In this Masterclass, we’ll explore everything from basic definitions to advanced trading strategies, helping you understand Futures vs Forex which is better for your trading goals and risk tolerance.

Whether you are exploring career options or curious about trading, understanding the difference between Futures trading and Forex trading is crucial for anyone looking to participate in financial markets. Both offer exciting opportunities, but they function quite differently.

TL;DR the Ultimate Futures vs Forex Comparison

| Key Aspects | Futures | Forex |

|---|---|---|

| Definition | Standardized contracts to buy/sell assets at a future date with fixed specifications (contract size, expiration, settlement) traded on centralized exchanges | Direct exchange of currency pairs in a decentralized over-the-counter (OTC) market with flexible position sizing and no expiration dates |

| Market Structure (Part I) | Centralized exchanges with transparent pricing, regulated by CFTC/NFA, standardized contracts, visible order flow, and specific futures trading hours | Decentralized 24/5 market with $6+ trillion daily volume, broker-dependent pricing, flexible position sizing from micro to standard lots |

| Trading Styles (Part II) | Day Trading: Better order flow data, no PDT rule, clearer support/resistance Swing Trading: Cleaner technicals, COT reports, no financing costs News Trading: Reliable execution during volatility For Beginners: More transparent but higher capital requirements | Day Trading: 24-hour access, flexible sizing, lower initial capital Swing Trading: No expirations, flexible sizing, watch for swap fees News Trading: More currency-specific opportunities For Beginners: Easier entry with micro lots, simpler to start |

| Prop Firms | Exchange-regulated markets, price uniformity, transparent data, streamlined evaluations, access to live capital, better for serious career traders | Often in less regulated jurisdictions, variable price feeds, typically multi-phase evaluations, easier initial access but potential compliance concerns |

| Which Market is Best | Consider Futures If: You value transparency, have $5,000+ capital, prefer standard market hours, want to trade multiple asset classes, value tax benefits, or use order flow analysis | Consider Forex If: You need 24-hour market access, have limited starting capital ($1-3K), want to focus solely on currencies, prefer flexible position sizing, or want to avoid contract expirations |

I) Futures and Forex Markets Fundamentals

1. What Are Futures Contracts?

A futures contract is a standardized legal agreement to buy or sell a particular commodity or financial asset at a predetermined price at a specified time in the future. When you trade futures, you’re not trading the actual asset immediately but rather a contract to trade that asset later. Key components of futures contracts include:

- The underlying asset (gold, oil, currencies, stock indices)

- An expiration date when the contract settles

- A standardized contract size (e.g., 1 gold futures contract = 100 troy ounces)

- Tick value – the minimum price movement of a futures contract (e.g., 0.25 points for E-mini S&P 500 futures = $12.50 per contract)

- Margin-to-tick ratio – how many adverse ticks it takes to deplete your initial margin

- The settlement price determined by the exchange

- Margin requirements set by the exchange and brokerage

Futures markets evolved from agricultural needs. The Dojima Rice Exchange in Japan (1730s) is often cited as the world’s first organized futures exchange. However, modern futures trading took shape with the founding of the Chicago Board of Trade (CBOT) in 1848, which standardized grain trading and introduced forward contracts that later evolved into futures.

Types of Futures Contracts

There are two main categories of futures contracts:

- Commodities futures: Contracts for physical goods like gold, oil, wheat, and livestock

- Financial futures: Contracts based on financial instruments including:

- Currency futures (Euro, Yen, etc.)

- Stock index futures (S&P 500, Nasdaq, etc.)

- Interest rate futures (Treasury bonds, Eurodollar)

Understanding Futures Contract Pricing

When trading futures, it’s essential to understand how contract pricing works:

- Each futures contract has a specific tick size – the minimum price increment the contract can move

- Each tick represents a specific dollar value that varies by contract (e.g., one tick in E-mini S&P 500 = $12.50, while one tick for Crude Oil = $10)

- Daily price limits exist on many futures contracts to prevent extreme volatility

- Contracts have settlement procedures that may be cash-settled or physically delivered

2. What is Forex Trading?

Forex trading (foreign exchange) involves buying one currency while simultaneously selling another. Unlike futures, FX trading happens directly in the present (spot market) rather than at a future date. The forex market is the largest financial market globally, with daily trading volumes exceeding $6 trillion. Key components of forex trading include:

- Currency pairs (EUR/USD, GBP/JPY, etc.)

- Exchange rates showing the value of one currency relative to another

- Bid price (what buyers are willing to pay)

- Ask price (what sellers are willing to accept)

- The spread between bid and ask prices

- Pips – the smallest price movement in a currency pair (usually 0.0001 for most pairs)

- Pip value – the monetary value of a single pip (varies based on lot size and currency pair)

- Lot sizes – standard (100,000 units), mini (10,000 units), and micro (1,000 units)

- Leverage and margin requirements set by brokers

The modern forex market emerged after the Bretton Woods Agreement (1944) established the U.S. dollar as the world’s primary reserve currency. The system eventually collapsed in 1971 when the United States suspended the dollar’s convertibility to gold, leading to the floating exchange rate system we use today.

Central Banks and Market Participants (crutial for Forex Trading)

Central banks play a crucial role in forex markets by setting monetary policy and sometimes directly intervening in currency markets. Key central banks include:

- The Federal Reserve (United States)

- The European Central Bank (Eurozone)

- The Bank of England (United Kingdom)

- The Bank of Japan (Japan)

Other major forex market participants include commercial banks, multinational corporations, investment firms, hedge funds, and retail traders like you and me.

