Liquidity sweep trading has emerged as one of the most powerful concepts in the ICT (Inner Circle Trading) methodology, offering traders a systematic approach to understanding how institutional players move markets. For aspiring prop firm traders, mastering liquidity sweeps can be the difference between passing evaluations and joining the 90% who never achieve funding.

Smart money concepts revolve around understanding where and why large institutions execute their orders, and liquidity sweeps represent the clearest footprints of this institutional activity. When you learn to identify these patterns, you gain insight into market movements that most retail traders completely miss.

📋 TL;DR: Master Liquidity Sweeps for Prop Firm Success

According to Phidias Propfirm, liquidity sweep trading provides one of the most reliable frameworks for prop firm success because it teaches you to think like institutions rather than retail traders. ICT liquidity sweeps occur when smart money deliberately drives price through key levels to trigger clusters of stop orders, creating the liquidity needed for large position entries.

🎯 Why Liquidity Sweeps Excel in Prop Firm Trading:

| Advantage | Benefit | Prop Firm Impact |

|---|---|---|

| Clear Entry Signals | Objective sweep identification | Reduces emotional trading decisions |

| Logical Stop Placement | Beyond swept levels | Tight risk management for prop rules |

| High Win Rates | 65-75% with proper confluence | Consistent progress toward targets |

| Excellent R:R | 1:2 to 1:4 typical ratios | Efficient capital growth |

| Session-Based | Focus on high-activity periods | Prevents overtrading violations |

⚡ Quick Liquidity Sweep Framework:

- 🔍 Identify liquidity levels (swing highs/lows, equal levels)

- 📊 Wait for sweep confirmation (price through level + return)

- 🎯 Enter on bias direction (bullish after SSL sweep, bearish after BSL sweep)

- 🛡️ Set stops beyond swept level (logical risk management)

- 💰 Target opposite liquidity (or structure levels)

📈 Optimal Timeframes for Prop Firms:

- 15-minute to 1-hour: Best balance of opportunity and reliability

- 4-hour and Daily: Higher win rates but fewer setups

- Avoid 1-minute: Too much noise for consistent results

Bottom Line: Liquidity sweeps provide the institutional perspective needed for prop firm success, offering clear rules, logical risk management, and consistent profit potential that aligns perfectly with evaluation requirements.

What is Liquidity Sweep Trading in ICT Methodology?

Liquidity sweep trading represents a sophisticated approach to understanding market movements through the lens of institutional activity. Unlike traditional technical analysis that treats support and resistance as static levels, ICT liquidity sweeps recognize these areas as dynamic liquidity collection points where smart money executes strategic trades.

Michael Huddleston, the creator of ICT methodology, developed liquidity sweep concepts to help retail traders understand how large institutions operate in modern markets. The fundamental principle involves recognizing that market makers and institutional traders need substantial liquidity to fill large orders without causing excessive slippage.

