Fair value gap trading has become one of the most powerful strategies in the ICT (Inner Circle Trader) methodology, especially for traders seeking prop firm funding. These market inefficiencies represent institutional footprints that smart money leaves behind, creating high-probability trading opportunities that can fast-track your journey to becoming a funded trader.

At Phidias, we’ve seen countless traders transform their results by mastering fair value gap strategies. This comprehensive guide will take you from understanding the basic concept to implementing advanced FVG techniques that work specifically within prop firm risk parameters. Whether you’re preparing for your evaluation or looking to maximize your funded account performance, this guide contains everything you need to succeed.

TL;DR Mastering Fair Value Gaps to Make Money with Prop Firms

According to Phidias Propfirm, Fair Value Gaps (FVG) are institutional trading zones that offer some of the highest probability setups for prop firm success. These price inefficiencies occur when aggressive buying or selling creates liquidity voids that price must eventually fill.

🎯 Why FVGs Dominate Prop Firm Trading:

- Tight stop losses (5-15 ticks) = larger position sizes within risk limits

- High win rates (70%+ with proper confluence) = consistent profit targets

- Clear entry/exit rules = perfect for evaluation requirements

- Works on all timeframes = flexible for any trading style

⚡ Quick FVG Identification:

- Find 3-candle pattern with aggressive middle candle

- Check non-overlapping wicks between outer candles

- Mark the gap zone for future price interaction

- Wait for retracement and enter with original bias

💰 Prop Firm Advantage:

- 15-minute to 1-hour timeframes = optimal for evaluations

- 1-2% risk per trade with tight stops = sustainable growth

- 2:1+ risk-reward typical from structure-based targets

- Multiple daily opportunities without overtrading

🚀 Success Framework:

✅ Filter for confluence (market structure + session timing)

✅ Align with higher timeframe bias (trend following)

✅ Use proper position sizing (max 1% risk per trade)

✅ Target logical levels (previous highs/lows, not arbitrary ticks)

Bottom Line: FVG trading provides the systematic, rule-based approach prop firms reward with funding. Master the identification, respect the risk management, and focus on quality setups over quantity. Read below for the complete implementation strategy that transforms demo profits into funded account success.

What is Fair Value Gap Trading in ICT Methodology?

A fair value gap (FVG) in ICT trading represents a price area where market inefficiency occurred due to aggressive buying or selling pressure from institutional traders. Unlike traditional gap analysis, ICT fair value gaps focus on intraday imbalances that create liquidity voids within the market structure.

The concept stems from understanding how smart money operates in the markets. When large institutions execute significant orders, they often move price so aggressively that normal market equilibrium gets disrupted. This leaves behind areas where fair value pricing never occurred – hence the term “fair value gap.” These gaps act like magnets, drawing price back to restore balance and provide liquidity to the market.

Fair value gaps differ from conventional price gaps because they occur within regular trading sessions rather than between session closes and opens. They represent real-time institutional activity and provide immediate trading opportunities for those who understand how to identify and trade them effectively.

