If you’re interested in trading but don’t have a large amount of capital to start with, you may have come across the term “prop firm”—short for proprietary trading firm. But what exactly are prop firms, and how do they work?

In short, prop firms give traders access to company capital in exchange for a share of the profits. This model offers a way to trade without putting your own money at risk—making it especially appealing for beginners and aspiring professionals alike.

Understanding Proprietary Trading Firms: The Ultimate Guide

Proprietary trading (or “prop trading”) refers to a trading setup where traders use a prop firm’s capital rather than their own money to execute trades in various financial markets. Unlike traditional brokerages that primarily earn from commissions on client trades, futures prop firm directly profit from market activities conducted with their own capital.

At its core, a prop trading firm is a company that provides trading capital to skilled traders, enabling them to trade various financial instruments like futures, forex, stocks, and commodities. The fundamental business model is straightforward: the online prop firm supplies the capital, the trader applies their skills to generate profits, and both parties share the returns according to a predetermined profit split arrangement.

The concept originated in traditional financial institutions where designated traders would execute trades with the company’s capital. Today, however, the landscape has evolved dramatically with the emergence of forex prop firms and cfd prop firms that make proprietary trading accessible to a wider audience of retail traders.

Key features of prop firms include:

- Capital allocation: Traders receive access to substantially larger trading accounts than they could fund personally

- Risk management frameworks: Rules and limits that protect the firm’s capital

- Profit-sharing structures: Arrangements that determine how profits are divided between the trader and the firm

- Evaluation processes: Methods to assess trader skills before allocating capital

- Trading support: Various resources, tools, and sometimes education provided to traders

For ambitious traders, futures prop firms represent a pathway to trading professionally without requiring substantial personal capital. They offer the opportunity to leverage your skills and potentially generate significant income through the profit-sharing model. Both forex prop firms and futures prop firms have created accessible paths to professional trading careers.

Traditional Prop Firms vs. Online Prop Firms: Key Differences

The prop firm industry has undergone a significant transformation in recent years, with online prop firms dramatically changing the accessibility and operational models of proprietary trading. Understanding the distinct differences between traditional and online futures prop firms and how they work is crucial for traders evaluating their options.

Traditional Prop Firms

Traditional prop firms typically operate from physical office locations where traders work on-site using the firm’s infrastructure. These established institutions often have deeper roots in the financial industry and more direct connections to financial markets.

Characteristics of traditional prop firms:

- Physical presence: Traders typically work in an office environment

- Rigorous recruitment: Often requires extensive interviews, trading tests, and sometimes previous professional experience

- Direct market access: More likely to provide direct market access and genuine execution

- Training programs: May offer comprehensive in-person training and mentorship

- Higher barriers to entry: Generally more selective and difficult to join

- Lower profit splits: Traders might receive 50-70% of their generated profits

- Networking opportunities: Daily interaction with other professional traders

Traditional futures prop firms often focus on specific trading strategies like market making, arbitrage, or high-frequency trading, and may require traders to specialize in particular markets or instruments. Unlike many online prop firms, these traditional establishments frequently emphasize specialized expertise.

Online Prop Firms

The digital revolution gave birth to online prop firms, which operate virtually and can accept traders from almost anywhere in the world. These modern futures prop firms and forex prop firms have democratized access to proprietary trading, making it available to retail traders who can demonstrate their skills.

Characteristics of online prop firms:

- Remote operation: Traders work from anywhere with an internet connection

- Evaluation-based selection: Typically requires traders to pass a trading challenge to assess skills

- Accessible entry: More open to traders without professional backgrounds

- Standardized programs: Clearly defined rules, targets, and scaling plans

- Higher profit splits: Often offering 70-90% of profits to traders

- Self-directed trading: Less supervision but also less support

- Diverse account types: Various account sizes and specialized programs (like our Fundamental, Swing, and Static accounts)

Online futures prop firms have revolutionized the industry by creating structured pathways for retail traders to access significant trading capital based purely on their demonstrated trading abilities. Many cfd prop firms also offer similar opportunities for traders specializing in contracts for difference.

