Order block trading has become one of the most popular methodologies in the ICT (Inner Circle Trading) approach, offering traders clear entry signals, logical stop placement, and structure-based profit targets.

Order blocks represent institutional footprints in the market – powerful zones where smart money executes large positions that create predictable support and resistance levels. For prop firm traders, mastering order block identification and trading strategies can be the difference between passing evaluations and joining the 90% who fail to achieve funding.

📋 TL;DR: Master Order Block Trading for Prop Firm Funding

🎯 Order Block Trading Progress

Track your journey from novice to expert trader

Phase 1: Foundation Building

Phase 2: Validation Mastery

Phase 3: Live Trading

According to Phidias Propfirm, order block trading provides one of the most systematic approaches to prop firm success because it teaches you to identify exactly where institutional money enters and exits the market.

ICT order blocks represent the last opposite-colored candle before significant market moves – institutional decision points that create predictable trading opportunities.

🎯 Order Block Essentials Summary

⏰ Optimal Timeframes for Prop Firms

💰 Risk Management Calculator

✅ Order Block Validation Tool

🚀 Success Framework

🎯 Entry Signals Priority

- 🥇 Higher timeframe OB + trend alignment

- 🥈 Multiple timeframe confluence

- 🥉 Session timing + volume confirmation

- 📊 Lower timeframe structure break

- 🕯️ Candlestick rejection pattern

⚠️ Red Flags to Avoid

- ❌ Trading against higher timeframe bias

- ❌ Entering before displacement occurs

- ❌ Risking more than 1% per trade

- ❌ No clear stop loss plan

- ❌ Overtrading during slow sessions

🎯 Jump Directly to Any Section of Our Order Block Guide:

What Are Order Blocks in ICT Trading?

Order blocks in ICT trading represent specific price zones where institutional traders have executed significant buying or selling orders, creating areas of high liquidity that the market often revisits. Unlike traditional support and resistance concepts, ICT order blocks focus on understanding the actual mechanics of how smart money operates in modern financial markets.

Michael Huddleston, the creator of ICT methodology, developed order block concepts to help retail traders understand where large institutions accumulate and distribute positions. These zones mark the footprints of smart money activity – the last areas where institutional traders positioned themselves before significant market moves.

The key difference between order blocks and traditional levels lies in their formation mechanism. While conventional support and resistance rely on historical price reactions, order blocks identify specific institutional activity zones based on market structure and liquidity dynamics. This makes them far more reliable for predicting future price behavior.

The Institutional Logic Behind Order Blocks

Smart money operates differently than retail traders when entering large positions. Institutional traders can’t simply place massive market orders without significantly impacting price, so they use sophisticated strategies to accumulate positions over time while minimizing market disruption.

Order blocks form when institutions need to position significant capital in the market. Rather than pushing price in one direction immediately, they often allow price to retrace back to their entry zones, providing opportunities to add to positions or complete order fills at optimal prices.

This institutional behavior creates predictable patterns that ICT traders can exploit. When price returns to an order block zone, it’s essentially returning to an area where institutional orders are waiting, often resulting in strong reactions that continue the original directional bias.

Order Blocks vs Traditional Technical Analysis

Traditional technical analysis treats support and resistance as static levels based on historical price reactions. ICT order blocks represent dynamic institutional activity zones that explain why certain levels hold while others fail catastrophically.

Order block methodology provides context for market movements that traditional analysis cannot explain. When a “strong support level” suddenly breaks, order block analysis often reveals that it was never a true institutional accumulation zone but rather a retail liquidity collection point.

We teach our traders to think like institutions rather than retail participants. Order block identification helps you understand where smart money is positioned and how they’re likely to defend or abandon these levels based on market development.

Types of Order Blocks: Bullish vs Bearish Institutional Zones

Order block classification depends on the directional bias of the institutional activity that created them. Understanding both types helps you identify trading opportunities in any market condition while maintaining alignment with smart money flow.