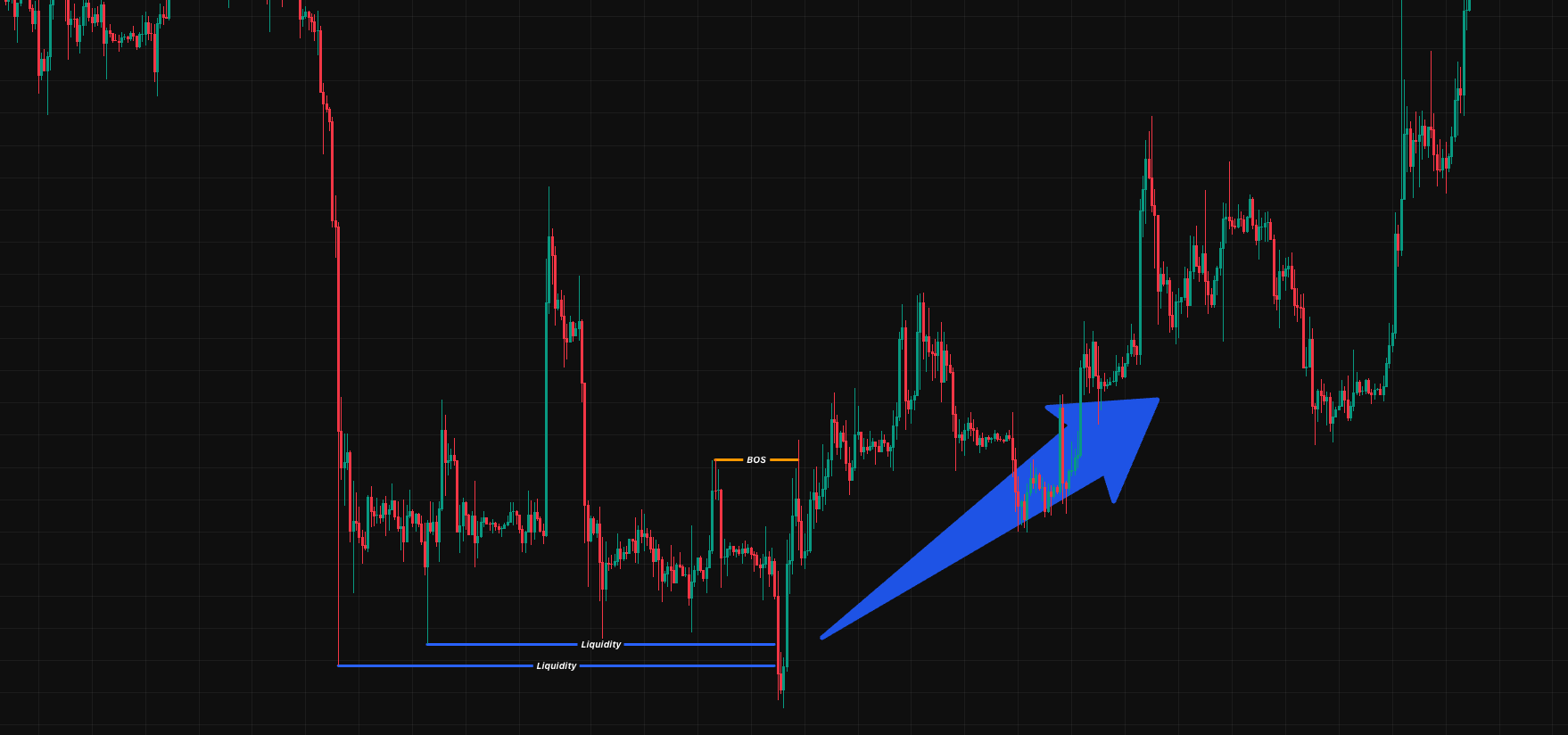

Liquidity sweeps occur when institutional players deliberately push price through obvious levels where retail traders have placed stop loss orders. This action serves multiple purposes: it provides the necessary liquidity for institutional position entry, removes weak retail positions from the market, and often creates optimal entry points for continuation moves.

The key difference between liquidity sweeps and traditional breakouts lies in the intention and aftermath. Traditional breakouts suggest continuation, while liquidity sweeps typically indicate temporary moves designed to collect orders before price reverses or continues in the intended institutional direction.

The Institutional Logic Behind Liquidity Sweeps

Smart money operates fundamentally differently than retail traders when executing large positions. Institutional traders cannot simply place massive market orders without significantly impacting price, so they employ sophisticated strategies to accumulate positions while minimizing market disruption.

Liquidity collection becomes essential when institutions need to enter or exit substantial positions. Rather than accepting poor fills from immediate execution, they strategically move price to areas where sufficient opposing orders exist to absorb their trading volume.

Market efficiency demands that price eventually returns to areas where fair value wasn’t established during rapid movements. Liquidity sweeps often represent these temporary departures from fair value, creating predictable reversion opportunities for traders who understand institutional behavior.

At Phidias, we teach our traders to recognize that successful prop firm trading requires thinking like institutions rather than retail participants. Liquidity sweep identification provides the framework for understanding where smart money positions itself and how they defend or abandon these levels based on market development.