The Key Differences

When comparing traditional and online prop firms, several critical distinctions emerge:

| Aspect | Traditional Prop Firms | Online Prop Firms |

|---|---|---|

| Capital Source | Often trade with actual firm capital | May use a combination of challenge fees and capital |

| Market Access | Direct market access | Often via broker arrangements |

| Entry Requirements | Interviews, experience, connections | Standardized trading challenges |

| Trading Environment | Office-based, collaborative | Remote, independent |

| Support | In-person mentoring and training | Digital resources and remote support |

| Trading Freedom | May have specific strategy requirements | Generally more strategy flexibility |

| Geographic Limitations | Usually requires relocation | Accessible globally (with some restrictions) |

For most retail traders seeking to leverage their skills with larger capital, futures prop firms like Phidias represent the most accessible entry point into the world of proprietary trading. While forex prop firms tend to focus on currency markets, and cfd prop firms specialize in contracts for difference, futures-focused firms offer access to a diverse range of markets.

How Online Futures Prop Firms Work: The Phidias Model

Futures prop firms like Phidias Propfirm have developed a structured business model that allows them to identify skilled traders and provide them with substantial trading capital. Understanding this model is essential for traders considering this path.

At its foundation, the our prop firm model operates on a simple premise: identify traders who can demonstrate consistent profitability with proper risk management, fund them with significant capital, and share in the resulting profits. This creates a mutually beneficial relationship where both the trader and the futures prop firm have aligned interests.

The Business Model Explained

Read also : How Prop Firms Make Money? Inside Phidias Business Model

The typical online prop firm business model consists of several interconnected components:

- Trader evaluation: Identifying skilled traders through challenges or assessments

- Capital allocation: Providing successful traders with funded accounts

- Risk management framework: Implementing rules to protect capital

- Profit sharing: Distributing trading profits between the firm and live funded trader

- Scaling opportunities: Allowing successful traders to access larger accounts

Many futures prop firm follows this model while at Phidias we add our own unique elements, particularly focused on switching skilled traders to live capital. Their business approach is designed to create sustainable trading relationships rather than merely collecting evaluation fees. Unlike some forex prop firms that may focus primarily on challenge fees, quality futures prop firms prioritize long-term trader success.

Revenue streams for online prop firms typically include:

- Evaluation fees: Charges for participating in trading challenges (though becoming less important with a focus on live profit share)

- Subscription or activation fees: Regular payments to maintain funded accounts

- Profit share: The firm’s portion of trading profits for live funding

- Market data and add-on services: Additional services traders may purchase

The sustainability of an online prop firm depends on having a significant percentage of successful traders who generate consistent profits. Contrary to some misconceptions, reputable futures prop firms like Phidias genuinely want their traders to succeed, as the firm’s own profitability depends on live funded traders success. This aligns the interests of both parties in a way that distinguishes legitimate prop firms from questionable operations.

The Evaluation Process: From Challenge to Funded Account

The journey from aspiring prop trader to funded status typically begins with an evaluation process designed to identify traders with the necessary skills to generate profits while managing risk appropriately.

At Phidias prop firm, we employs a structured evaluation approach that assesses traders based on their performance against specific metrics. This process allows the futures prop firm to minimize risk while identifying genuine trading talent. Most reputable online prop firms use similar challenge-based evaluation systems to screen potential traders.

The typical evaluation process includes:

- Registration and subscription: Traders register and select an evaluation account size

- Evaluation phase: Traders demonstrate their abilities by meeting specific targets

- Review and approval: The prop firm assesses overall performance against requirements

- Funded account activation: Successful traders receive access to a funded account

In our model, traders must prove their trading capabilities by reaching profit targets without exceeding maximum loss parameters. The evaluation accounts at futures prop firms come with specific rules regarding drawdown limits, profit targets, and trading behavior. This structured approach is common among quality online prop firms regardless of their market focus.

What sets Phidias prop firm apart is their focus on creating a clear path to live funding. Traders who successfully complete their evaluation can progress to CASH accounts and potentially to LIVE accounts after demonstrating consistent performance.

Key evaluation metrics often include:

- Profit targets: Minimum profit requirements (e.g., $4,000 on a $50K Fundamental account)

- Maximum drawdown: Limits on acceptable losses (e.g., $2,500 EOD for a $50K account)

- Trading consistency: Requirements for balanced, sustainable trading approaches

- Minimum trading days: Requirements to trade for a minimum number of days (e.g., 3 days)

- Risk management: Adherence to position size limits and other risk parameters

Successful completion of the evaluation phase demonstrates a trader’s ability to generate profits while adhering to the futures prop firm’s risk management framework—essential qualities for long-term trading success. While forex prop firms may have slightly different metrics, the fundamental evaluation principles remain similar across most online prop firms.

Trading Rules and Requirements for Funded Traders

Once a trader receives a funded account, they must adhere to specific rules designed to protect the prop firm’s capital while allowing the trader sufficient freedom to implement their strategies effectively.