📊 Bullish vs Bearish Order Blocks: Complete Comparison

Bullish Order Blocks: Institutional Buying Zones

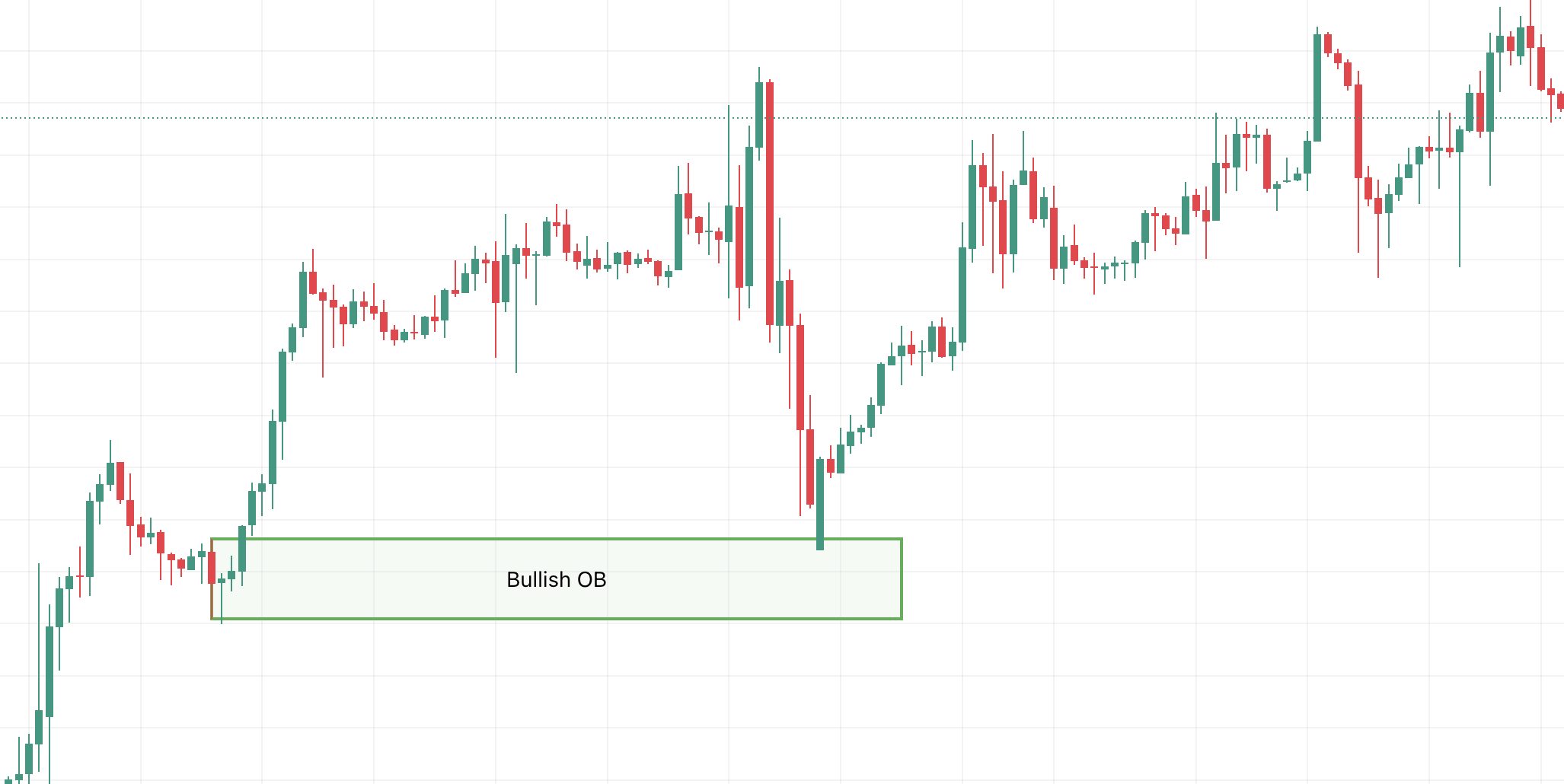

Bullish order blocks form when institutional buying interest overwhelms selling pressure, creating demand zones that often provide support during future retracements. These zones represent areas where smart money accumulated long positions before significant upward moves.

Identification criteria for bullish order blocks include the last bearish candle or series of candles before a significant bullish move begins. This bearish price action represents the final selling pressure before institutional buying takes control and drives price higher.

Bearish Order Blocks: Institutional Selling Zones

Bearish order blocks develop when institutional selling pressure overcomes buying interest, establishing supply zones that frequently act as resistance during subsequent rallies. These areas mark where smart money distributed long positions or initiated short positions.

Bearish order block formation involves identifying the last bullish candle or candle series before substantial bearish movement begins. This bullish price action represents the final buying pressure before institutional selling dominates and pushes price lower.

Order Block Time Horizons and Strength

Timeframe analysis determines order block significance and potential reaction strength. Higher timeframe blocks (daily, weekly) generally produce stronger reactions and longer-lasting effects than lower timeframe formations.