Understanding Forex Pairs Pricing

Forex trading requires understanding how currency price movements are measured:

- A pip (percentage in point) is typically the fourth decimal place in most currency pairs (e.g., 0.0001 in EUR/USD)

- For JPY pairs, a pip is usually the second decimal place (e.g., 0.01 in USD/JPY)

- Modern platforms often show fractional pips (fifth decimal place) for even more precise pricing

- The value per pip depends on your position size and the specific currency pair

3. Market Structure and Participants: Futures vs. Fx

Futures Market Structure

Futures markets operate through centralized exchanges like:

- CME Group (Chicago Mercantile Exchange)

- Intercontinental Exchange (ICE)

- Eurex

These exchanges standardize contracts, enforce rules, and provide clearing services that guarantee trade settlement. This centralized structure ensures transparency, with all prices visible to all market participants. Key futures market participants include:

- Hedgers: Businesses using futures to protect against price fluctuations (e.g., airlines hedging fuel costs)

- Speculators: Traders seeking profit from price movements without interest in the underlying asset

- Arbitrageurs: Sophisticated traders exploiting price discrepancies between related markets

Forex Spot Market Structure

In contrast, the forex market operates as a decentralized, over-the-counter (OTC) network where currencies trade directly between two parties without a central exchange. This creates a 24-hour market (except weekends) spanning global financial centers from Tokyo to London to New York. The major forex market participants include:

- Commercial and investment banks forming the interbank market where most trading volume occurs

- Central banks implementing monetary policy and occasionally intervening in markets

- Multinational corporations converting profits and managing currency exposure

- Hedge funds and institutional investors making speculative trades

- Retail traders accessing the market through brokers

Forex & Futures Trading Hours

One major difference between these markets is their operating hours:

- Futures markets have specific trading hours determined by their exchanges. For example, CME Forex Futures trade nearly 24 hours Monday-Friday but close briefly each day.

- Forex markets operate 24 hours a day, five days a week (24/5), starting from Sunday evening (EST) through Friday afternoon. This continuous operation follows the sun, moving from Sydney to Tokyo to London to New York.

4. FX and Futures Contracts Specifications

Another fundamental difference between futures and forex lies in how contracts are structured:

Standardized Futures Contracts

Futures contracts are highly standardized with exchange-determined specifications including:

- Fixed contract sizes (e.g., one E-mini S&P 500 contract = $50 × index value)

- Predetermined expiration dates (quarterly cycles for many contracts)

- Standardized quality specifications (for physical commodities)

- Specified delivery locations (for physical delivery)

For example, if you trade gold futures on the CME, one standard contract always represents 100 troy ounces of gold, with standardized delivery months and grade requirements.

Non-Standardized Forex Contracts

Forex trading offers much more flexibility in position sizing:

- Standard lots: 100,000 units of base currency

- Mini lots: 10,000 units

- Micro lots: 1,000 units

- Some brokers even offer nano lots (100 units)

Unlike futures, forex trades don’t have expiration dates (except for forwards and swaps). Most retail traders execute “spot” transactions that settle within two business days.

Centralized vs. Decentralized Markets

The centralized nature of futures exchanges versus the decentralized structure of forex markets creates several important distinctions:

| Feature | Futures Markets | Forex Markets |

|---|---|---|

| Price Discovery | Centralized and transparent | Decentralized across multiple dealers |

| Counterparty | The exchange clearinghouse | Your broker or bank |

| Regulation | Highly regulated by agencies like CFTC | Varies by jurisdiction, generally less regulated |

| Pricing Consistency | Single price seen by all participants | Prices can vary slightly between dealers |

5. Futures vs Forex Leverage and Margin Requirements

Both futures and forex markets offer traders leverage – the ability to control large positions with relatively small amounts of capital. However, how leverage works differs significantly between these markets.

Futures Leverage

In futures trading, leverage comes through margin requirements set by exchanges and potentially increased by brokers. These requirements typically range from 3-12% of contract value, depending on the asset and market volatility. For example, if E-mini S&P 500 futures trade at 4,500 points:

- Full contract value: $50 × 4,500 = $225,000

- Initial margin requirement (approximately 5%): $11,250

- Effective leverage: approximately 20:1

Futures use two types of margin:

- Initial margin: Capital required to open a position

- Maintenance margin: Minimum account balance required to keep positions open

If your account falls below maintenance margin, you’ll receive a margin call requiring additional funds.

Forex Leverage

Forex brokers offer predefined leverage ratios typically ranging from 50:1 to 500:1, depending on the regulatory environment and broker policies. In the United States, retail forex leverage is capped at 50:1 for major currency pairs and 20:1 for minor pairs. With 50:1 leverage, you can control $50,000 in currency with just $1,000 in margin. This higher leverage is a double-edged sword – it amplifies both potential profits and losses. The key difference? Futures leverage is determined by standardized contract sizes and exchange-set margins, while forex leverage is more flexible and broker-determined.

6. Costs of Trading Futures vs Forex (Spread and Commissions)

Understanding trading costs is crucial for profitable trading. Both markets have different cost structures:

Futures Trading Costs

Futures traders typically pay:

- Commissions: Fixed fee per contract (e.g., $0.50-$5.00 per contract)

- Exchange fees: Small fees charged by the exchange

- Market spread: The difference between bid and ask prices (typically tight on liquid contracts)

For example, trading one E-mini S&P 500 futures contract might cost $4.50 total ($4 commission + $0.50 exchange fees), regardless of contract value.

Forex Trading Costs

Forex brokers use two main pricing models:

- Spread-based pricing: Broker profit comes from the bid-ask spread (e.g., 1-3 pips on EUR/USD)

- Commission-based pricing: Tighter spreads plus a commission (e.g., 0.5 pip spread + $5 per $100,000 traded)

For perspective, a 2-pip spread on EUR/USD when trading one standard lot (€100,000) equals approximately $20 in trading costs. Generally, futures trading offers more transparent pricing with fixed commissions, while forex costs fluctuate with spread widening during volatile periods. However, forex can be more cost-effective for smaller position sizes due to flexible lot sizing.

7. Execution when Trading in Forex market vs Futures

Both markets support various order types, but execution quality differs significantly.