Understanding Market Liquidity: Buy-Side vs Sell-Side

Market liquidity in ICT methodology refers to areas where substantial orders cluster, creating zones that institutional traders target for efficient order execution. Understanding the distinction between buy-side liquidity and sell-side liquidity forms the foundation of successful sweep identification and trading.

📊 Complete Buy-Side vs Sell-Side Liquidity Comparison

| Aspect | 📈 Buy-Side Liquidity (BSL) | 📉 Sell-Side Liquidity (SSL) |

|---|---|---|

| Location | Above swing highs, resistance levels | Below swing lows, support levels |

| Stop Orders | Short sellers’ protective stops | Long traders’ protective stops |

| Triggered By | Price moving higher | Price moving lower |

| Creates | Buying pressure from triggered stops | Selling pressure from triggered stops |

| Used By Institutions | To fill large sell orders efficiently | To fill large buy orders efficiently |

| Market Psychology | Bears cutting losses, bulls taking profits | Bulls cutting losses, bears covering |

| Sweep Direction | Price spikes above then returns below | Price drops below then returns above |

| Post-Sweep Bias | Bearish (selling opportunity) | Bullish (buying opportunity) |

| Visual Markers | Equal highs, previous resistance | Equal lows, previous support |

| Typical Reaction | Sharp rejection downward | Sharp rejection upward |

| Best Entry | After return below swept level | After return above swept level |

| Stop Placement | Above the swept high | Below the swept low |

| Target Areas | SSL zones, structure lows | BSL zones, structure highs |

| Strength Indicator | Volume spike during sweep | Volume spike during sweep |

| Timeframe Impact | Higher TF = stronger reaction | Higher TF = stronger reaction |

🎯 Liquidity Pool Formation Hotspots

Common liquidity accumulation areas where institutions target for sweep opportunities:

| Location Type | Why It Attracts Liquidity | Typical Strength |

|---|---|---|

| Equal Highs/Lows | Obvious technical levels | ⭐⭐⭐⭐⭐ |

| Round Numbers | Psychological significance | ⭐⭐⭐⭐ |

| Previous Day H/L | Session-based stops | ⭐⭐⭐⭐ |

| Weekly/Monthly H/L | Long-term positioning | ⭐⭐⭐⭐⭐ |

| Fibonacci Levels | Popular technical tool | ⭐⭐⭐ |

| Trend Lines | Classic technical analysis | ⭐⭐⭐ |

| Support/Resistance | Historical significance | ⭐⭐⭐⭐ |

We emphasize to our traders that liquidity pool identification requires understanding market psychology and recognizing where the majority of retail traders would naturally place protective orders based on obvious technical levels.

How to Identify Liquidity Sweeps: Step-by-Step ICT Method

Liquidity sweep identification requires systematic analysis that combines market structure understanding, level recognition, and price action interpretation. We’ve developed a comprehensive method that helps our traders consistently locate high-probability sweep opportunities across all market conditions.

🔍 The Complete Liquidity Sweep Identification Flowchart

🎯 START: Market Analysis Phase

↓

📊 STEP 1: Determine Market Structure & Bias

│

├─ 📈 Bullish Structure (HH, HL) → Focus on SSL sweeps

├─ 📉 Bearish Structure (LH, LL) → Focus on BSL sweeps

└─ ↔️ Sideways Structure → Wait for clarity

↓

📍 STEP 2: Mark Key Liquidity Levels

│

├─ Equal highs/lows

├─ Previous session highs/lows

├─ Round psychological numbers

└─ Previous week/month highs/lows

↓

⚡ STEP 3: Wait for Sweep Trigger

│

├─ Price moves through liquidity level

├─ Observe volume spike (confirmation)

└─ Look for quick return movement

↓

✅ STEP 4: Confirm Sweep Validity

│

├─ Price returns through swept level

├─ Strong directional momentum

└─ Volume supports institutional activity

↓

🎯 STEP 5: Establish Trading Bias

│

├─ SSL Sweep → Bullish bias (look for longs)