How to Identify Fair Value Gaps: Complete ICT Criteria

The 3-Candle FVG Formation Pattern

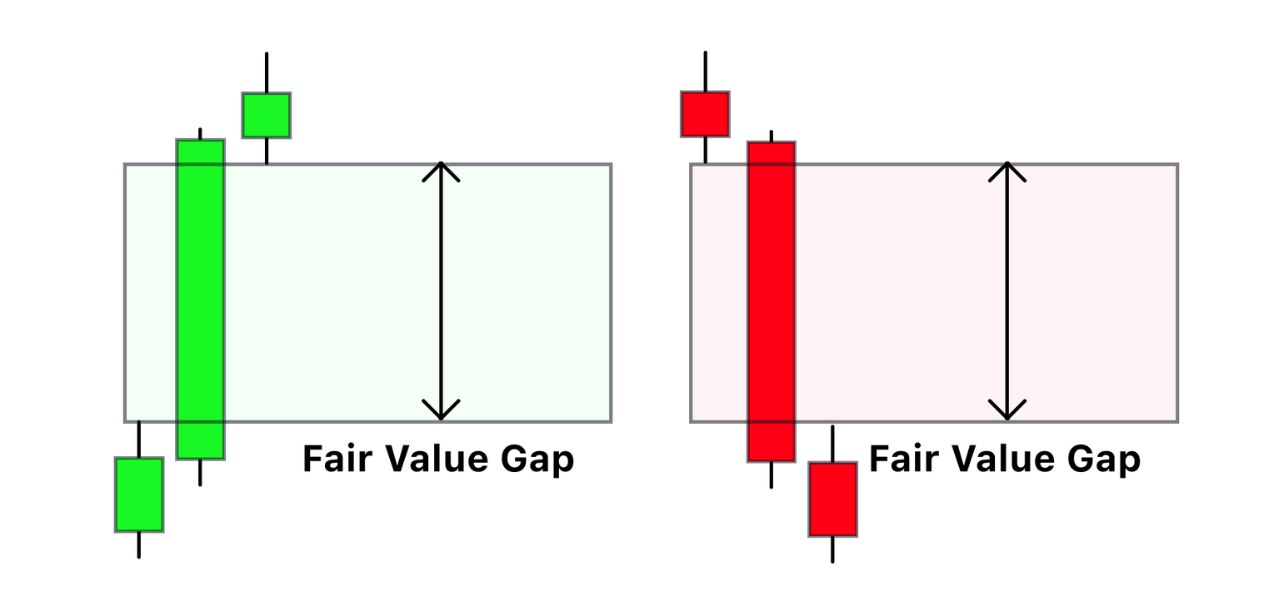

Fair value gap identification follows a specific three-candle pattern that creates the foundation for all FVG trading strategies. The pattern requires a large impulse candle flanked by two smaller candles that fail to overlap with the impulse candle’s range.

For a valid FVG formation, examine the high of the first candle and the low of the third candle. If these two price points don’t overlap with the middle candle’s range, you’ve identified a fair value gap. The space between these non-overlapping areas becomes your FVG zone – the area where price is likely to return for rebalancing.

✅ FVG Identification Checklist

Use this step-by-step checklist to identify valid fair value gaps:

- [ ] Locate a three-candle formation on your chart

- [ ] Identify the middle candle with significant size/momentum

- [ ] Check that first candle’s high/low doesn’t overlap with third candle’s low/high

- [ ] Measure the gap – minimum 5-10 ticks depending on timeframe

- [ ] Confirm the middle candle shows aggressive directional movement

- [ ] Mark the FVG zone between the non-overlapping levels

- [ ] Note the gap’s direction (bullish below price, bearish above price)

- [ ] Validate with volume and market context

The middle candle must show significant buying or selling pressure, typically characterized by a large body relative to the surrounding candles. This aggressive price movement indicates institutional involvement and validates the gap’s significance for future price action.

Bullish vs Bearish Fair Value Gap Recognition

Bullish fair value gaps form when aggressive buying creates an upward impulse, leaving a gap between the first candle’s high and the third candle’s low. In this scenario, the middle candle shows strong bullish pressure, and the gap appears below current price action. These gaps often act as support zones where price finds buying interest during retracements.

Bearish fair value gaps develop through aggressive selling pressure that creates a downward impulse. Here, the gap exists between the first candle’s low and the third candle’s high, with the middle candle displaying strong bearish characteristics. These gaps typically function as resistance areas where selling pressure emerges during upward retracements.

The key to successful FVG identification lies in understanding that the direction of the impulse candle determines the gap’s bias. A bullish impulse creates a bullish FVG below price, while a bearish impulse creates a bearish FVG above price. This relationship helps you anticipate how price will interact with these zones.