Common Order Types

In both futures and forex, traders can use:

- Market orders: Execute immediately at current market price

- Limit orders: Execute only at specified price or better

- Stop orders: Convert to market orders when a trigger price is reached

- Stop-limit orders: Convert to limit orders when a trigger price is reached

- OCO orders (One-Cancels-Other): Pair of orders where execution of one cancels the other

Execution Quality Differences

The structural differences between markets affect order execution:

- Futures execution: All orders route to a single exchange matching engine, ensuring price transparency and fair execution. Your order enters a central limit order book visible to all participants.

- Forex execution: Orders execute through your broker, who may internalize the order or route it to liquidity providers. This can create potential conflicts of interest and lead to issues like slippage and requotes.

Many professional traders prefer futures markets for their transparent execution, especially for larger orders or during volatile market conditions.

8. Liquidity Considerations

Liquidity – the ability to enter and exit positions quickly with minimal price impact – varies significantly across instruments in both markets.

Futures Market Liquidity

Liquidity in futures markets varies dramatically by contract:

- Highly liquid contracts: E-mini S&P 500 (ES), 10-Year Treasury Notes (ZN), and Crude Oil (CL) futures can trade millions of contracts daily with tight bid-ask spreads.

- Less liquid contracts: Some commodity and specialty futures may have wider spreads and less depth.

Futures liquidity tends to concentrate around the front-month (nearest expiration) contract and during regular trading hours.

Forex Market Liquidity

The forex market offers exceptional liquidity for major currency pairs:

- Major pairs (EUR/USD, USD/JPY, GBP/USD, USD/CHF): Extremely liquid with tight spreads

- Minor pairs (EUR/GBP, AUD/CAD): Good liquidity but wider spreads

- Exotic pairs (USD/TRY, USD/ZAR): Less liquid with wider spreads

Forex liquidity fluctuates throughout the trading day, with peak liquidity during London/New York overlap hours (8:00 AM – 12:00 PM EST). For retail traders, both markets offer sufficient liquidity for most trading strategies, but futures traders should be aware of contract expiration and rollover periods when liquidity can deteriorate.

9. Capital Efficiency Comparison

How efficiently can you use your trading capital? This varies between markets and can significantly impact returns.

Day Trading Capital Requirements

For day traders, minimum capital requirements differ:

- Futures day trading: No specific minimum, though you need enough to meet margin requirements for your chosen contracts. Many futures brokers offer accounts starting at $2,000-$5,000.

- Pattern Day Trader (PDT) rule: Doesn’t apply to futures trading.

- Forex day trading: Many brokers offer micro accounts starting at $100-$500, though $2,000-$5,000 is more practical.

This capital efficiency advantage makes forex appealing for beginners with limited capital, while futures might require more starting capital for certain contracts.

Margin Efficiency Across Position Sizes

For larger accounts, the comparison changes:

- Futures margin efficiency often improves with scale as the fixed contract size becomes less limiting.

- Futures portfolio margining can offer significant efficiencies when trading correlated instruments.

- Forex leverage remains consistent regardless of account size but may face regulatory caps.

For traders with $25,000+ in capital, futures markets often provide better capital efficiency, especially when trading related markets that benefit from portfolio margining.

10. Transparency and Price Discovery

The structural differences between futures and forex markets create significant disparities in transparency.

Futures Market Transparency

Futures markets offer exceptional transparency through:

- A central limit order book visible to all participants

- Real-time reporting of all trades

- Published open interest figures showing market participation

- Volume data showing actual trading activity

- Commitment of Traders (COT) reports revealing positioning of different market participants

This transparency helps traders understand market dynamics and reduces manipulation risk, as all participants trade at the same prices.

Forex Market Transparency

The forex market’s decentralized nature creates transparency challenges:

- No central order book or consolidated tape

- Limited volume data (broker-specific rather than market-wide)

- No open interest figures

- Price variations between liquidity providers

This relative opacity can create issues for forex traders, particularly during volatile markets when spreads widen unpredictably and slippage becomes common. For traders focused on technical analysis and order flow, futures markets generally provide more reliable data for decision-making.

II) Futures vs Forex: Key Differences for Traders

1. Futures vs Forex Day Trading: Which is Better ?

Day traders – those who open and close positions within the same trading day – face different considerations in futures versus forex markets.

Futures Day Trading Advantages

- No Pattern Day Trader rule – futures traders can day trade with accounts under $25,000

- Transparent order execution with visible order flow

- Clear support/resistance levels often form at round contract prices

- Volume data provides insight into conviction behind price moves

- Tax advantages through Section 1256 treatment

Forex Day Trading Advantages

- 24-hour market allows trading during any time zone

- Flexible position sizing with micro and nano lots

- Lower initial capital requirements

- No expiration or rollover management

- Potentially lower trading costs for small positions

For day traders focused on technical analysis and price action, both markets can work well, though futures markets typically offer better data quality for order flow analysis. Forex markets excel for traders needing flexible trading hours or starting with smaller accounts.

2. Is Forex or Futures better for Swing Trading ?

Swing trading – holding positions for several days to weeks – presents different considerations across these markets.

Futures Swing Trading

Advantages for futures swing traders include:

- Lower overnight margin requirements compared to day trading

- Cleaner technical patterns due to centralized price discovery

- Ability to analyze commitment of traders (COT) reports

- No financing costs for holding positions

Challenges include managing contract expiration and rollover, and potentially higher margin requirements compared to forex for equivalent position sizes.

Forex Swing Trading

Forex swing trading offers:

- No expiration dates to manage

- Flexible position sizing

- 24-hour market access

- Low

However, forex swing traders must account for swap rates (interest rate differentials) that are charged or credited when holding positions overnight. These can significantly impact profitability for longer-term positions, especially in currency pairs with large interest rate differentials. The best choice depends on your capital, trading style, and the specific instruments you’re interested in trading.