⏰ Order Block Timeframe Performance Dashboard

🎯 Optimal Timeframe Selection Guide:

🥇 For Prop Firm Evaluations: 15-minute to 1-hour (perfect balance of opportunity and reliability)

🥈 For Funded Account Growth: 4-hour to Daily (higher win rates, bigger moves)

🥉 For Scalping Experience: 5-minute to 15-minute (requires advanced skills)

❌ Avoid for Beginners: 1-minute charts (too much noise and false signals)

We recommend focusing primarily on 4-hour and daily order blocks for prop firm trading, as they provide the optimal balance between opportunity frequency and profit potential while maintaining manageable risk parameters.

How to Identify Order Blocks: Step-by-Step ICT Method

Order block identification requires systematic analysis of market structure, trend development, and institutional activity patterns. We’ve developed a comprehensive method that helps our traders consistently locate high-probability order block zones across all market conditions.

🎯 The Complete Order Block Identification Process

Phase 1: Market Analysis 🔍

Step 1: 📊 Determine Market Structure and Bias

Market structure analysis forms the foundation of successful order block identification. Begin by analyzing daily and 4-hour charts to determine the prevailing trend direction and overall institutional bias.

📊 Market Structure & Bias Assessment

Analyze market structure across multiple timeframes

📈 Trend Direction Assessment

🔄 Recent Structure Breaks

💹 Market Momentum

📊 Multi-Timeframe Summary

📊 Market Structure Quick Assessment Guide

Bullish market structure consists of higher highs and higher lows, indicating institutional accumulation and upward pressure. In these conditions, focus on identifying bullish order blocks that align with the dominant trend.

Bearish market structure shows lower highs and lower lows, suggesting institutional distribution and downward pressure. During these periods, prioritize bearish order blocks that support the prevailing downtrend.

Step 2: 📍 Locate the Base of Significant Moves

Base identification involves finding where current trending moves originated – the point where institutional activity initiated the directional change that created the present market structure.

🔍 Base Location Checklist:

- ☐ 🎯 Find trend starting point (where current structure began)

- ☐ 📊 Identify consolidation area before the move

- ☐ ⚡ Look for breakout zones that initiated momentum

- ☐ 📈 Confirm with volume spikes during breakout

- ☐ ⏰ Note session timing (London/NY preferred)

Step 3: 🎯 Identify the Last Opposite Candle

Candle analysis focuses on finding the final opposite-colored candle before significant directional movement begins. This candle represents the last area where opposing pressure existed before institutional flow took control.

🕯️ For Bullish Order Blocks: 📈

- ✅ Last red (bearish) candle before upward move

- ✅ Candle should close near its low

- ✅ Followed by aggressive bullish movement

- ✅ Creates clear market structure break

For Bearish Order Blocks: 📉

- ✅ Last green (bullish) candle before downward move

- ✅ Candle should close near its high

- ✅ Followed by aggressive bearish movement

- ✅ Creates clear market structure break

Step 4: ✅ Validate Order Block Formation

Order block validation ensures you’re identifying genuine institutional activity rather than random price movements. Valid order blocks should demonstrate specific characteristics that confirm smart money involvement.

Displacement requirement means the order block should be followed by aggressive directional movement that breaks previous market structure. This displacement indicates institutional commitment to the directional bias.

Order Block Formation and Market Structure Analysis

Market structure evolution directly influences order block formation and effectiveness. Understanding how institutions create and utilize these zones within broader market patterns helps you identify the highest probability trading opportunities.

Market Structure Shifts and Order Block Creation

Structure shifts occur when institutional activity breaks previous market patterns, often originating from order block zones. These shifts signal changes in institutional sentiment and create new directional bias for future trading.

Break of structure (BOS) events frequently originate from order block zones, as institutional traders use these areas to initiate significant directional moves. When price breaks previous highs or lows from order block areas, it confirms institutional commitment.

Order Block Mitigation Patterns

Order block mitigation occurs when price returns to previously formed institutional zones, providing opportunities for institutions to complete orders or manage existing positions. Understanding mitigation patterns helps predict optimal entry timing.

Full mitigation happens when price completely fills the order block zone, potentially signaling that institutional interest has been satisfied. However, this doesn’t always invalidate the zone for future reactions.

Partial mitigation involves price touching or partially entering the order block without complete penetration. These interactions often provide the strongest reaction signals for trading entries.

Order Block Trading Strategies for Prop Firm Success

Prop firm trading requires systematic approaches that consistently generate profits while maintaining strict risk parameters. Order block strategies provide the perfect framework for meeting evaluation requirements and scaling funded accounts effectively.