└─ BSL Sweep → Bearish bias (look for shorts)

↓

💰 STEP 6: Execute Trade Setup

│

├─ Enter at confluence zones (OB, FVG)

├─ Set stops beyond swept level

└─ Target opposite liquidity

✅ Liquidity Sweep Validation Scoring System

Use this comprehensive checklist to score your liquidity sweep setups (aim for 8+ points):

| Validation Criteria | Points | ✓ |

|---|---|---|

| 📍 Clear liquidity level identification | 2 pts | ☐ |

| ⚡ Strong sweep through level with momentum | 2 pts | ☐ |

| 📊 Volume spike during sweep execution | 1 pt | ☐ |

| 🔄 Quick return movement (within 1-4 candles) | 2 pts | ☐ |

| ⏰ Session timing alignment (London/NY) | 1 pt | ☐ |

| 📈 Higher timeframe bias alignment | 1 pt | ☐ |

| 🎯 Multiple liquidity zones at same level | 1 pt | ☐ |

| 💨 Immediate price reaction after return | 1 pt | ☐ |

| 📋 Market structure confirmation | 1 pt | ☐ |

| 🚫 No major news interference | 1 pt | ☐ |

Scoring Guide:

- 10-13 points: Exceptional setup – maximum position size

- 8-9 points: Strong setup – standard position size

- 6-7 points: Marginal setup – reduced position size

- Below 6: Skip the trade

🕐 Trading Session Effectiveness Dashboard

| Session | GMT Time | EST Time | 🎯 Sweep Effectiveness | 📊 Volume | 💰 Best Opportunities | ⭐ Rating |

|---|---|---|---|---|---|---|

| Asian Range | 23:00-08:00 | 18:00-03:00 | Low-Medium | Low | Range boundaries | ⭐⭐ |

| London Kill Zone | 07:00-10:00 | 02:00-05:00 | Very High | High | Major sweeps | ⭐⭐⭐⭐⭐ |

| London Session | 08:00-17:00 | 03:00-12:00 | High | High | Trend development | ⭐⭐⭐⭐ |

| NY Kill Zone | 13:30-16:30 | 08:30-11:30 | Extremely High | Very High | Maximum liquidity | ⭐⭐⭐⭐⭐ |

| New York Session | 13:00-22:00 | 08:00-17:00 | High | High | Continuation moves | ⭐⭐⭐⭐ |

At Phidias, we recommend focusing primarily on London and New York kill zones for evaluation accounts, as these sessions provide optimal balance between opportunity frequency and signal reliability while maintaining manageable risk parameters.

Liquidity Sweep vs Liquidity Grab: Key Differences

Understanding the distinction between liquidity sweeps and liquidity grabs helps traders identify optimal entry timing and manage expectations for subsequent price behavior. Both concepts involve institutional liquidity collection, but they differ significantly in execution and trading implications.

📊 Sweep vs Grab: Complete Comparison Matrix

| Characteristic | 🌊 Liquidity Sweep | ⚡ Liquidity Grab |

|---|---|---|

| Duration | Multiple candles (extended) | Single candle (immediate) |

| Movement Pattern | Gradual push through level | Sharp spike through level |

| Consolidation | Often consolidates beyond level | Immediate reversal |

| Volume Pattern | Sustained elevated volume | Sharp volume spike |

| Candle Appearance | Series of directional candles | Large wick, small body |

| Reversal Speed | Gradual return movement | Instant snap-back |

| Institution Intent | Large position accumulation | Quick order fill |

| Best Entry Timing | After consolidation completion | Immediately after grab |

| Risk Management | Stops beyond consolidation | Stops beyond grab wick |

| Profit Potential | Larger moves typically | Smaller but faster moves |

| Win Rate | 65-75% when confirmed | 70-80% when clear |

| R:R Typical | 1:2 to 1:4 | 1:1.5 to 1:3 |

| Market Conditions | Works in trending markets | Effective in all conditions |

| Recognition Difficulty | Moderate (need patience) | Easy (obvious patterns) |

🎯 Trading Applications Guide

When to Trade Sweeps:

- ✅ Trending market conditions

- ✅ During high-activity sessions

- ✅ When seeking larger position moves

- ✅ Multiple timeframe alignment exists

When to Trade Grabs:

- ✅ Range-bound market conditions

- ✅ Quick scalping opportunities

- ✅ Clear single-candle patterns

- ✅ High-frequency trading approach

We teach our traders to adapt their approaches based on market conditions and personal trading styles, as both patterns provide legitimate opportunities when properly identified and traded within appropriate risk parameters.

Liquidity Sweep Trading Strategies for Prop Firm Success

Prop firm trading requires systematic approaches that consistently generate profits while maintaining strict risk parameters. Liquidity sweep strategies provide an ideal framework for meeting evaluation requirements and scaling funded accounts effectively.

🎯 The Complete Liquidity Sweep Trading System

Phase 1: Pre-Market Analysis 📊

🔍 Market Structure Review

↓

📍 Key Level Identification

↓

⏰ Session Planning

↓

📈 Bias Establishment

Phase 2: Live Market Execution ⚡

👀 Monitor Liquidity Levels

↓

✅ Confirm Sweep Criteria

↓

🎯 Execute Entry Strategy

↓

🛡️ Manage Risk Parameters

Phase 3: Trade Management 💰

📊 Monitor Price Development

↓

🎯 Partial Profit Taking

↓

📈 Trail Stops at Structure

↓

📋 Document Performance

🏆 Prop Firm Optimization Strategies

| Strategy Element | Evaluation Phase | Funded Account Phase |

|---|---|---|

| Position Sizing | Conservative (0.5-1%) | Standard (1-2%) |

| Daily Trade Limit | 3-5 sweep setups max | 5-8 sweep setups max |

| Risk Per Day | 2-3% maximum | 3-5% maximum |

| Profit Targets | Structure-based logical levels | Extended targets possible |

| Session Focus | Kill zones only | All active sessions |

| Setup Quality | High confluence required | Can take medium quality |

🎯 Advanced Confluence Integration

Multi-Concept Combination Matrix:

| Primary Setup | Confluence Factor | Success Rate | R:R Ratio |

|---|---|---|---|

| Liquidity Sweep | Order Block | 75-80% | 1:2.5 |

| Liquidity Sweep | Fair Value Gap | 70-75% | 1:2.8 |

| Liquidity Sweep | Market Structure | 80-85% | 1:2.2 |

| Liquidity Sweep | Session Timing | 65-70% | 1:2.0 |

| All Confluence | Multiple factors | 85-90% | 1:3.5+ |

At Phidias, we’ve observed that traders using systematic sweep approaches show significantly higher evaluation pass rates compared to those using discretionary methods, primarily due to the objective nature of sweep identification and trade management.

Risk Management for Liquidity Sweep Trading

Risk management forms the foundation of sustainable prop firm success, and liquidity sweep trading naturally supports conservative approaches through precise entry timing and logical stop placement.

💰 Enhanced Position Sizing Calculator

Scenario-Based Risk Management Examples:

| Account Size | Risk % | Stop Distance | Position Size | Real Example |

|---|---|---|---|---|

| $25,000 | 1% | 10 pips | 2.5 lots | Entry: 1.1050, SL: 1.1040 |

| $25,000 | 1% | 15 pips | 1.67 lots | Entry: 1.1050, SL: 1.1035 |

| $25,000 | 1% | 20 pips | 1.25 lots | Entry: 1.1050, SL: 1.1030 |

| $50,000 | 1% | 10 pips | 5.0 lots | Entry: 1.1050, SL: 1.1040 |

| $50,000 | 1% | 15 pips | 3.33 lots | Entry: 1.1050, SL: 1.1035 |

| $100,000 | 1% | 10 pips | 10.0 lots | Entry: 1.1050, SL: 1.1040 |

📐 Position Size Formula & Risk Rules:

Position Size = (Account Balance × Risk %) ÷ (Stop Loss Distance in Pips × Pip Value)

🎯 Golden Risk Management Rules:

- ✅ Never exceed 1% risk per trade (2% maximum for exceptional setups)

- ✅ Keep daily risk under 3% of account balance

- ✅ Adjust position size based on actual stop distance

- ✅ Smaller stops = larger positions (better risk/reward)

- ✅ Track correlation – avoid multiple correlated positions

🛡️ Stop Loss Strategy Matrix

| Sweep Type | Stop Placement | Typical Distance | Risk Level |

|---|---|---|---|

| SSL Sweep | Below swept low + buffer | 10-20 pips | Low-Medium |

| BSL Sweep | Above swept high + buffer | 10-20 pips | Low-Medium |

| Extended Sweep | Beyond consolidation zone | 15-30 pips | Medium |

| Grab Pattern | Beyond grab wick + buffer | 5-15 pips | Low |

📊 Daily Risk Allocation Framework

| Trading Phase | Max Trades | Risk Per Trade | Daily Limit | Recovery Protocol |

|---|---|---|---|---|

| Fresh Start | 5 setups | 1% | 3% | Normal operation |

| 1% Daily Loss | 3 setups | 0.75% | 2% | Reduce frequency |

| 2% Daily Loss | 2 setups | 0.5% | 1% | High quality only |

| 3% Daily Loss | STOP | 0% | 0% | End session |

Account preservation takes priority over profit generation during challenging conditions. Reduce position sizes or take trading breaks when experiencing unusual failure rates in sweep identification or execution.

Why Liquidity Sweeps Fail: Common Mistakes and Solutions

Liquidity sweep failures often result from systematic errors in identification, timing, or risk management rather than inherent problems with the methodology. Understanding common mistakes helps traders avoid these pitfalls while improving their overall approach.

⚠️ Mistakes vs Solutions: Complete Troubleshooting Matrix

| Common Mistake | Why It Happens | ❌ Consequences | ✅ Phidias Solution | 📈 Result |

|---|---|---|---|---|

| Trading Every Level | FOMO, overconfidence | 45-55% win rate | Use validation scoring (8+ points) | 70%+ win rate |

| Ignoring Market Bias | Focus only on setups | Counter-trend losses | Always check HTF structure first | Trend alignment |

| Poor Entry Timing | Impatience, early entries | Premature stop hits | Wait for full sweep confirmation | Better R:R ratios |

| Wrong Position Sizing | Static lot sizes used | Inconsistent risk exposure | Calculate per stop distance | Consistent 1% risk |

| No Confluence Required | Taking isolated setups | Low probability trades | Require 2+ confluence factors | 75%+ win improvement |

| Session Ignorance | Trading all hours equally | Low-activity failures | Focus on kill zones only | Higher success rate |

| Arbitrary Stop Placement | Using fixed pip distances | Illogical risk management | Stops beyond swept levels | Logical exits |

| News Trading Conflict | Ignoring fundamental events | Technical override losses | Check economic calendar | Avoid major conflicts |

| Overtrading After Losses | Emotional recovery attempts | Account rule violations | Set daily limits (3-5 max) | Prevent blowups |

| Fighting Market Structure | Stubborn technical analysis | Continued directional losses | Adapt when structure shifts | Flow with institutions |

🔧 Quick Implementation Guide

Problem 1: Trading Every Liquidity Level

The Fix:

- ✅ Use our validation scoring system (require 8+ points minimum)

- ✅ Limit to 3-5 high-quality setups per day

- ✅ Focus on kill zone sessions only

- ✅ Require multiple confluence factors

Problem 2: Poor Risk Management

The Fix:

- ✅ Risk exactly 1% per trade (never more)

- ✅ Calculate position size using our formula

- ✅ Set daily loss limits at 3% maximum

- ✅ Use logical stop placement beyond swept levels

Problem 3: Ignoring Market Context

The Fix:

- ✅ Start with higher timeframe analysis (daily/4H)

- ✅ Only trade sweeps aligned with major bias

- ✅ Check session timing for optimal conditions

- ✅ Avoid major news event periods

📊 Success Metrics Comparison

| Approach | Win Rate | Avg R:R | Monthly Return | Account Survival |

|---|---|---|---|---|

| ❌ Common Mistakes | 35-45% | 1:1.2 | -2% to 5% | 20% |

| ✅ Phidias Method | 70-80% | 1:2.5+ | 8-15% | 85% |

By implementing our systematic solutions, traders consistently achieve better results while maintaining the discipline required for prop firm success.

Advanced Liquidity Sweep Concepts

Advanced liquidity analysis involves understanding complex institutional behavior patterns and recognizing how sweep patterns evolve under different market conditions. These concepts separate professional traders from amateur participants in the prop firm environment.

🏗️ Institutional Liquidity Engineering

Liquidity engineering refers to sophisticated institutional strategies that deliberately create and manipulate liquidity conditions to facilitate large position entries and exits. Understanding these patterns helps traders anticipate market movements.

🎯 Multi-Timeframe Confluence Matrix

| Primary TF | Confluence TF | Setup Strength | Success Rate | Typical R:R |

|---|---|---|---|---|

| 15-min | 1-hour | Medium-High | 70-75% | 1:2.2 |

| 15-min | 4-hour | High | 75-80% | 1:2.8 |

| 1-hour | 4-hour | High | 75-80% | 1:2.5 |

| 1-hour | Daily | Very High | 80-85% | 1:3.2 |

| 4-hour | Daily | Very High | 85-90% | 1:3.5 |

| 4-hour | Weekly | Exceptional | 90-95% | 1:4+ |

🔄 Liquidity Sweep Evolution Patterns

Market Adaptation Stages:

| Stage | Characteristics | Trader Response |

|---|---|---|

| Classic Sweeps | Clean through-and-return | Standard approach works |

| Extended Sweeps | Longer consolidation periods | Patience required |

| Multiple Sweeps | Several attempts needed | Wait for final sweep |

| False Sweeps | No institutional follow-through | Adapt criteria |

At Phidias, we continuously monitor sweep pattern evolution and adapt our educational content to reflect current market realities, ensuring our traders stay ahead of changing institutional behaviors.

🛠️ Platform Setup Checklist for Liquidity Sweep Trading

Essential Platform Requirements

📋 Platform Setup Checklist:

Chart Configuration ✅

- [ ] Multi-timeframe layout (15m, 1H, 4H, Daily)

- [ ] Clean price action charts (minimal indicators)

- [ ] Clear swing high/low markings

- [ ] Volume indicator for confirmation

- [ ] Session separators for timezone clarity

Drawing Tools Setup ✅

- [ ] Horizontal line tool (for liquidity levels)

- [ ] Rectangle tool (for liquidity zones)

- [ ] Trend line tool (for structure)

- [ ] Color coding system (BSL=red, SSL=blue)

- [ ] Text labels (for level identification)

Alert System Configuration ✅

- [ ] Price alerts at key liquidity levels

- [ ] Mobile notifications enabled

- [ ] Email alerts for major setups

- [ ] Sound alerts for immediate attention

- [ ] Custom alert messages for different setups

Risk Management Tools ✅

- [ ] Position size calculator readily available

- [ ] Risk percentage tracker

- [ ] Daily P&L monitor

- [ ] Trade journal integration

- [ ] Economic calendar overlay

Getting Started with Liquidity Sweep Trading at Phidias

Ready to transform your trading results with professional liquidity sweep strategies? At Phidias, we provide the ideal environment for developing and implementing sweep trading skills with our industry-leading prop firm funding opportunities.

Our comprehensive evaluation process allows you to demonstrate your liquidity sweep proficiency while providing the capital needed to generate substantial profits. With account sizes up to $100,000 and profit splits up to 80%, you can turn your sweep trading expertise into sustainable income.