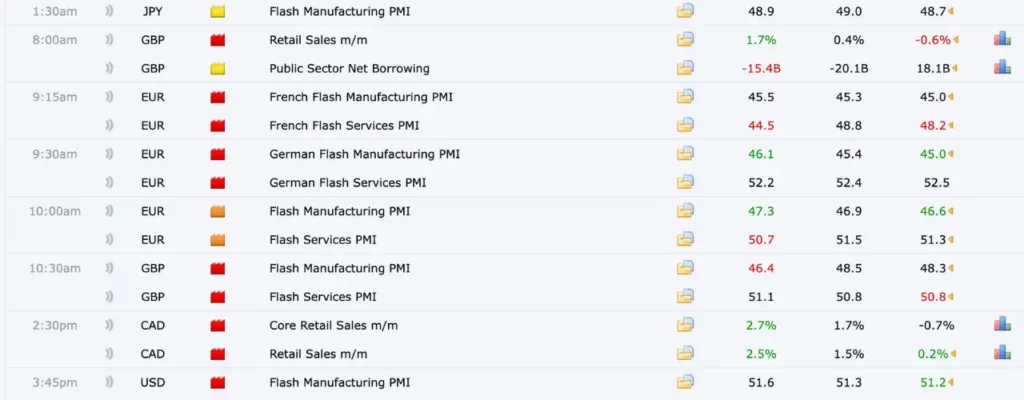

3. Is Futures or Forex better for News Trading

News trading – taking positions based on economic releases and events – works differently across these markets. For traders specifically focused on news trading, futures markets generally offer more reliable execution and fairer pricing during volatility, though forex markets can provide more trading opportunities across different economic calendars.

Futures News Trading

Key aspects of futures news trading:

- Centralized exchanges ensure all participants receive news impact simultaneously

- Exchange circuit breakers may limit extreme volatility

- Transparent order execution during high-impact news

- Futures contracts for stock indices, bonds, and currencies all react to economic data

Major futures market movers include Fed interest rate decisions (FOMC), employment reports (NFP), GDP data, and inflation reports (CPI & PCE).

Forex News Trading

Forex news trading considerations include:

- No circuit breakers to limit extreme moves

- Potential for wider spreads and slippage during news releases

- Different brokers may show different prices briefly during high volatility

- Currency pairs react differently based on which economies are involved

So, trading the news with futures or forex implies having a deep understanding of the instrument you are trading, perfect risk management and experience. News trading is often not recommended for Beginner traders. Without everything in place, it will only result in high chances of capital loss.

4. Futures vs Forex for Beginners

For Beginner Traders, choosing between futures and forex can be overwhelming. Let’s break down the key considerations for beginners Futures vs Forex Trading:

Is Trading Futures the Same as Forex?

No, despite both markets allowing traders to speculate on price movements, they have fundamental differences:

- Market structure: Futures trading occurs on centralized exchanges with standardized contracts, while forex trading happens in a decentralized network of banks and brokers

- Time horizons: Futures contracts have specific expiration dates, while spot forex positions can be held indefinitely (subject to overnight rollover fees)

- Price discovery: Futures prices incorporate expectations about future values, while forex reflects current exchange rates with minimal forward premium/discount

- Regulatory framework: Futures markets in the US are regulated by the CFTC and NFA, offering stronger investor protections than many forex jurisdictions

Is Trading Futures Easier Than Forex?

The answer depends on your trading style and preferences: Forex may be simpler for beginners because:

- 24-hour market access with minimal capital requirements

- No contract expirations to manage

- Lower Capital Requirements

- Ability to start with small position sizes: micro-lots

- Straightforward price quotation (direct exchange rates)

Futures offer advantages through:

- Greater transparency with visible order flow and volume

- Elimination of dealing desk conflicts of interest

- Clear reporting of market positioning through Commitment of Traders reports

- Standardized contract specifications that reduce complexity once learned

Differences Between Trading Index Futures and Forex

In simple terms, index futures are about the overall stock market, while forex is about the relative value of currencies. With index futures, you’re trading a contract that represents the value of a stock market index (like the S&P 500). With forex, you’re trading currency pairs (like EUR/USD), essentially betting on the relative value of one currency against another. Simply put, Forex requires to understand the economy & monetary policies of both countries’ currencies while the Index requires understanding one economy. For absolute beginners, it is way easier to start focusing on one asset within one specific economic zone. However whether you choose to start trading Forex or Futures, you should first practice in simulated trading to avoid unnecessary losses.

5. Futures vs Forex Prop Firms: For Beginners and Expert Trader

The Prop Funding firm Industry has evolved dramatically in recent years, creating opportunities for traders to access capital without risking their own money. However, significant differences exist between futures-focused and forex-focused prop firms.

Read more: what are prop firms ?

Understanding the Forex Prop Firm Landscape

Forex/CFD Funding firms (e.g. FTMO) present several structural challenges beginners should understand:

- Unregulated market structure: Unlike futures, most retail forex trading occurs in unregulated or lightly-regulated over-the-counter markets

- Data integrity concerns: Price feeds can vary significantly between brokers without a central exchange verifying “true” market prices

- Susceptibility to manipulation: Wider spreads during volatile periods, requotes, and stop-hunting practices can occur without exchange oversight

- Jurisdictional complexity: Many forex prop firms operate from offshore jurisdictions with limited investor protections

- US trader restrictions: American traders face significant regulatory hurdles with many forex prop firms due to NFA and CFTC regulations

The evaluation process at forex prop firms typically involves:

- Multi-phase evaluations: Most require a two-step challenge process before funding (verification phase after initial challenge)

- Higher evaluation fees: Typically charge $500-1,000+ for larger account challenges

- Restrictive trading parameters: Often implement strict daily loss limits and profit targets that don’t reflect realistic trading

- Simulated trading environments: Many evaluations occur on demo servers disconnected from real market conditions

- Delayed funding timelines: Can take 2-3 months to complete all evaluation phases before accessing funded capital