The Basic Order Block Entry Strategy

Entry timing represents the most critical aspect of order block trading success. We teach our traders to wait for specific confirmation signals rather than blindly buying or selling at order block boundaries.

Zone approach strategy involves entering trades when price reaches the order block area rather than waiting for exact level touches. This approach increases trade frequency while maintaining high probability setups.

Advanced Order Block Confluence Strategies

Confluence trading combines order blocks with additional ICT concepts to create higher probability setups. Multiple confirmations significantly increase trade success rates while reducing overall risk exposure.

Fair value gap alignment creates powerful trading opportunities when order blocks coincide with unfilled price imbalances. These setups often provide exceptional risk-to-reward characteristics ideal for prop firm growth.

Risk Management for Order Block Trading in Prop Firms

Risk management forms the cornerstone of sustainable prop firm trading success. Order block trading naturally supports conservative risk approaches through tight stop placements and logical risk-reward characteristics.

Position Sizing for Order Block Setups

Position sizing calculations must account for the distance between entry points and stop loss levels beyond order block zones. This approach ensures consistent risk regardless of setup specifics.

Stop Loss Strategies for Order Blocks

Stop loss placement for order block trades requires understanding zone boundaries and institutional behavior patterns. Proper stop placement protects capital while allowing institutional zones to function normally.

Zone-based stops position stop losses beyond the opposing end of order block zones rather than using arbitrary pip distances. This placement respects institutional levels while providing logical exit points.

Daily Loss Limits and Recovery Protocols

Daily loss limits prevent emotional trading decisions that often compound losses during difficult periods. Establish maximum daily loss thresholds before beginning each trading session.

Advanced Order Block Concepts and Confluence

Advanced order block analysis involves understanding complex institutional behavior patterns and combining multiple ICT concepts for enhanced trading opportunities. These techniques separate professional traders from amateur participants.

Order Block Breaker Patterns

Breaker blocks form when order blocks fail to hold and instead become opposing levels. Understanding breaker patterns helps traders adapt to changing institutional sentiment and avoid fighting new market dynamics.

Bullish to bearish breakers occur when bullish order blocks get penetrated aggressively to the downside, converting former support zones into resistance areas. This transformation signals institutional sentiment shifts.

Order Block Clustering and Nested Levels

Order block clustering occurs when multiple institutional zones form in close proximity, creating powerful confluence areas that often produce significant market reactions.

Common Order Block Trading Mistakes and Solutions

Trading mistakes can devastate prop firm accounts and prevent successful evaluations. Understanding common order block errors helps traders avoid these pitfalls while maintaining systematic approaches.

⚠️ Order Block Trading Mistakes vs Solutions

🔧 Quick Fix Implementation Guide:

Mistake 1: Trading Invalid Order Blocks – Use our validation checklist (aim for 7+ points)

Mistake 2: Poor Entry Timing – Wait for zone touch + confirmation signals

Mistake 3: Wrong Position Sizing – Calculate size based on actual stop distance

Mistake 4: No Risk Management – Risk exactly 1% per trade, 3% daily maximum

Order Block Trading Tools and Platform Setup

Platform optimization enhances order block identification and trading execution, helping traders operate more efficiently while maintaining accuracy. We recommend specific tools and configurations for optimal results.

Essential Order Block Indicators and Tools

TradingView setup provides excellent order block analysis capabilities through various indicators and drawing tools designed specifically for ICT methodology implementation.

Order block indicators can help automate zone identification, though manual analysis often provides better understanding of institutional behavior patterns.

Getting Started with Order Block Trading at Phidias

Ready to transform your trading results with professional order block strategies? At Phidias, we provide the ideal environment for developing and implementing order block trading skills with our industry-leading prop firm funding opportunities.

Our comprehensive evaluation process allows you to demonstrate your order block trading proficiency while providing the capital you need to generate substantial profits. With account sizes up to $100,000 and profit splits up to 80%, you can turn your order block expertise into a sustainable income stream.

📊 Track Your Order Block Trading Progress

Professional traders understand that consistent improvement comes from detailed performance tracking. Use our integrated trade journal to monitor your order block trading results and identify areas for optimization.

📈 Complete Performance Dashboard

Data-driven improvement requires comprehensive analytics across all your order block trading activities. Our performance dashboard aggregates data from all interactive tools to provide actionable insights for optimizing your trading edge.

