature and you can switch to the premium licence version once you’re ready.

Consider both platform fees and commission structures when evaluating cost.

By Data Feed

Rithmic Compatible Trading Platforms

- NinjaTrader

- Sierra Chart

- MotiveWave

- Optimus Futures

- Quantower

- Bookmap

- Investor/RT

- MultiCharts

- Jigsaw Trading

- EdgeClear

- ATAS

Read also: Why are you having Rithmic Issues ? And How to Avoid Them

CQG Futures Trading Platform

- Tradovate

- NinjaTrader

- Interactive Brokers (TWS)

- CQG Trader

- CQG QTrader

- MultiCharts

- Optimus Futures

- TradingView

- MotiveWave

- Quantower

- Sierra Chart

- Bookmap

- Investor/RT

- EdgeClear

- ATAS

DxFeed Compatible Trading Platforms

- NinjaTrader

- MotiveWave

- Quantower

- BookMap

- ATAS

IQFeed (DTN IQFeed) Compatible Trading Platforms

- NinjaTrader

- Sierra Chart

- MotiveWave

- MultiCharts

- Investor/RT

Denali Trading platforms (sierra chart proprietary data feed)

- SierraChart is best used with Denali data feed (ultra low latency) pared Teton order routing.

By Broker

Best Broker and platforms for futures trading Integrated

These brokers offer their own proprietary trading platforms, providing a seamless experience for account management, order execution, and charting. This can be a convenient option for traders who prefer an all-in-one solution.

- Interactive Brokers (TWS): Offers the powerful Trader Workstation (TWS) platform, known for its global market access, low commissions, and advanced features.

- Thinkorswim (TOS): Now part of Charles Schwab, thinkorswim is a highly regarded platform for its charting, analysis tools, and options trading capabilities.

- TradeStation: Offers its own robust platform, known for its advanced charting, automated trading capabilities (EasyLanguage), and a new web-based version.

- NinjaTrader: Unique in that it offers both a standalone platform (requiring a license for use with other brokers) and its own brokerage. Using the NinjaTrader platform with a NinjaTrader Brokerage account unlocks the free version of the platform.

- Tradovate: A futures-focused broker with a cloud-based platform designed for simplicity and ease of use, particularly popular among beginners. Acquired by NinjaTrader, but still operating as a separate platform.

AMP Futures Trading Platforms

AMP Futures offers a wide variety of platforms (50+), including NinjaTrader, MultiCharts, Sierra Chart, and TradingView.

Charles Schwab Futures Trading Platform

Offers the thinkorswim platform (acquired from TD Ameritrade).

E*TRADE Futures Trading Platform

Offers Power E*TRADE and Futures Trader platforms.

Interactive Brokers Futures Trading Platform

Offers its Trader Workstation (TWS) platform, and also allows connections to NinjaTrader or Tradingview.

Does Interactive Brokers Have a Free Futures Trading Platform: The platform access is free, commissions and data feed apply.

TD Ameritrade (part of Charles Schwab)

Offers the thinkorswim platform.

Does TD Ameritrade Offer Web Based Futures Trading Platform: Yes.

Cannon Trading Futures Platform for Mac

Cannon Trading offers various platforms, check their website for Mac compatibility.

Fidelity Trading Platform Futures

Fidelity offers Active Trader Pro, which supports futures trading.

Goldman Sachs Futures Trading Platform

Goldman Sachs primarily caters to institutional clients; their platform information is not readily available to the public.

Infinity Futures Trading Platforms

Infinity Futures offers a range of platforms, including InfinityAT.

Lightspeed Trading Futures Platform

Lightspeed offers various platforms, including Sterling Trader Pro and Livevol X.

Optimus Futures Trading Platforms

Optimus Futures offers a wide selection of platforms, including their own Quantower version (Optimus Flow), NinjaTrader, Sierra Chart, and TradingView, catering to various trading styles and preferences.

TradeStation Futures Trading Platforms

TradeStation offers its own flagship platform, TradeStation Desktop, as well as TradeStation Web Trading and TradeStation Mobile.

By Traded Instrument

Best Platform for E-mini CME Futures

- NinjaTrader

- Sierra Chart

- Interactive Brokers (TWS)

- Tradovate

These are among the best platforms for trading s&p500 futures and the best trading platform for micro e mini futures.

Best Trading Platform for Options and Futures

The most popular derivatives trading software are:

- Thinkorswim (TOS)

- Interactive Brokers (TWS)

- TradeStation

Best Commodity Futures Trading Platform

- Interactive Brokers (TWS)

- Thinkorswim (TOS)

- NinjaTrader

Specific commodities:

- gold futures trading platform : Interactive Broker, Ninjatrader

- oil futures trading platform and crude oil futures trading platform : Interactive Broker, Ninjatrader, Tradovate.

- grain futures trading platform: Tradovate, Interactive Broker, TD Ameritrade.

Forex & Currency Futures Trading Platform

Platforms providing Forex and Futures trading:

- Interactive Brokers (TWS)

- NinjaTrader

- Thinkorswim (TOS)

Stock and Futures Trading Platforms

- Interactive Brokers (TWS)

- Thinkorswim (TOS)

- TradeStation

Best crypto Futures trading platforme

- Deribit (focused on crypto derivatives)

- Binance Futures: most used for perpetual futures trading platform

- Bybit

- OKX

- BitMEX

By Country

Platform availability and regulatory compliance vary significantly by country. This section provides recommendations for some key regions, but it’s primordial to verify the current availability and regulations in your specific location before choosing a platform.