At Phidias futures prop firm, we established a comprehensive framework of trading rules that balance risk management with trading flexibility. These rules are designed to create a sustainable trading environment that benefits both the trader and the firm. Unlike some forex prop firms with overly restrictive requirements, quality futures prop firms strive to create reasonable parameters that allow for authentic trading.

Common funded account rules include:

- Drawdown limits: Maximum allowed losses before account suspension

- Trailing drawdown: Adjustable loss limits that change based on profitability

- Position size restrictions: Limits on maximum contracts or exposure

- Trading hours: Designated periods when trading is permitted

- Holding period rules: Regulations regarding overnight and weekend positions

- Profit targets: Minimum profit requirements for payouts

- Trading consistency: Requirements to maintain balanced risk-reward profiles

At Phidias futures prop firm we offer different account types with varying rules to accommodate different trading styles. For example, their Fundamental accounts require positions to be closed before the end of the trading day, while Swing accounts allow for overnight and weekend positions. This flexibility distinguishes reputable online prop firms from one-size-fits-all operations.

The Static accounts feature a fixed drawdown limit without trailing stops, making them more straightforward for certain trading styles. The 10K Drawdown accounts offer unique competition-based opportunities for traders seeking a different pathway to funding with this futures prop firm.

Our profit consistency rule is particularly noteworthy: traders must maintain balanced trading where no single day exceeds 30% of total profits, encouraging sustainable approaches rather than gambling behavior. This rule exemplifies how quality prop firms promote discipline.

Understanding and adhering to these rules is crucial for long-term success with a prop firm. While they may initially seem restrictive, these guidelines actually promote disciplined trading practices that benefit traders beyond their relationship with online prop firms. Many successful traders find that the structure imposed by futures prop firms improves their overall trading methodology.

The Legal and Regulatory Landscape of Prop Firms

The legal and regulatory status of prop firms—particularly online prop firms—is a common concern for traders considering this path. Understanding the regulatory framework helps traders make informed decisions and select reputable firms.

Are Prop Firms Legal?

Yes, proprietary trading firms are legal business entities. The fundamental model—providing capital to traders and sharing in the profits—is a legitimate business arrangement. However, the specific regulatory requirements for prop firms vary significantly based on:

- The jurisdiction where the prop firm operates

- The specific financial instruments being traded

- How the prop trading firm structures its operations and capital allocation

Traditional prop firms operating as market participants typically require various licenses and registrations with financial regulators. Online prop firms may operate under different regulatory frameworks depending on their business model, with futures prop firms often having distinct requirements from forex prop firms.

Regulatory Considerations

The regulatory landscape for online prop firms continues to evolve as the industry grows. Key points to understand include:

- Broker relationships: Many online prop firms partner with regulated brokers to execute trades

- Capital protection: How client funds and prop firm capital are segregated and protected

- Contractual clarity: The legal agreements between traders and futures prop firms

- Jurisdictional differences: Varying regulatory requirements across countries for prop firms

- Industry self-regulation: Emerging standards and best practices within the prop firm industry

Reputable futures prop firms like Phidias Propfirm operate with transparency about their business model and trader relationships. They typically have clear terms of service, explicit rules, and established payment processes that comply with relevant financial regulations, setting them apart from questionable prop firms.

Red Flags and Due Diligence

Traders should conduct thorough due diligence before committing to any prop firm. Warning signs that may indicate potential issues with online prop firms include:

- Excessive promises: Unrealistic guarantees of trading success or income from the prop firm

- Unclear business model: Ambiguity about how the futures prop firm actually generates revenue

- Poor communication: Unresponsive support or unclear answers to direct questions about the prop firm

- Negative trader experiences: Consistent complaints about payment issues or rule enforcement

- Obscure ownership: Lack of transparency about who operates the prop firm

model and have verifiable testimonials from successful traders.

Country Restrictions

Most prop firms, including Phidias, maintain a list of restricted countries where they cannot offer services due to regulatory requirements, sanctions, or risk management considerations.

These restrictions typically stem from:

- International sanctions or embargoes

- High-risk jurisdictions with limited legal recourse

- Countries with regulations that conflict with the prop firm’s business model

- Operational limitations in serving specific regions

Before applying to any prop firm on futures market, traders should verify that their country of residence is eligible for the firm’s services.

Can Traders Really Make Money with Prop Firms?