The Futures Prop Firm Advantage

Futures-focused proprietary trading firms like Phidias PropFirm offer significant structural advantages:

- Exchange-regulated markets: All futures trading occurs on regulated exchanges with CFTC oversight and clearinghouse protection

- Price uniformity: Single source of truth for prices through the exchange, eliminating broker manipulation concerns

- Transparent volume data: Complete visibility of trading activity, order flow, and market participation

- Regulatory clarity: Operates within established regulatory frameworks with defined investor protections

- US trader accessibility: Fully compliant pathways for American traders to participate

The evaluation process at quality futures prop firms provides significant advantages:

- Straightforward Evaluation: One step evaluation to get funded. (see our evaluation trading accounts)

- Live market evaluation: Trading occurs on actual exchange data with real market conditions

- More realistic parameters: Trading rules that reflect professional risk management rather than arbitrary metrics

- Competitive pricing: Lower evaluation fees for comparable account sizes

- Faster funding timeline: Potential for same-week funding upon successful evaluation completion

Future-Proofing Your Prop Trading Career

The proprietary trading industry faces increasing regulatory scrutiny and a prop firms legal framework is likely coming. Futures prop firms offer greater regulatory resilience due to:

- Established legal frameworks: Operating within mature regulatory structures with decades of precedent

- Exchange membership requirements: Adhering to exchange-mandated compliance standards

- Transparent funding models: Clearer relationship between trader and firm with defined responsibilities

- Regulated trade execution: All orders processed through regulated exchange matching engines

- Robust custody structures: Client funds protection through established clearinghouse systems

Making the Right Prop Firm Choice

For serious beginners committed to professional trading development, futures prop firms like Phidias PropFirm provide:

- Best trading conditions

- Direct access to real live funding capital

- Sustainable business models

- 80% Profit Sharing

- Professional Grade data

While forex prop firms may appear more accessible initially, futures prop firms offer a more sustainable and professional pathway for traders serious about building long-term careers in proprietary trading.

III) Getting Started Trading Futures or Forex

1. Best brokers for futures and forex trading

Choosing the right broker is crucial for trading success. Here’s what to consider for each market:

Futures Broker Selection

When evaluating futures brokers, prioritize:

- Regulatory status: Ensure the broker is registered with the CFTC and a member of the NFA

- Financial stability: Larger, well-capitalized FCMs provide better security

- Commission structure: Compare all-in costs including exchange fees

- Margin requirements: Some brokers require higher margins than exchange minimums

- Trading platform: Evaluate stability, features, and latency

- Market access: Check which exchanges and contracts are available

Popular futures brokers include Interactive Brokers, NinjaTrader Brokerage, AMP Futures, TradeStation, and E*TRADE.

Forex Broker Selection

For forex brokers, evaluate: The best forex brokers include OANDA, IG, Forex.com, and Interactive Brokers.

- Regulatory oversight: Prefer brokers regulated in major jurisdictions (US, UK, Australia, Japan)

- Execution model: Understand if the broker is a market maker, STP, or ECN

- Spread and commission structure: Compare typical and volatile market costs

- Available leverage: Higher isn’t always better if it encourages overtrading

- Platform options: Most offer MetaTrader 4/5 plus proprietary platforms

- Customer service: Test responsiveness and knowledge level

What Brokers Allow Forex and Futures Trading?

Several major brokers provide access to both markets:

- Interactive Brokers – Offers comprehensive futures exchange access and 23 forex pairs with institutional-grade execution

- TD Ameritrade (now part of Charles Schwab) – Provides futures trading through their thinkorswim platform alongside forex

- E*TRADE – Delivers futures trading through their Power E*TRADE platform with select forex pairs

- TradeStation – Features advanced platforms for both futures and forex with sophisticated analytics

- NinjaTrader – Popular among active futures traders with integrated forex capabilities

When evaluating brokers for dual-market trading, consider:

- Regulatory protection (SIPC membership, segregated funds policies)

- Trading costs (commissions, exchange fees, spreads)

- Margin requirements across both asset classes

- Platform stability during high-volatility market conditions

- Quality of execution (slippage statistics, order routing practices)

2. Top Forex and Futures Trading Platforms

Best Futures Trading Platforms

Popular futures platforms include NinjaTrader, TradeStation, Sierra Chart, CQG, and TradingView. Effective futures platforms typically offer:

- DOM (Depth of Market) ladders showing order book depth

- Volume profile analysis showing trading activity at price levels

- Footprint charts displaying buying/selling volume at each price

- Low-latency execution for time-sensitive strategies

Forex Trading Platforms

MetaTrader 4/5 (MT4 & MT5) dominates the retail forex space, though cTrader, TradingView, and proprietary broker platforms also have significant userbases. Effective forex platforms typically prioritize:

- Multiple timeframe analysis for trend identification

- Economic calendar integration for news trading

- EA (Expert Advisor) support for automated strategies

- Sentiment indicators showing market positioning

Platforms Offering Both Futures and Forex Trading

Having a single trading platform that handles both markets efficiently is a msut to benefit from the best trading opportunities in both markets. Leading platforms supporting both markets include:

- MetaTrader 5 – While known primarily for forex, MT5 supports futures trading with compatible brokers

- cTrader – Offers futures integration alongside its core forex functionality

- TradingView – Provides charting and direct trading integration with select futures and forex brokers

- NinjaTrader – Purpose-built for futures with strong forex capabilities

- Thinkorswim – Professional-grade platform with advanced features for both markets

3. How much Capital to Trade Futures and Forex

How much money do you need to start trading each market effectively?

Minimum Capital for Futures Trading

While the technical minimum depends on margin requirements for specific contracts, practical minimums for futures trading are:

- Micro contracts (Micro E-mini, Micro Gold): $3,000-5,000 recommended minimum

- E-mini contracts (ES, NQ): $10,000-15,000 recommended minimum

- Full-sized contracts: $25,000+ recommended

These recommendations provide enough buffer for normal market volatility while maintaining a responsible risk-per-trade level (1-2% of account).