Best Futures Trading Platform in the USA

The US has a wide range of options. Popular and well-regarded choices include:

- NinjaTrader: (Platform and Brokerage)

- Tradovate: (Brokerage with integrated platform)

- Interactive Brokers (TWS): (Brokerage with integrated platform)

- TD Ameritrade (thinkorswim): (Brokerage with integrated platform, now part of Charles Schwab)

- TradeStation: (Platform and Brokerage)

- Sierra Chart: (Standalone platform – requires separate brokerage)

- Quantower: (Standalone platform – requires separate brokerage)

Note: Most major platforms and brokers operate in the US, subject to US regulations (CFTC, NFA).

Best Futures Trading Platform Australia

- Interactive Brokers (TWS): Widely considered the best option in Australia due to its low fees, global market access, and powerful platform.

- CMC Markets: A local Australian broker offering futures trading on its own platform.

- Saxo Markets: Offers access to a wide range of futures markets.

Note: Look for platforms and brokers regulated by ASIC (Australian Securities and Investments Commission).

Best Futures Trading Platform Canada

- Interactive Brokers (TWS): Remains a top choice in Canada for its low cost and comprehensive features.

- Questrade: A Canadian broker offering futures trading, though with a more limited selection than IBKR.

- Saxo Markets: Provides access to futures markets.

Note: Canadian regulations are overseen by IIROC (Investment Industry Regulatory Organization of Canada) and provincial regulators.

Best Futures Trading Platform UK

- Interactive Brokers (TWS): Popular in the UK for the same reasons as elsewhere: low fees and wide market access.

- IG: A well-established UK-based broker offering futures trading on its own platform.

- Saxo Markets: Another strong option for UK futures traders.

Note: The Financial Conduct Authority (FCA) regulates financial services in the UK.

Best Futures Trading Platform Singapore

- Interactive Brokers (TWS): A dominant player in Singapore due to its global reach and competitive pricing.

- Saxo Markets: Offers a wide range of futures markets and a user-friendly platform.

- IG: Provides access to futures markets.

Note: The Monetary Authority of Singapore (MAS) is the primary financial regulator.

Best Futures Trading Platform India

Access to global futures markets for Indian residents can be complex due to regulations. The following options offer limited or indirect access:

- Interactive Brokers (TWS): Allows Indian residents to trade on international exchanges, including futures, subject to Indian regulations.

- Zerodha and Upstox: These are primarily Indian stockbrokers. They do not directly offer global futures trading. They may have tie-ups with international brokers that provide limited access to some futures markets, but this is not their core offering. These are NOT recommended for dedicated futures trading, compared to IBKR.

Note: The Securities and Exchange Board of India (SEBI) regulates the Indian financial markets. Regulations regarding overseas derivatives trading for Indian residents are complex; consult a financial advisor.

Futures Trading Platform Malaysia

- Interactive Brokers (TWS): A strong option for Malaysian traders seeking international market access.

- Saxo Markets: Offers futures trading capabilities.

Note: The Securities Commission Malaysia (SC) regulates the capital markets.

Best Futures Trading Platform Europe

- Interactive Brokers (TWS): Widely available and popular across Europe due to its low costs and extensive market access.

- DEGIRO: A European broker that provides access to futures exchanges, but its platform is less advanced than TWS.

- Saxo Markets: Offers a good range of futures markets and a user-friendly platform.

Note: Regulations vary across European countries, but MiFID II (Markets in Financial Instruments Directive II) provides a common regulatory framework.

SECTION IV: List of all main futures trading platforms

Here’s a comprehensive list of trading platforms for futures markets, including those mentioned above and many others. Note that some platforms may primarily focus on other asset classes but also offer futures trading.

- Quantower

- Ninjatrader

- MetaTrader 5 (MT5)

- Sierra Chart

- TradingView

- MultiCharts

- ATAS

- Trading Technologies (TT)

- Trader Workstation (TWS) – Interactive Brokers

- Thinkorswim – TD Ameritrade/Charles Schwab

- TradeStation

- CQG Trader / QTrader

- Jigsaw Trading

- MotiveWave

- VolFix

- Optimus futures, Optimus Flow

- BlueWater – InsideEdge

- BookMap

- Volumetrica – VolSys / VolBook

- Rithmic – R | Trader Pro

- Trade Navigator

- AgenaTrader

- C2 – Collective2

- Investor/RT

- eSignal

- iSystems

- iBroker

- Quantirica – Ticker Explorer

- Overcharts

- Medved Trader

- Tiger.Trade

- Qcaid by Qubitia

- Barchart Trader

- DTN IQFeed (Data provider, integrates with platforms)

- FutureSource

- Hidden Force Flux

- Keyboard Trader

- QScalp

- Quick Screen Trading (QST)

- SmartQuant

- Scaled Dynamics

- ScalpTool – euSpeed

- StealthPro – Stealth Trader

- StockSharp

- TickerQuant

- TSLab

- Veritian

- Zlantrader

- e futures international trading platform

- Deribit (Crypto Futures)

- Binance Futures (Crypto Futures)

- Bybit (Crypto Futures)

- OKX (Crypto Futures)

- BitMEX (Crypto Futures)

- Power E*TRADE

- Futures Trader (E*TRADE)

- Sterling Trader Pro

- Livevol X

- InfinityAT

- IG

- Saxo Markets

- Zerodha

- Upstox

- DEGIRO

This list is not exhaustive, and new platforms and tools emerge regularly. The best platform for you will depend on your individual needs, trading style, budget, and experience level. Always do your own research and consider trying out demo accounts before committing to a specific platform.