Perhaps the most critical question for prospective prop traders is whether they can genuinely profit from these arrangements. The short answer is yes—skilled traders can indeed make substantial income through prop firms, but success requires significant skill, discipline, and understanding of the business model.

The Realistic Profit Potential

The profit potential when trading with a prop firm is substantially higher than what most retail traders could achieve with their personal capital. This increased potential stems from:

- Larger trading capital: Access to accounts many times larger than a typical retail account

- Leverage effect: The ability to take position sizes that would be impossible with personal funds

- Focus on trading: No need to risk personal savings, allowing better psychological conditions

- Structured environment: Rules that often promote better trading practices

At Phidias prop firm, for example, we offer accounts ranging from $25,000 to $100,000, with profit targets that can translate to significant monthly income for successful traders.

Profit-Sharing Structure

Understanding the profit-sharing model is crucial for evaluating the actual income potential. Most online prop firms, including Phidias, employ a percentage-based split where:

- Traders receive 70-90% of the profits they generate

- The prop firm retains the remaining 10-30% of profits

- Specific split percentages may vary based on account type and trader experience

For example, Phidias propfirm’s payout structure includes:

- Monthly payouts after meeting minimum trading requirements

- A profit split where traders receive 80% of their generated profits

- Scaling opportunities to increase capital allocation based on performance

- 2-days only payout path with the $25K static account (Prop Firm With the Fastest Payout)

The key advantage of this model is that it aligns the interests of both parties—both the trader and the prop firm benefit when trades are profitable.

Real Success Stories: Traders Who Made It

The prop firm landscape includes numerous examples of traders who have achieved significant success. Phidias Propfirm showcases several success stories and payout certificates on their website, with traders receiving substantial payouts.

Examples of successful payouts from Phidias include:

- Benjamin: $42,500

- Kevin: $42,000

- Arnaud: $20,000

- Parth: $20,000

- Numerous traders receiving $8,000-$12,000 payouts

These examples demonstrate that skilled traders can indeed generate significant income through futures prop firm arrangements. However, it’s important to understand that these results represent successful traders who have developed consistent trading approaches.

Challenges and Realistic Expectations

While success stories are inspiring, traders should maintain realistic expectations about the challenges involved:

- Skill requirements: Profitable trading requires significant skill, regardless of whose capital is being used

- Learning curve: Most traders need time to develop consistent profitability

- Rule adherence: Trading within the prop firm’s guidelines adds complexity to strategy development

- Psychological factors: Trading larger sums brings additional psychological challenges

- Evaluation hurdles: Many traders fail their initial evaluations and need multiple attempts

Industry statistics suggest that a relatively small percentage of traders who attempt prop firm evaluations successfully reach and maintain funded status. This reality doesn’t indicate problems with the business model but rather reflects the inherent difficulty of consistent trading success.

Understanding Profit Splits and Payout Structures

The financial arrangements between traders and prop firms determine how profits translate into actual income. At Phidias Propfirm we have established clear protocols for payouts and profit sharing:

Payout requirements typically include:

- Minimum trading days (e.g., 10 trading days between withdrawal requests)

- Minimum withdrawal amounts (e.g., $1,000 minimum withdrawal)

- Maximum withdrawal limits (e.g., $2,000-$2,500 per payment period on initial withdrawals)

- Account minimum thresholds that must be maintained after withdrawal

We also offers a path to LIVE accounts after traders have demonstrated consistent success, with three payouts on one account or $75,000 in cumulative payouts potentially triggering an upgrade to a live account with daily payout capabilities.

For traders seriously considering this path, understanding these financial structures is essential for accurate income planning and expectations.

How to Choose the Right Prop Firm for Your Trading Style

With numerous prop firms available, selecting the right one for your specific trading style, goals, and circumstances is crucial. The ideal firm will align with your trading approach while providing appropriate support and opportunities.

Factors to Consider

When evaluating prop firms, consider these key factors:

1. Trading Style Compatibility

Different firms specialize in various markets and accommodate different trading approaches. Phidias prop firm offers specialized account types for different trading styles:

- Fundamental accounts: For intraday traders who close positions daily

- Swing accounts: For traders who hold positions overnight and over weekends

- Static accounts: For traders who prefer fixed drawdown limits without trailing stops

- 10K Drawdown accounts: For competitive traders seeking a different qualification path

Your trading style should align with the firm’s available account types and rules.