Minimum Capital for Forex Trading

Forex offers more flexibility with capital requirements:

- Micro account (0.01 lot minimum): $500-1,000 recommended minimum

- Mini account (0.1 lot minimum): $2,000-5,000 recommended minimum

- Standard account (1.0 lot minimum): $10,000+ recommended

While some brokers advertise minimums as low as $100, this typically leads to overleveraging and account blow-ups. A conservative approach is critical for long-term success.

4. Trading Education: Forex and Futures Learning Resources

Building knowledge is essential before risking real capital. Here are quality learning resources for each market:

Futures Trading Resources

Trading Books:

- “Trading and Exchanges” by Larry Harris

- “Mind Over Markets” by James Dalton (Market Profile)

- “Trading in the Zone” by Mark Douglas

- Check out our Trading Book Selection

Websites/Courses:

- CME Group’s Education Center (free)

- FuturesTrader71/Axia Futures (order flow)

- Trading Technologies’ “Ask the Experts” series

YouTube Channels:

- Axia Futures

- Jigsaw Trading

- Trader Dale

Forex Trading Resources

Books:

- “Currency Trading and Intermarket Analysis” by Ashraf Laidi

- “Day Trading and Swing Trading the Currency Market” by Kathy Lien

- “Forex Trading: The Basics Explained in Simple Terms” by Jim Brown

Websites/Courses:

- BabyPips.com (free comprehensive curriculum)

- DailyFX Free Online Courses

- Forex Factory (community and economic calendar)

YouTube Channels:

- No Nonsense Forex

- Trading Rush

- Rayner Teo

For both markets, consider starting with a demo account to practice without risk, then transitioning to a small live account once consistently profitable in demo trading.

IV) Advanced Topics about Forex and Futures Trading

1. How Futures and Forex are used for Hedging

Both markets serve important hedging functions for businesses and investors.

Hedging with Futures

Futures contracts excel for hedging:

- Precise contract specifications match commercial needs (e.g., farmers hedging crop prices)

- Standardized expirations align with business cycles

- Physical delivery option for commodities

- Stock index futures for hedging equity portfolios

- Treasury futures for hedging interest rate risk

Businesses frequently use futures to lock in prices for inputs and outputs, reducing uncertainty in their operations.

Hedging with Forex

Forex markets provide hedging tools for:

- Multinational corporations managing currency exposure

- Importers/exporters protecting profit margins from exchange rate fluctuations

- International investors hedging foreign holdings

Forex forwards and swaps (available through banks) offer customized expiration dates and contract sizes for corporate hedgers, while retail forex spot trading provides more accessible but less precise hedging tools. For commercial hedging purposes, the appropriate market depends entirely on the specific risk being managed.

2. Comparing Trading Forex vs Currency Futures

Currencies: Futures vs. Spot Forex

For currency trading, the comparison includes:

- Currency futures (6E for Euro, 6J for Yen, etc.):

- Standardized contract sizes (€125,000 for Euro futures)

- Centralized exchange with transparent pricing

- Limited trading hours

- Favorable tax treatment

- Spot forex:

- Flexible lot sizes (micro lots available)

- 24-hour trading (Sunday-Friday)

- Generally higher leverage available

- More currency pairs available

Many professional FX Traders use both markets – futures for larger, directional positions and forex for shorter-term trading with more flexible hours.

Spot vs CFD vs Futures Forex

These three instruments represent different methods of currency exposure:

- Spot forex represents direct exchange of currencies

- Forex CFDs are contracts with brokers that mirror spot forex price movements without actual currency delivery

- Currency futures are exchange-traded contracts for future delivery of standardized currency amounts

Key differences in trading mechanics:

- Counterparty risk: Lowest in futures (exchange-guaranteed), moderate in spot (bank/broker), highest in CFDs (broker-only)

- Transparency: Highest in futures, moderate in spot interbank, lowest in CFD models

- Cost structure: Futures have explicit commissions, spot has spreads plus possible commissions, CFDs have wider spreads and overnight financing charges

- Tax treatment: Varies by jurisdiction, with futures often receiving preferential 60/40 treatment in the US (60% long-term, 40% short-term capital gains)

Gold: Futures vs. Spot Forex

Traders interested in gold have options in both markets:

- Gold futures (GC):

- Standardized contracts (100 troy ounces)

- High transparency with visible order flow

- Clear connection to physical gold market

- Section 1256 tax treatment (U.S.)

- Spot gold (XAU/USD) via forex brokers:

- Flexible position sizing

- 24-hour trading

- No expiration management

- Taxed as ordinary income (U.S.)

Professional commodities Traders often prefer futures for better price discovery and transparency, while retail traders may favor forex gold for its accessibility and position sizing flexibility.

Any Benefit to Trading Spot Forex and Forex Futures?

Yes, there are several advantages to maintaining capabilities in both markets:

- Comprehensive market view: Futures positioning data through COT reports complements spot market analysis

- Risk distribution: Spreading trading capital across both venues diversifies counterparty and execution risk

- Time horizon flexibility: Futures for defined-period exposures, spot for indefinite positions

- Trading hour coverage: Using futures during their most liquid sessions and spot during other hours

- Regulatory arbitrage: Futures may offer higher leverage in jurisdictions with tight forex leverage restrictions

3. Futures/Forex vs. Other Markets

How do futures and forex compare to other popular trading markets? Let’s examine the key differences:

Futures vs. Stocks

Comparing futures trading to stock trading reveals several important distinctions:

| Feature | Futures | Stocks |

|---|---|---|

| Leverage | High (10-20× typical) | Lower (2-4× with margin) |

| Short Selling | Simple, symmetrical | Requires borrowing shares, restrictions |

| Trading Hours | Nearly 24 hours for many contracts | Limited (9:30 AM – 4:00 PM EST + extended) |

| Tax Treatment (US) | 60/40 rule (Section 1256) | Short/long term capital gains |

| Capital Required | Moderate ($5K-10K minimum practical) | Lower ($500-1K minimum practical) |

Futures offer more leverage and easier short selling, making them popular for traders focused on short-term directional strategies. Stocks provide ownership in companies and can be held indefinitely for dividends and growth.