Multi-Timeframe FVG Analysis for Prop Traders

Timeframe analysis becomes crucial for prop firm traders who need high-probability setups to meet evaluation targets efficiently. Higher timeframe FVGs (4-hour, daily) carry more weight and often provide stronger reactions when price returns to these levels.

| Timeframe | Opportunity Frequency | Signal Strength | Typical Reaction | Best For | Recommended Level |

|---|---|---|---|---|---|

| 1-minute | Very High | Low-Medium | Quick scalps | Day trading | Advanced |

| 5-minute | High | Medium | 10-30 pip moves | Scalping/Day | Intermediate |

| 15-minute | Medium-High | Medium-High | 20-50 pip moves | Day/Swing | Beginner |

| 1-hour | Medium | High | 50-100 pip moves | Swing trading | Beginner |

| 4-hour | Low-Medium | Very High | 100+ pip moves | Position/Swing | All levels |

| Daily | Low | Extremely High | Major reversals | Position trading | All levels |

Lower timeframe FVGs (1-minute, 5-minute) offer more frequent trading opportunities but require careful filtering to avoid overtrading. We recommend using 15-minute and 1-hour charts as your primary analysis timeframes, as they provide the optimal balance between opportunity frequency and signal reliability for prop firm trading.

Confluence between multiple timeframe FVGs creates the highest probability trading scenarios. When a 15-minute FVG aligns with a 4-hour FVG, the combined liquidity void becomes a prime target for institutional rebalancing, offering excellent risk-to-reward opportunities that align perfectly with prop firm profit targets.

Fair Value Gap Trading Strategies for Prop Firm Success

The FVG Retracement Entry Strategy

The FVG retracement strategy forms the cornerstone of successful prop firm trading using fair value gaps. This approach involves waiting for price to return to a previously formed FVG and entering in the direction of the original impulse that created the gap.

🎯 Step-by-Step FVG Trading Process

- Identify the FVG: Use the checklist above to confirm valid gap formation

- Determine bias: Note if it’s bullish (below price) or bearish (above price)

- Wait for retracement: Price must return to the FVG zone

- Look for rejection signals: Watch for candlestick patterns within the gap

- Enter the trade: Place order in direction of original impulse

- Set stop loss: Position 3-5 pips beyond the gap boundary

- Target profits: Aim for previous highs/lows or structure levels

- Manage position: Trail stops and take partial profits as planned

Entry timing requires patience and precision. Price doesn’t always immediately reverse upon touching a FVG; instead, it might partially fill the gap before showing rejection signals. Look for candlestick rejection patterns such as hammer formations, shooting stars, or engulfing patterns within the FVG zone to confirm your entry timing.

Position management becomes critical once you’re in the trade. Set your stop loss just beyond the FVG zone (typically 5-10 pips depending on the timeframe), and target previous highs or lows for profit-taking. This approach maintains the 1:2 or better risk-reward ratios that prop firms expect from consistently profitable traders.

FVG Fill vs Mitigation: Understanding the Difference

FVG mitigation occurs when price partially enters the gap zone and then reverses, while complete fill happens when price moves through the entire gap area. Understanding this distinction helps you manage expectations and adjust your trading approach accordingly.

Mitigation often provides the best trading opportunities because price shows respect for the gap zone without completely negating its significance. When price partially fills an FVG and then strongly reverses, it confirms the zone’s validity and often leads to extended moves in the anticipated direction.

Complete fills don’t necessarily invalidate an FVG, but they do reduce its future significance. Some gaps get completely filled and then continue to act as support or resistance levels, while others lose their magnetic effect entirely. Experience and backtesting help you distinguish between these scenarios.

Combining FVGs with Order Blocks and Market Structure

ICT confluence trading involves combining fair value gaps with other institutional concepts like order blocks and market structure analysis. This multi-layered approach significantly increases your probability of success and helps you avoid lower-quality trade setups.

Order blocks represent areas where institutions placed significant orders, often appearing as the last up-close candle before a bearish move or the last down-close candle before a bullish move. When an order block aligns with a fair value gap, you’ve identified a zone where multiple institutional concepts converge.