2. Capital Requirements and Scaling Opportunities

Consider both the initial capital requirements and the potential for growth:

- Evaluation costs: Initial fees to participate in challenges

- Account sizes: Available funded account sizes

- Scaling plans: Protocols for increasing your capital allocation

- Long-term prospects: Opportunities for transitioning to live accounts

Legit futures prop firm offers clear scaling opportunities, with traders potentially accessing LIVE accounts after demonstrating consistent success.

3. Rules and Restrictions

Each prop firm imposes different rules that impact trading freedom:

- Drawdown calculations: How losses are measured and limited

- Profit targets: Required profit levels for success

- Time requirements: Minimum trading days or time periods

- Position size limits: Restrictions on contract numbers or exposure

- Instrument availability: Which markets and products are available

Review these trading rules carefully to ensure they accommodate your trading approach without imposing excessive constraints.

4. Profit-Sharing and Fee Structure

The financial arrangement significantly impacts your potential income:

- Profit split percentage: Your share of generated profits

- Recurring fees: Monthly or periodic charges to maintain accounts

- Payout frequency: How often you can withdraw profits

- Payout requirements: Conditions that must be met before withdrawals

- Hidden costs: Any additional fees or charges

At Phidias prop firm, we offer competitive profit splits with clearly defined payout protocols.

5. Technology and Support

The platform environment and available support influence your trading experience:

- Trading platforms: Available software and technology

- Data feeds: Quality and cost of market data

- Technical support: Assistance with platform and account issues

- Trading support: Guidance and resources for strategy development

- Community: Opportunities to connect with other traders

Futures prop firms provide access to professional trading platforms like Rithmic and offers 24/7 support in multiple languages.

What Makes Phidias Propfirm Different

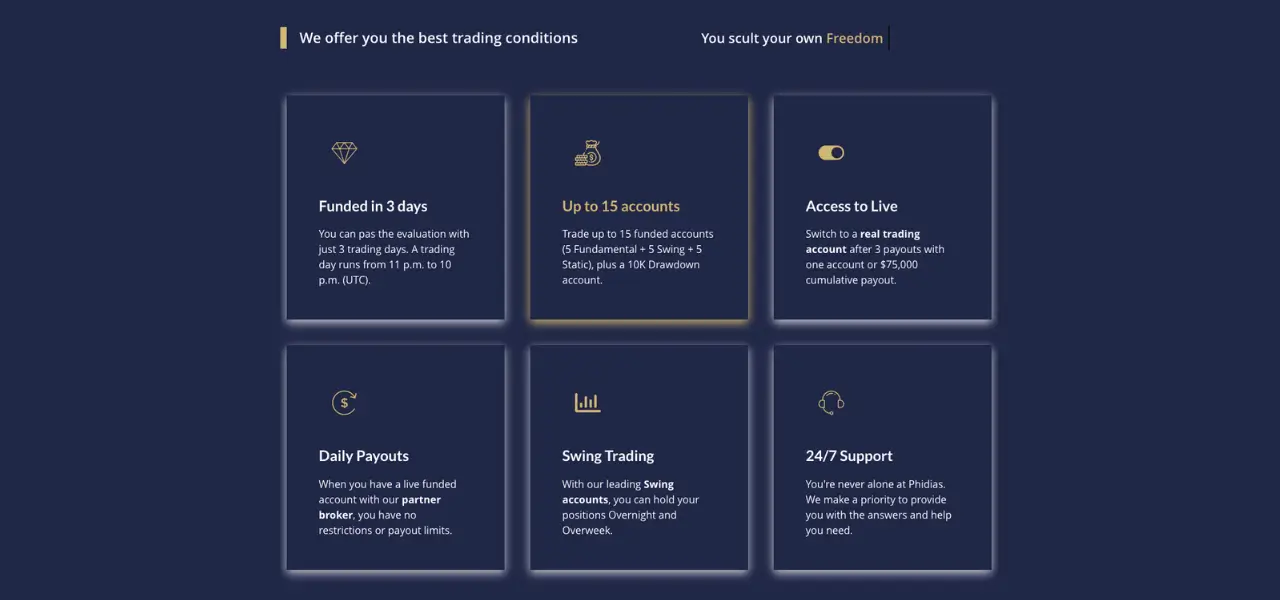

Phidias prop firm distinguishes itself from competitors through several key features:

- Diverse account types: Options for different trading styles, including Fundamental, Swing, Static, and 10K Drawdown accounts

- Clear path to live funding: Structured progression from evaluation to CASH accounts to LIVE accounts

- Flexible trading conditions: Accommodations for different trading approaches, including overnight and weekend holding options

- Transparent rules: Clearly documented trading guidelines and requirements

- Multilingual support: Assistance available in English, French, and Spanish

- Competitive profit splits: Traders receive 80% of their generated profits

- Multiple accounts option: Traders can operate up to 15 accounts (5 Fundamental, 5 Swing, 5 Static)

These features make Phidias particularly suitable for futures traders seeking a balance of flexibility and structure in their proprietary trading journey.