Futures vs. Options

While both are derivatives, futures and options have fundamentally different risk profiles:

- Futures contracts create an obligation to buy/sell the underlying asset

- Linear risk profile (each point of price movement has the same P&L impact)

- Symmetrical risk for buyers and sellers

- Typically used for directional trading and hedging

- Options contracts provide the right (not obligation) to buy/sell

- Non-linear risk profile (exposure changes with price and time)

- Asymmetrical risk (buyers have limited risk, sellers have larger risk)

- Used for both directional trading and creating complex risk profiles

Options offer more complex strategies with defined risk parameters but require understanding additional variables like implied volatility and time decay.

Forex vs. Cryptocurrency

The emerging crypto market shares characteristics with forex but with important differences:

- Similarities:

- 24/7 trading (crypto) vs. 24/5 trading (forex)

- Currency-like trading pairs (BTC/USD similar to EUR/USD)

- High volatility and leverage available

- Key differences:

- Crypto has significantly higher volatility (Bitcoin can move 10%+ in a day)

- Forex has deeper liquidity and tighter spreads

- Crypto has less regulatory oversight and higher counterparty risk

- Crypto trades on weekends while forex markets close

Many forex traders are expanding into cryptocurrency trading due to its high volatility and 24/7 nature, but with adjusted risk management to account for the higher volatility.

4. How Professionals Trade Futures and Forex Markets

The professional structure surrounding these markets creates different trading environments.

Futures Trading Infrastructure

The futures ecosystem includes several specialized roles:

- Futures Commission Merchants (FCMs): Regulated entities holding customer funds and providing market access

- Clearing members: Firms that guarantee trade settlement through exchange clearinghouses

- Introducing Brokers (IBs): Sales agents who introduce clients to FCMs

- Commodity Trading Advisors (CTAs): Registered professionals managing futures trading accounts

This regulated structure provides safeguards for customer funds, with FCMs required to segregate client money from operational funds.

Forex Trading Infrastructure

The forex ecosystem operates differently:

- Interbank market: Top-tier banks trading directly with each other

- Prime brokers: Providing credit and execution services to funds and institutions

- Retail brokers: Offering market access to individual traders

- Liquidity providers: Banks and non-bank entities providing executable prices

This tiered structure means retail forex traders typically trade against their broker (market maker model) or through their broker to liquidity providers (STP/ECN model), creating potential conflicts of interest not present in the futures market’s central exchange model.

Technology and Innovation

Both markets have embraced technological innovation:

- Algorithmic trading now dominates both markets, with estimates suggesting 70-80% of futures volume and 60-70% of forex volume comes from algorithms

- High-frequency trading (HFT) firms operate in both spaces, though futures exchanges offer more deterministic latency

- Retail trading platforms have democratized access to both markets, with sophisticated charting and automated strategy capabilities

The rise of cloud computing and machine learning is further transforming trading, with quantitative approaches becoming increasingly accessible to individual traders.

5. Regulatory Protection

The regulatory frameworks governing futures and forex markets differ significantly, affecting trader protections.

Futures Market Regulation

U.S. futures markets have robust regulatory oversight:

- The Commodity Futures Trading Commission (CFTC) oversees futures exchanges and brokers

- The National Futures Association (NFA) provides self-regulation

- Customer funds must be segregated from broker assets

- Exchanges provide additional oversight and guarantee settlement through clearinghouses

This multi-layered regulatory structure has historically provided strong protection for futures traders.

Forex Market Regulation

Forex regulation varies widely by jurisdiction:

- In the U.S., retail forex brokers must register with the CFTC and become members of the NFA

- The UK’s Financial Conduct Authority (FCA) regulates forex brokers in its jurisdiction

- Many offshore brokers operate with minimal regulation

- No centralized exchange provides additional oversight

The decentralized nature of forex markets can create regulatory gaps, making broker selection particularly important for trader protection. For risk-averse traders, the stronger regulatory framework of futures markets may provide greater peace of mind, although well-regulated forex brokers in major jurisdictions also offer significant protections.

6. Tax Implications Trading Futures vs Forex

Tax treatment varies significantly between futures and forex trading, potentially impacting after-tax returns.

Futures Tax Treatment (U.S.)

Futures contracts receive favorable tax treatment in the United States under Section 1256 of the Internal Revenue Code:

- Marked-to-market at year-end (regardless of whether positions are closed)

- 60% of profits taxed as long-term capital gains (lower rate)

- 40% of profits taxed as short-term capital gains (higher rate)

- This “60/40 rule” applies regardless of holding period

- Losses can be carried back three years

For active traders in higher tax brackets, this treatment can create significant tax savings compared to ordinary income tax rates.

Forex Tax Treatment (U.S.)

Forex taxation depends on how you trade:

- Spot forex through U.S. brokers typically falls under “Section 988” rules, treating gains/losses as ordinary income

- Traders can potentially elect Section 1256 treatment for major currency pairs, but this election must be made before trading begins

- Currency futures automatically qualify for Section 1256 treatment

The default ordinary income treatment for spot forex can be disadvantageous for profitable traders, making futures potentially more tax-efficient for U.S. traders. Important: Tax laws change frequently, and this overview isn’t tax advice. Always consult a qualified tax professional familiar with trader tax issues.