Market structure analysis provides the broader context for your FVG trades. Trading FVGs in the direction of the overall market structure bias increases your win rate and helps you avoid counter-trend trades that can quickly violate prop firm risk parameters.

Prop Firm Risk Management for FVG Trading

Position Sizing for FVG Setups

Proper position sizing ensures you can trade FVG strategies while staying well within prop firm risk parameters. Calculate your position size based on the distance from your entry to your stop loss, never risking more than 1-2% of your account balance on any single trade.

📊 Prop Firm Risk Management Guidelines

| Account Size | Max Risk Per Trade | Daily Risk Limit | Max Position Size | Recommended Stop Distance |

|---|---|---|---|---|

| $25,000 | $250 (1%) | $500-750 (2-3%) | 2.5 lots max | 10-15 pips |

| $50,000 | $500 (1%) | $1,000-1,500 (2-3%) | 5 lots max | 10-15 pips |

| $100,000 | $1,000 (1%) | $2,000-3,000 (2-3%) | 10 lots max | 10-15 pips |

Note: Adjust position size based on actual stop loss distance. Tighter stops allow larger positions while maintaining consistent risk.

FVG trades often offer tight stop loss opportunities due to the precise nature of these zones. Use this advantage to size your positions appropriately – smaller stop losses allow for larger position sizes while maintaining consistent risk levels. This approach helps you maximize profit potential while protecting your prop firm account.

Daily risk allocation should spread across multiple FVG opportunities rather than concentrating on single trades. We recommend limiting individual FVG trades to 0.5-1% risk each, allowing for 3-5 trade opportunities per day without exceeding safe daily risk thresholds that prop firms expect.

Stop Loss Placement and Management

Strategic stop loss placement for FVG trades involves positioning stops just beyond the gap zone rather than using arbitrary pip distances. This approach aligns your risk with actual market structure and provides logical exit points if the trade setup fails.

For bullish FVGs, place your stop loss 3-5 pips below the gap’s low. For bearish FVGs, position stops 3-5 pips above the gap’s high. This placement gives the trade room to breathe while clearly defining when the FVG has failed to perform as expected.

Trailing stop techniques can help you lock in profits as FVG trades develop in your favor. Once price moves favorably by 1:1 risk-reward, consider moving your stop to breakeven. At 1:2 risk-reward, trail your stop to lock in at least 1:1 profit, ensuring you never turn a winning FVG trade into a loser.

Daily Loss Limits and FVG Trading

Daily loss limit management requires discipline and planning when trading FVG strategies. Set a maximum daily loss threshold before you start trading – typically 3-5% of your account balance – and stop trading for the day if you reach this limit.

FVG trading can present multiple opportunities throughout a session, making it easy to overtrade after experiencing losses. Create a structured approach that limits you to a specific number of FVG trades per day, regardless of how many setups you identify. This prevents emotional decision-making that often leads to prop firm rule violations.

Recovery strategies should focus on the next trading day rather than trying to recover losses within the same session. FVG opportunities will continue to present themselves, and maintaining long-term perspective helps you avoid the psychological pressure that leads to poor trading decisions and account violations.

Advanced Fair Value Gap Concepts

Fair Value Gap Liquidity and Imbalances

FVG liquidity concepts explain why these gaps form and why price returns to fill them. When institutional traders execute large orders, they consume all available liquidity at certain price levels, creating areas where no fair value price discovery occurred.

These liquidity imbalances represent unfilled orders and pending market participants who never had the opportunity to trade at those price levels. When price returns to FVG zones, it’s essentially providing these market participants with their desired entry or exit opportunities, which is why we often see strong reactions at these levels.

Understanding liquidity flow helps you anticipate which FVGs are most likely to provide trading opportunities. Gaps formed during high-impact news events or significant market sessions (London/New York open) typically contain more trapped liquidity and offer stronger reactions when revisited.