Frequently Asked Questions About Prop Firms

What exactly is a prop firm and how does it differ from a broker?

A proprietary trading firm (prop firm) provides traders with capital to trade financial markets, sharing the resulting profits. Unlike brokers, who facilitate client trades and earn from spreads and commissions, prop firms profit directly from market activities performed with their capital.

Is trading with a prop firm risky?

While all trading involves risk, futures prop firms provide a structured environment where traders risk the firm’s capital rather than their own. The primary risk for traders is the evaluation fee (if applicable) and the time invested in the process. The prop firm bears the financial risk of trading losses.

Do I need experience to join a prop firm?

Most online prop firms don’t explicitly require prior professional experience, but you do need demonstrated trading skills to pass their evaluations. Successful prop traders typically have developed effective strategies and risk management approaches through practice and education.

Can I trade part-time with a prop firm?

Yes, many prop firms, including Phidias, allow for part-time trading. However, you must still meet any minimum trading day requirements and adhere to all trading rules.

How much money can I make trading with a prop firm?

Earnings potential varies widely based on your trading skill, the capital allocation, market conditions, and the profit-sharing arrangement. Successful traders can earn substantial income, with some of our funded traders receiving payouts of $2,000-$42,500.

Are prop firms scams?

While some questionable operations exist, legitimate futures prop firms like Phidias operate transparent businesses with verified trader payouts. Due diligence is essential when selecting a firm—look for clear rules, verified reviews, and transparent communication.

What happens if I lose money?

If your losses reach the predetermined maximum drawdown limit, your account will typically be suspended. Depending on the prop firm’s policies, you may need to purchase a reset, wait for an automatic reset, or re-evaluate entirely.

Can I withdraw my profits immediately?

Most prop firms, including Phidias, have specific withdrawal protocols that include minimum trading day requirements, profit thresholds, and scheduled payout periods. We requires 10 trading days between withdrawal requests and processes payments between the 20th and 25th of each month.

What trading platforms do prop firms use?

Futures prop firms offer various platforms depending on their focus. Phidias Propfirm provides access to professional trading platforms that support Rithmic data feeds.

Are there any hidden fees?

Reputable firms disclose all fees upfront. With Phidias, these may include evaluation subscription fees, reset fees for failed evaluations, and activation fees for funded accounts. Always review the complete fee structure before committing.

Can I trade any instrument with a prop firm?

Each firm specifies which instruments traders can access. We focuses on futures trading, with a comprehensive list of authorized products including indices, currencies, cryptocurrencies, metals, energy products, and agricultural futures.

What happens if I consistently make profits?

Consistent profitability typically leads to opportunities for account scaling, higher payouts, and potentially transitioning to live accounts with more favorable conditions. We offers a path to LIVE accounts after demonstrated success.

Conclusion: Is a Prop Firm Right for Your Trading Journey?

Proprietary trading firms offer a unique opportunity for skilled traders to access substantial capital without risking their own funds. For many, this path represents the most accessible route to professional trading careers without requiring large personal investments.

The decision to pursue prop firm trading should be based on a realistic assessment of:

- Your trading skills: Do you have a proven strategy with consistent results?

- Your trading style: Does it align with the firm’s rules and account types?

- Your financial goals: Are the profit-sharing arrangements compatible with your income needs?

- Your commitment level: Are you willing to adapt to the firm’s requirements?

Phidias futures prop firm offers a structured yet flexible approach to proprietary trading, with diverse account options and a clear progression path. Their focus on futures trading, combined with accommodations for different trading styles, makes them particularly suitable for traders seeking to leverage their futures trading skills.

As with any significant business decision, thorough research and due diligence are essential. Take time to understand the complete rules, review trader experiences, and evaluate how the prop firm’s approach aligns with your trading methods before committing.

For those with the necessary skills and discipline, prop firm trading can provide the capital leverage needed to transform trading talent into substantial income. The journey requires patience, adaptation, and commitment—but the potential rewards make it a compelling option for aspiring professional traders.

Ready to explore proprietary trading? Consider how Phidias futures prop firm’s diverse account options might align with your trading goals and take the next step in your trading career.