Liquidity sweep trading aligns perfectly with our evaluation criteria, emphasizing systematic approaches, controlled risk, and consistent profit generation. We support both Fundamental and Swing account types, giving you flexibility to trade sweeps across different timeframes based on your preferred methodology.

🚀 Why Liquidity Sweep Traders Choose Phidias

| Advantage | Benefit | Impact |

|---|---|---|

| 🎯 Systematic Approach | Rewards methodical trading | Higher pass rates |

| 📊 Multiple Account Types | Accommodates different styles | Flexibility |

| ⚡ Fast Funding | 3-day minimum evaluation | Quick capital access |

| 🏆 Professional Support | ICT methodology expertise | Optimized strategies |

| 💰 Scaling Opportunities | Up to 15 funded accounts | $1M+ combined capital |

Professional platform integration ensures you have access to the tools needed for effective sweep identification and execution. Our Rithmic-compatible platforms provide institutional-grade execution and advanced charting capabilities ideal for ICT methodology implementation.

Frequently Asked Questions About Liquidity Sweep Trading

What is a liquidity sweep in ICT trading?

A liquidity sweep is a market movement where institutional traders deliberately push price through key levels containing clustered stop orders, creating the liquidity needed for large position entries. These sweeps typically target areas where retail traders place stops, such as swing highs and lows.

Is liquidity sweep bullish or bearish?

Liquidity sweeps themselves are directional tools that establish market bias. Sell-side liquidity sweeps (below lows) typically create bullish bias for long opportunities, while buy-side liquidity sweeps (above highs) establish bearish bias for short positions.

What is the difference between liquidity grab and liquidity sweep?

Liquidity grabs occur within single candlesticks that spike through levels and immediately reverse, while liquidity sweeps involve extended movements that may consolidate beyond levels before reversing. Grabs are faster and more aggressive, while sweeps allow more time for institutional order completion.

Why do market makers create liquidity sweeps?

Market makers use liquidity sweeps to facilitate large order execution without causing excessive price impact. By triggering clustered stops, they create the opposing flow needed to fill institutional orders efficiently while maintaining orderly markets.

How do you identify a valid liquidity sweep?

Valid sweeps require price movement through obvious liquidity levels, followed by return movement that establishes directional bias. Use our validation scoring system requiring 8+ points including volume spikes, market structure alignment, and session timing during high institutional activity periods.

What timeframes work best for liquidity sweep trading?

15-minute to 4-hour timeframes provide optimal balance between opportunity frequency and signal reliability. Daily sweeps offer higher win rates but fewer opportunities, while lower timeframes require careful filtering to avoid false signals.

Can you trade liquidity sweeps alone?

While sweeps provide strong directional bias, we recommend combining them with other ICT concepts like order blocks and fair value gaps for optimal entry timing and enhanced probability. Our confluence scoring system requires multiple confirmation factors for highest probability setups.

How do you manage risk when trading liquidity sweeps?

Risk management involves placing stops beyond swept liquidity levels, calculating position sizes based on actual stop distances using our formula, and never risking more than 1% per trade. Use structure-based targets rather than arbitrary profit objectives for optimal risk-reward ratios.

Do liquidity sweeps work in all market conditions?

Sweep effectiveness varies with market conditions. They work best during trending markets and high-activity sessions (London/NY kill zones) but may fail during low-volatility periods or when major news events override technical levels. Context analysis using our scoring system remains crucial for success.

What’s the success rate of liquidity sweep trading?

When properly implemented with our validation scoring system and confluence requirements, liquidity sweep strategies typically achieve 70-80% win rates with 1:2.5 to 1:4 risk-reward ratios. Success depends on setup quality, market context, and disciplined execution rather than frequency of trades.

Transform your trading approach today with professional liquidity sweep strategies. Apply for Phidias funding and discover how institutional analysis can accelerate your path to consistent profitability and financial independence through systematic prop firm trading.