📊 Order Block Performance Dashboard

Track your progress and optimize your order block trading edge

📈 Performance Trend

⭐ Quality Distribution

💡 Personalized Insights & Recommendations

Setup Quality

Best Timeframes

Risk Management

🛠️ Tool Usage Overview

🎯 Progress Tracking

🎯 Recommended Actions

🚀 Start Your Funded Trading Journey Today

Join thousands of successful traders who have already unlocked their potential with Phidias funding.

🗺️ Order Block Trading Implementation Roadmap

Systematic implementation ensures you develop order block trading skills progressively while building the consistency required for prop firm success. Follow this structured approach to maximize your learning efficiency.

📅 30-Day Order Block Mastery Plan

🌱 Week 1: Foundation (Days 1-7)

- Days 1-2: Study order block theory and ICT concepts

- Days 3-4: Practice identification on historical charts

- Days 5-6: Use market bias tool for structure analysis

- Day 7: Complete first validation assessments

🎯 Week 2: Validation (Days 8-14)

- Days 8-9: Master the validation scoring system

- Days 10-11: Practice confluence identification

- Days 12-13: Use trading wizard for complete setups

- Day 14: Risk calculation and position sizing

📊 Week 3: Demo Trading (Days 15-21)

- Days 15-16: Begin demo trading with small sizes

- Days 17-18: Track all trades in the journal

- Days 19-20: Analyze performance and adjust

- Day 21: Review weekly performance data

🚀 Week 4: Optimization (Days 22-30)

- Days 22-24: Refine setup selection criteria

- Days 25-27: Optimize entry and exit timing

- Days 28-29: Prepare for prop firm evaluation

- Day 30: Final performance review and plan

🏆 Success Metrics for Each Week

🎯 Key Order Block Trading Takeaways

Mastering order block trading requires understanding both the technical methodology and the psychological discipline needed for consistent execution. These key principles separate successful order block traders from those who struggle with implementation.

✅ Order Block Fundamentals

- Quality over quantity – Focus on high-scoring setups (7+ points)

- Timeframe alignment – Ensure higher TF bias supports your trades

- Institutional thinking – Trade with smart money, not against it

- Patience pays – Wait for proper mitigation and confirmation

📊 Risk Management Essentials

- 1% risk maximum – Never exceed this per trade

- Structure-based stops – Place stops beyond order block zones

- Position sizing – Calculate based on actual stop distance

- Daily limits – Respect maximum daily drawdown rules

🎯 Execution Excellence

- Systematic approach – Follow the same process every time

- Tool utilization – Use our interactive tools consistently

- Performance tracking – Journal every trade and analyze results

- Continuous improvement – Adapt based on performance data

🧠 Psychology & Discipline

- Emotional control – Stick to your plan regardless of outcomes

- Patience training – Wait for quality setups, avoid overtrading

- Confidence building – Trust the process and your analysis

- Long-term thinking – Focus on process, not individual trade results

🎯 The Order Block Success Formula

❓ Comprehensive Order Block Trading FAQ

🔰 Beginner Questions

What is an order block in simple terms? ▼

How long does it take to learn order block trading? ▼

Do I need expensive software to trade order blocks? ▼

📊 Technical Questions

What timeframes work best for order blocks? ▼

How do I validate order block quality? ▼

When do order blocks become invalid? ▼

💰 Prop Firm Questions

Can order blocks help pass prop firm evaluations? ▼

What win rate should I expect with order blocks? ▼

How should I manage risk with order blocks? ▼

🚀 Advanced Questions

How do breaker blocks work? ▼

Can I combine order blocks with other strategies? ▼

What’s the difference between order blocks and smart money concepts? ▼

❓ Still Have Questions?

Our interactive tools provide hands-on answers to most questions. The best way to understand order blocks is to practice with our step-by-step guides.

🎯 Complete Order Block Trading Mastery Summary

🏆 From Novice to Expert: Your Complete Journey

Knowledge Gained

- Complete ICT order block methodology

- Institutional thinking and analysis

- Market structure interpretation

- Risk management principles

Tools Mastered

- Order block validation system

- Risk calculation tools

- Market bias assessment

- Performance tracking dashboard

Skills Developed

- High-probability setup identification

- Systematic trade execution

- Performance analysis and optimization

- Prop firm evaluation readiness

Results Expected

- 65-75% win rate on quality setups

- Consistent 2:1+ risk-reward ratios

- Systematic approach to trading

- Prop firm funding readiness

🚀 Your Next Steps to Success

🎯 Transform Your Trading Results Today

Master professional order block strategies and accelerate your path to consistent profitability and financial independence.