Inverse Fair Value Gaps and Market Shifts

Inverse fair value gaps occur when price returns to a previously respected FVG zone but fails to react as expected, instead pushing through the gap aggressively. This behavior often signals a significant shift in market sentiment or the emergence of stronger institutional interest.

When an FVG gets inversely filled, it typically indicates that the market structure is changing. What was once a support zone (bullish FVG) might become resistance, or vice versa. Recognizing these inversions helps you avoid fighting against new market dynamics and potentially identify emerging trends.

Trading inverse FVGs requires adapting your strategy to the new market context. Rather than expecting the gap to hold, you might trade the breakdown or breakout that occurs when price aggressively moves through a previously respected zone. This advanced concept helps experienced traders stay aligned with evolving market conditions.

FVG Clustering and Confluence Zones

FVG clustering occurs when multiple fair value gaps form in close proximity, creating powerful confluence zones that often produce significant price reactions. These areas represent concentrated liquidity voids and typically offer some of the highest probability trading opportunities.

Confluence analysis involves identifying areas where FVGs align with other technical levels such as previous support/resistance, Fibonacci retracements, or psychological price levels. The more factors that converge at a specific price area, the higher the probability that price will react when it reaches that zone.

Priority ranking helps you focus on the most significant FVG clusters rather than trying to trade every gap that forms. Daily and 4-hour FVGs typically take precedence over lower timeframe gaps, and gaps that align with major market structure levels deserve more attention than isolated formations.

Common FVG Trading Mistakes (And How We Avoid Them at Phidias)

⚠️ FVG Trading Mistakes vs. Solutions

| Common Mistake | Why It Happens | Phidias Solution | Result |

|---|---|---|---|

| Trading every FVG | FOMO and overconfidence | Use strict filtering criteria (min. 2 confluence factors) | Higher win rate, better R:R |

| Ignoring market bias | Focus only on setups, not context | Always check higher timeframe trend first | Fewer counter-trend losses |

| Poor risk-reward | Arbitrary targets and stops | Use structure-based targets (previous highs/lows) | Consistent 2:1+ R:R ratios |

| Overtrading after losses | Emotional recovery attempts | Set daily trade limits (max 3-5 FVG trades) | Prevent account violations |

| Wrong timeframe focus | Trading too low or too high | Primary analysis on 15min-1H charts | Optimal opportunity vs quality |

| No confluence required | Taking isolated FVG setups | Require order blocks, structure, or session confluence | 70%+ win rate improvement |

Chasing Every Fair Value Gap

Selective FVG trading represents one of the most important skills for prop firm success. New traders often attempt to trade every gap they identify, leading to overtrading and poor risk management. At Phidias, we teach our traders to focus on quality over quantity when selecting FVG opportunities.

Filtering criteria should include timeframe significance, confluence with other levels, and alignment with overall market bias. We recommend limiting yourself to trading only FVGs that meet at least two additional confluence factors, such as market structure support, session timing, or alignment with higher timeframe trends.

Patience and discipline separate successful FVG traders from those who struggle with consistency. Wait for the market to come to your identified levels rather than chasing price action. The best FVG opportunities often require hours or even days to develop properly.

Ignoring Market Context and Bias

Market context analysis provides the framework for successful FVG trading. Trading against the prevailing market bias, even with a perfect FVG setup, significantly reduces your probability of success and can lead to extended drawdown periods that violate prop firm rules.

Session-based bias helps you understand when FVGs are most likely to be respected versus when they might be aggressively filled. During high-impact news events or major session transitions, market dynamics can override normal FVG behavior, leading to unexpected price action.

Trend alignment ensures your FVG trades work with rather than against the dominant market forces. We teach our traders to identify the prevailing trend on higher timeframes and prioritize FVG setups that align with this bias, significantly improving their win rates and profit consistency.

Poor Risk-Reward on FVG Trades

Risk-reward optimization for FVG trades requires understanding the typical price movements that follow successful gap fills. Most FVG reactions produce moves that extend at least to the next significant level, often providing 2:1 or better risk-reward ratios when properly executed.