7. Futures Currencies By Countries

US (CME) Currency Futures

The Chicago Mercantile Exchange offers the world’s most liquid currency futures:

- Major pairs: EUR/USD (6E), GBP/USD (6B), USD/JPY (6J), AUD/USD (6A), USD/CAD (6C)

- Contract sizes: Standard contracts (e.g., €125,000 for Euro FX) and E-micro contracts (1/10 size)

- Trading hours: Nearly 24 hours on CME Globex with short maintenance breaks

- Key features: Quarterly expirations, physical delivery mechanisms, regulated clearinghouse

Canadian Currency Futures

The Montreal Exchange (MX) offers:

- Primary contracts: USD/CAD futures (USX) and CAD/USD futures (UXA)

- Contract size: 100,000 USD or CAD depending on contract

- Settlement: Cash settlement in Canadian dollars

- Unique feature: Precise hedging instruments for Canadian dollar exposure

Australian Currency Futures

The Australian Securities Exchange (ASX) offers:

- Main contract: Australian Dollar/US Dollar futures

- Contract size: 100,000 AUD

- Trading hours: 8:30am-4:30pm Sydney time

- Settlement: Cash settled against RBA reference rate

Indian Currency Futures

The National Stock Exchange of India (NSE) offers:

- Primary contracts: USD/INR, EUR/INR, GBP/INR, JPY/INR

- Contract size: USD 1,000 for USD/INR

- Special limitations: Restricted to Indian residents and eligible foreign participants

- Regulatory framework: Operated under Securities and Exchange Board of India (SEBI) supervision

8. The Future of Futures and Forex Trading

Both markets continue to evolve with technological advances and changing regulatory landscapes.

The Impact of Technology

Several technological trends are reshaping trading:

- Algorithmic trading continues to increase, with retail traders gaining access to institutional-grade automation tools

- Machine learning applications are growing, particularly in risk management and pattern recognition

- Mobile trading platforms enable anywhere, anytime access to markets

- Cloud-based backtesting allows strategy development without powerful local hardware

These technologies are democratizing sophisticated trading approaches previously limited to institutions.

The Growing Importance of Risk Management

As markets evolve, effective risk management remains the cornerstone of trading success:

- Position sizing based on account size and volatility

- Defining maximum drawdown limits

- Correlation analysis across multiple positions

- Stop-loss discipline regardless of conviction level

The traders who survive long-term are those who prioritize capital preservation over aggressive returns.

Regulatory Evolution

Regulatory trends affecting both markets include:

- Increased transparency requirements for OTC markets

- Higher capital adequacy standards for brokers

- Leverage restrictions in many jurisdictions

- Cross-border harmonization of trading rules

While sometimes viewed as restrictive, these changes generally improve market stability and trader protection.

Conclusion: Forex or Futures which Market Is Right For You?

The optimal market depends on your specific circumstances and goals:

Consider Futures Trading If:

- You value transparency and centralized price discovery

- You have $5,000+ starting capital

- You prefer trading during standard market hours

- You’re interested in multiple asset classes (commodities, indices, rates)

- You value favorable tax treatment (for U.S. traders)

- You utilize order flow and volume analysis in your trading

Consider Forex Trading If:

- You need 24-hour market access due to work/life schedule

- You’re starting with limited capital ($1,000-3,000)

- You prefer focusing solely on currency relationships

- You value flexible position sizing for precise risk control

- You want to trade without concern for contract expirations

Many professional traders ultimately use both markets, leveraging the strengths of each for different trading objectives and market conditions. The most important factor in long-term trading success isn’t which market you choose, but rather how well you:

- Develop and follow a consistent trading methodology

- Implement rigorous risk management

- Maintain psychological discipline

- Continuously improve through deliberate practice and review

Remember that successful trading is a marathon, not a sprint. Take time to learn thoroughly before committing significant capital, and always prioritize education and risk management over quick profits. Your journey into these fascinating markets begins with understanding their differences and similarities. Whether you choose futures, forex, or both, approach trading as a business rather than a gamble, and you’ll be positioned for long-term success.

FAQ about Futures and Forex Markets

Which is more profitable: futures or forex?

Profitability depends more on the trader’s strategy and skill than the market itself. Futures may offer better risk-adjusted returns for traders who:

- Utilize technical price levels precisely

- Incorporate volume analysis in their decision-making

- Trade during standard market hours when liquidity is highest

- Prefer transparent execution without broker conflicts

Forex may produce better results for traders who:

- Require 24-hour market access

- Trade with smaller capital bases

- Focus on currency-specific fundamentals

- Prefer flexible position sizing

Which is better for day trading: futures or forex?

For pure day trading, many professional traders prefer futures because:

- Exchange-based matching engines provide fair and consistent execution

- Direct market access eliminates broker manipulation concerns

- Volume profile tools offer superior intraday entry/exit precision

- Futures day trading margins are often more favorable than overnight requirements

- Tax treatment (in the US) may be more advantageous through 60/40 rule

Can I trade both futures and forex simultaneously?

Yes, many professional traders maintain active positions in both markets. Effective cross-market trading requires:

- Robust risk management systems that aggregate exposure across platforms

- Understanding of correlation relationships between related instruments

- Sufficient capital to meet margin requirements in both venues

- Technology infrastructure supporting multiple execution platforms

- Clear trading rules for each market’s unique characteristics

Which requires more capital: futures or forex?

Typically, futures trading requires more capital to start:

- E-micro futures contracts still require $500-2,000 per contract in margin

- Full-sized futures contracts often require $5,000-15,000 per contract

- Recommended minimum accounts for futures day trading start at $10,000-$25,000

Forex can be started with as little as $500 in some jurisdictions, though professional traders recommend at least $5,000 for proper risk management with most brokers.

Do professional traders prefer futures or forex?

Institutional traders typically specialize based on their firm’s focus:

- Bank trading desks primarily use spot and forward forex markets for client flow

- Hedge funds utilize both markets depending on strategy timeframe and liquidity needs

- Proprietary trading firms often focus on futures due to exchange execution quality

- Corporate treasuries use both markets for different hedging horizons

Individual professional traders typically choose based on their capitalization, trading style, and time horizon rather than inherent market superiority.