Target selection should be based on logical market structure levels rather than arbitrary pip targets. Look for previous highs or lows, significant round numbers, or confluent technical levels to place your profit targets. This approach aligns your expectations with how price naturally moves in response to FVG reactions.

Position scaling allows you to maximize profits from strong FVG reactions while securing gains from typical moves. Consider taking partial profits at 1:1 risk-reward and allowing the remainder to run toward extended targets. This approach balances profit security with profit maximization.

Getting Started with FVG Trading at Phidias

Ready to transform your trading results with professional fair value gap strategies? At Phidias, we provide the ideal environment for developing and implementing FVG trading skills with our industry-leading prop firm funding opportunities.

Our comprehensive evaluation process allows you to demonstrate your FVG trading proficiency while providing the capital you need to generate substantial profits. With account sizes up to $100,000 and profit splits up to 80%, you can turn your FVG trading expertise into a sustainable income stream. We support both Fundamental and Swing account types, giving you the flexibility to trade FVGs across different timeframes and holding periods.

Start your funded trading journey today with our streamlined application process and competitive evaluation parameters. Our experienced support team understands ICT methodology and can help you optimize your FVG strategies for maximum profitability within our risk management framework. Join thousands of successful traders who have already unlocked their potential with Phidias funding.

Frequently Asked Questions About Fair Value Gap Trading

What is ICT fair value gap?

An ICT fair value gap is a price area where market inefficiency occurred due to aggressive institutional buying or selling, creating a liquidity void that price typically returns to fill. These gaps represent areas where normal price discovery didn’t occur, making them high-probability zones for future price reactions.

What does FVG mean in trading?

FVG stands for Fair Value Gap, which refers to areas on a price chart where rapid price movement created an imbalance between supply and demand. These zones often act as magnets for future price action as the market seeks to restore equilibrium and provide liquidity to trapped market participants.

How do I identify a fair value gap?

Identify fair value gaps by looking for a three-candle pattern where the middle candle shows aggressive movement and the outer candles don’t overlap with the middle candle’s range. The gap between the first candle’s high/low and the third candle’s low/high creates the FVG zone.

What are the criteria for FVG?

Valid FVG criteria include: a three-candle formation, significant impulse movement in the middle candle, non-overlapping wicks between the first and third candles, and clear directional bias. The gap must be visible and measurable, typically spanning at least 5-10 pips depending on the timeframe.

How to use FVG in trading?

Use FVGs by waiting for price to return to the gap zone and entering trades in the direction of the original impulse. Set stop losses just beyond the gap boundaries and target logical profit levels based on market structure. Combine FVGs with other ICT concepts for higher probability setups.

Is FVG an imbalance?

Yes, FVGs represent market imbalances where buying and selling pressure was unequal, creating areas where fair value pricing never occurred. These imbalances create liquidity voids that price typically revisits to restore market equilibrium and accommodate trapped market participants.

Can fair value gaps fail to fill?

Not all fair value gaps get filled completely. Some gaps may only be partially mitigated before price reverses, while others might be completely filled without producing the expected reaction. Understanding market context and confluence factors helps identify which gaps are most likely to perform as expected.

What timeframes work best for FVG trading?

FVG trading works across all timeframes, but 15-minute to 4-hour charts often provide the best balance between opportunity frequency and signal reliability. Higher timeframes produce stronger reactions but fewer opportunities, while lower timeframes offer more setups but require careful filtering.

How long do fair value gaps remain valid?

Fair value gaps can remain valid for days, weeks, or even months depending on their timeframe and market context. Higher timeframe gaps generally maintain their significance longer than lower timeframe formations. Some gaps lose relevance after being tested multiple times without producing expected reactions.

Should I trade all fair value gaps I identify?

No, selective trading is crucial for FVG success. Focus on gaps that meet multiple confluence criteria such as alignment with market structure, proper session timing, and support from higher timeframe analysis. Quality over quantity leads to better consistency and risk management.